Prices

May 31, 2015

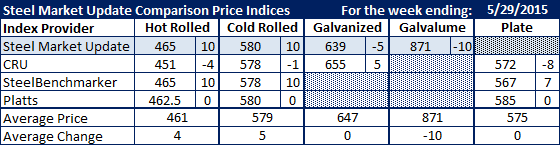

SMU Comparison Price Indices: Market Still Unsettled

Written by John Packard

Today SMU is not only going to discuss where flat rolled steel prices were this past week based on our analysis of steel pricing from our steel index as well as CRU, Platts and SteelBenchmarker, we are also going to discuss price momentum which our SMU Price Momentum Indicator currently points to higher prices over the next 30 days.

With the exception of CRU, which saw the market as being down on benchmark hot rolled coil this past week ($451 per ton), all of the other indexes followed by Steel Market Update are showing HRC pricing between $462.50 (Platts) and $465 per ton (SMU and SteelBenchmarker).

Although there may be some disagreement on hot rolled, there appears to be a consensus on cold rolled. Two indexes measured CRC this past week at $578 per ton (CRU & SteelBenchmarker) and two were at $580 per ton (SMU and Platts).

SMU saw galvanized prices as still “settling” as our GI price dropped $5 per ton last week while CRU saw GI prices as up $5 per ton.

We also saw Galvlaume prices as still settling as well as our index average dropped $10 per ton this past week.

Plate prices rose according to CRU and SteelBenchmarker while Platts has kept their prices the same.

It is SMU opinion that the price fluctuations are a sign of the unsettled nature of a the market. Inventories are still too high at the service centers. There are questions regarding the strength or staying paying of steel demand. The U.S. continues to receive high amounts of imports of foreign steel which affects mill order books and lead times. These issues are keeping pressure on momentum which, SMU still sees as moving higher but not as a surge but rather a slow methodical move higher.

That is our opinion for today, however there are two outstanding (or expected) items which steel buyers need to be aware: the possible filing of dumping suits and second the expiration of union contracts at US Steel and ArcelorMittal on the 1st of September. A filing would have an immediate impact on momentum as will any belief that there will not be a resolution of the USW contracts.

We have been hearing about a possible filing of AD (anti-dumping) or CVD (countervailing duty) cases on light flat rolled (cold rolled and coated) for more than a year. The announcement itself will create a small rush to protect inventories that might be at risk. But, the impact could be less pronounced than thought as buyers have been protecting themselves against any filing for a long time now.

Lead times are already into August on coated products at many mills. Galvanized buyers should be cognizant of where lead times are on their products at each of their suppliers and you should anticipate issues (especially from mills that have a strong automotive or appliance order book) as we get into late August lead times. Automotive and other large contract customers are going to insist that their items be protected against any possible interruption in production at USS or ArcelorMittal.

As always, steel buyers need to keep your ears and eyes open to any changes on either of the above mentioned issues. The first key to watch are mill lead times and any quick changes at any of the mills

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.