Prices

June 2, 2015

Galvanized and Galvalume Trade Cases Expected Yet This Week

Written by John Packard

Steel Market Update sources: mill, service center and others are advising us that anti-dumping and countervailing duty (AD/CVD) trade cases on coated products will be filed yet this week. We have heard that the filing could come as early as tomorrow (Wednesday, June 3rd) or on Thursday of this week.

Any trade filing on coated products would most likely be filed against: China, India, Taiwan and South Korea. We do not have any inside information that lays out the exact parties to any filing so our suggestion of China, India, Taiwan and South Korea is based on those countries which have been consistently exporting galvanized and Galvalume (zinc-aluminum) to the United States. Other countries could be included (Brazil for example) but, we will not know for sure until the filings are made.

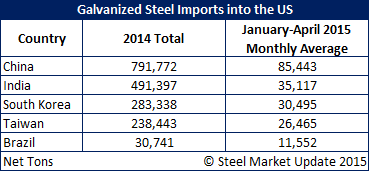

In coated products galvanized is the item with the most tons attached to the foreign imports. Three hundred thousand tons of galvanized is as much as produced by Nucor Berkeley, NLMK USA (Sharon Coatings), SDI Butler, The Techs, US Steel Fairfield and CSN in Terre Haute, Indiana. In other words imports have a major impact on domestic production. In the table below we are providing the monthly averages for China, Taiwan, South Korea, Indiana and Brazil for galvanized exports out of each country to the United States in calendar year 2014 and again for the first four months 2015.

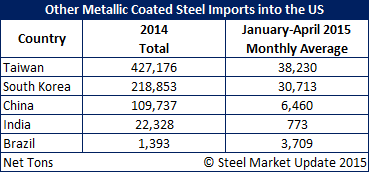

Galvalume is another item that we are hearing will be part of the dumping suit. Over the past year, foreign steel imports have taken more than 50 percent of total market share from the domestic steel industry. Here is what Galvalume import penetration looks like for China, Taiwan, India, South Korea and Brazil.

Our expectation is that a filing would have an immediate impact on mill lead times and pricing momentum on the products targeted. We would expect coated minimum base price levels on any new offers would be at the $29.00/cwt or $30.00/cwt level with limited to no exceptions. We would expect mill lead times on coated products, some of which were already well into August, could easily stretch into September rather quickly.

Our readers need to understand that a potential “perfect storm” is brewing on coated products. This is due to the expiration of the USW contracts with US Steel and ArcelorMittal at the end of August/September 1st. We encourage our readers who buy coated products to remain close to your suppliers and be aware of the USS/ArcleorMittal negotiations even if they are not a supplier to your company.

Our 2015 Steel Summit Conference is already well positioned to discuss the topic of trade in detail. We have Kevin Dempsey, Senior Vice President of Public Policy, General Counsel and Secretary of the American Iron & Steel Institute as well as attorney Lewis Leibowitz a well known attorney representing consumers against dumping suits speaking at this year’s conference. We also have a number of steel mills, economists and analysts who will be well versed on the subject by the 1st of September.

May Import License Data Suggests No Reprieve for Domestic Mills

The U.S. Department of Commerce released foreign steel import license data late this afternoon. Based on what we found in the data it appears steel imports during the month of May will be very close to the 3.4 million net tons seen in April 2015.

We remind our readers that import license data is not final and can vary by 200-300,000 net tons from the final numbers. We therefore are suggesting that when the final month of May tonnage is released, it will be approximately 3.2 to 3.5 million net tons.

As you can see by the numbers below, we expect semi-finished (slabs) and hot rolled coil to be higher than April’s numbers. We also expect very large numbers on galvanized and Galvalume compared to the already high 3 month and 12 month moving averages.