Prices

May 26, 2015

SMU Analysis: Iron Ore, Metallurgical Coal & Zinc

Written by Peter Wright

This is the first time we have dedicated a piece specifically to raw materials prices. It combines our own data analysis with expert opinion published in the last couple of weeks that we find credible.

Iron Ore

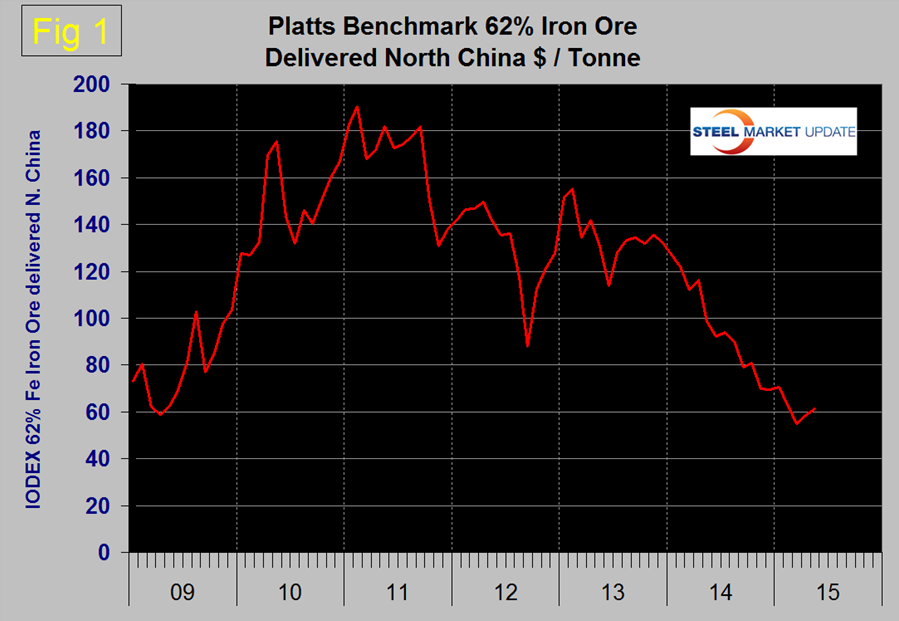

As of this past weekend, the Platts IODEX of 62% Fe delivered North China recovered by $6.25/dmt in the last two months from the recent low of $55 in March (Figure 1).

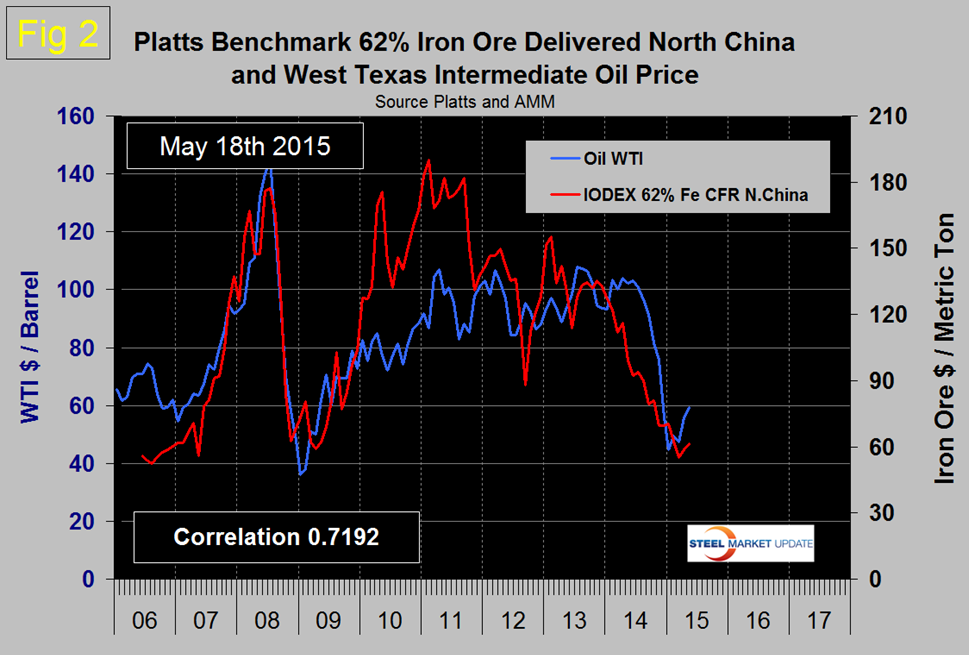

In these reports we will try to describe where we think the price of ore seems to be headed. There is a relationship between the price of ore and the price of oil. Both are international commodities driven by the state of the global economy and the value of the US dollar. However, the international global trade in oil is over 10 times more than the blue water trade in iron ore in dollar terms. Since 2006 there has been a correlation of 0.7192 between the IODEX and West Texas Intermediate crude which we don’t consider to be particularly close. However the correlation in the three years between 2007 and 2009 was 0.9182 which we do consider to be a very close though non-causal relationship. The correlation was upset in 2010 and 2011 by the activities of the big 3 ore cartel to limit the availability of long term contracts. Since then the relationship has come back in line.

The point is that since the global oil market is so much larger than the global ore market we believe we can get some insight into whether ore is currently priced high or low relative to the oil benchmark. Figure 2 shows the ore/oil relationship since 2005. At present it looks as though ore has some upside potential in the next couple of months.

The following was written by Alpha world, published in Seeking Alpha and does not conflict with the view of SMU described above. Iron ore prices have been above $60 per ton so far this month. On May 11th, Platts noted that supply in China, the most important market for iron ore, was seen as lower as sellers did not offload to current prices. Sellers are obviously expecting higher prices in the coming weeks. Platts also noted a dip in port stocks to below 900 metric tons, which tightened supply to an extent. In the near-term, it seems that prices will remain strong, although a significant appreciation like the one seen in April is unlikely. The gains in April were driven by BHP Billiton’s decision to slow down its expansion plan, a rebound in Chinese steel output, and stimulus measures from China’s central bank.

Since then, China has announced another rate cut. On May 10th, the People’s Bank of China (PBoC) slashed interest rates by 0.25%. This is the third time the PBoC has cut benchmark interest rates in the last six months. It will be interesting to see what kind of impact the rate cut will have as real interest rates still remain high. However, it does show the PBoC’s intent.

After BHP Billiton said that it will slow down its iron ore expansion plant, Vale SA said that it plans to focus on high-grade ores and cut-back on medium-grade ores, a move that could ease some of the glut in the oversupplied seaborne iron ore market. Having said that Vale still expects iron ore production of 340 million tons this year and 376 million tons in 2016. Speaking to the Financial Times, Vale’s CFO Luciano Siani said that the company will manage its production of standard iron ore supplies and “push to the fullest” production of the highest grade of iron ore. The highest grade of iron ore commands a premium and coupled with reducing costs will help VALE in boosting its margins.

Another interesting development is a possible parliamentary inquiry in Australia of alleged predatory pricing in the iron ore market. Since last year, major Australian miners, BHP Billiton and Rio Tinto, have been clear about their strategy which along with that of Vale, has been to increase supplies of iron ore despite the glut. The increasing supplies have coincided weakening demand in China, leading to the rout in iron ore prices. However, the top three have the lowest production costs and can survive even in the current low price environment. The idea is to drive out the high cost miners in Australia and China, and then gain market share. However, this strategy is already being question from within and outside the industry.

Australia’s Prime Minister Tony Abbott has already backed call for a parliamentary inquiry into the tactics adopted by majors. This does not come as a surprise, given the importance of iron ore to the broader Australian economy. The state of Western Australia is already struggling. A possible parliamentary inquiry could force Australia’s big two miners to change their strategy. And given that Vale is already considering focusing more on highest grade ore, this could help in improving in the fundamentals of the iron ore market.

Coking Coal

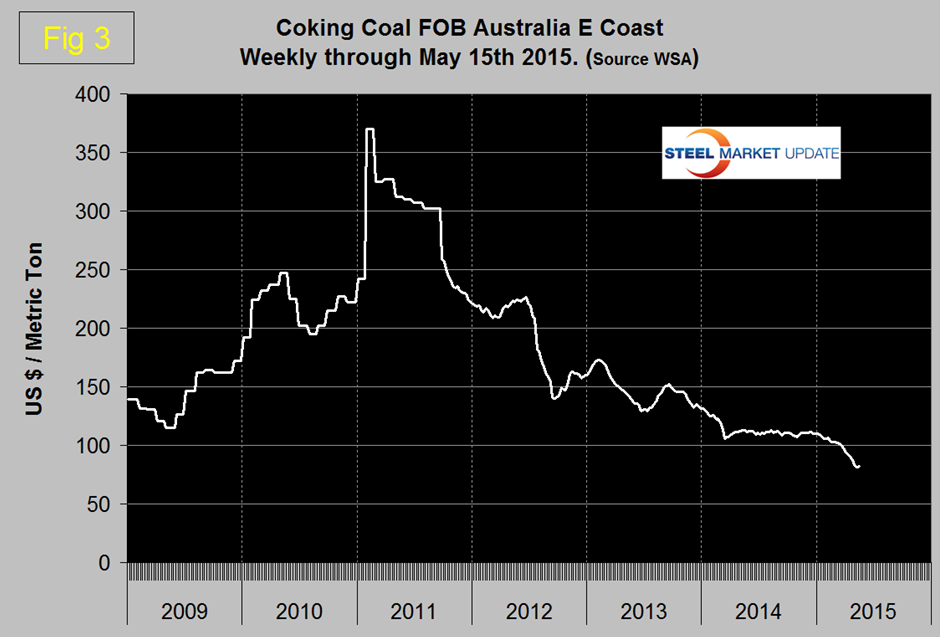

In the May 15th data the price of coking coal FOB East Australian ports recovered slightly to US $ 82.05 from $81.56 on May 8th. This followed a steady decline from $110.00 on January 2nd (Figure 3). Asian steel producers have started to re-stock, which caused the increase of demand for seaborne material. In China the situation for downstream steel products has improved which has had a positive influence on the raw material markets. Local coal miners retain their positions. Inventories of import coal are dwindling at ports. Companies are mostly booking cargoes of import material for late-June or July deliveries.

Zinc

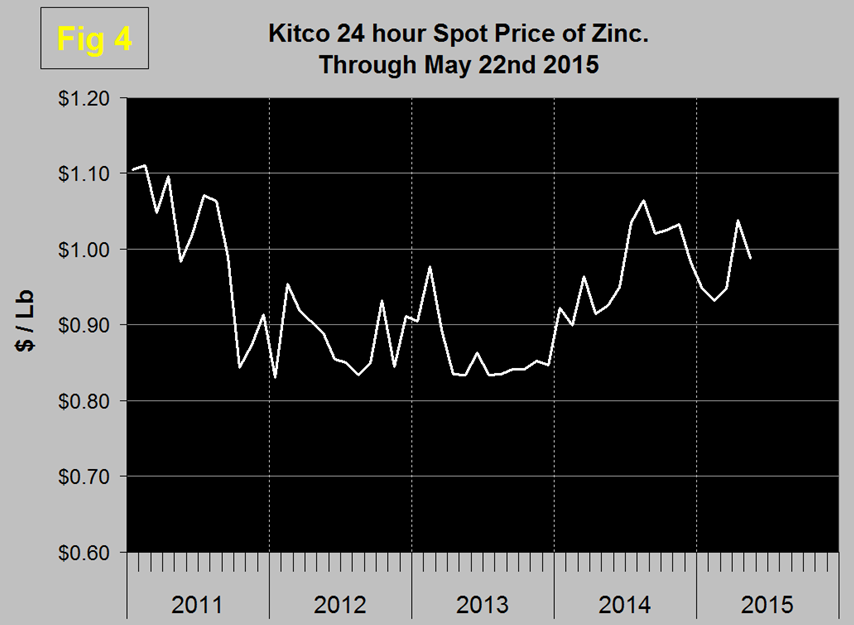

According to the International Zinc Association, the major use of zinc is for galvanizing, other significant uses include the alloying of brass and bronze and in zinc-based alloys used in the die-casting industry. Kitco publish a daily spot price of zinc which we have transcribed to Figure 4. At the end of April the price recovered to > $1.00/lb. but on May 22nd had slid back to $0.9878/lb.

Based on comments from Hard Assets Investor May 12th 2015 it appears that the outlook through 2017 is for zinc prices to increase.

While mine production in Australia, Canada, India, Kazakhstan, Namibia and Peru decreased in 2014, this decrease was more than offset by the increase in production in China. Going forward, however, it is far from certain that, after this year, global production growth will balance consumption growth and according to a number of projections, it will not. Mines continue either to close or reduce output. From 2016 on out, sufficient new production capacity to offset the loss of output from these seems unlikely for some years. And with what new projects there are in the pipeline, there is also concern that their deposits may consist of lower-grade ores.

Given the level of zinc prices over the last several years, there has been little incentive, or sense of urgency, for investment in new mining capacity. According to the International Lead and Zinc Study Group, in 2014, global usage of refined zinc exceeded output by some 296,000 tonnes, with Bloomberg Intelligence believing it could rise to 1.98 million tonnes by 2017.

In 2014, while world refined zinc consumption rose 6.5 percent, China, which accounted for some 46.5 percent of total refined zinc consumption, increased its apparent consumption by 11.7 percent. Looking at where zinc will go from here, the three big unknowns have to be: first, the effect China’s slowing growth will have on zinc demand, if both the country’s steel production and the demand for the steel it produces decrease drastically – especially since the greatest use for zinc globally is for galvanizing. Second, there is China’s ability, in the face of any tightening in supply to increase mine and refined zinc production. And third, the value of the US $ against other relevant currencies especially the Australian dollar and how this affects future production decisions.

Steel Market Update (SMU) will have a raw materials segment at this year’s SMU Steel Summit Conference which will be held in Atlanta, Georgia on September 1st and 2nd, 2015. Details about the conference and registration can be found on our website: www.SteelMarketUpdate.com or by contacting our office: 800-432-3475.