Market Data

May 12, 2015

SMU Price Momentum Indicator Adjusted to Higher

Written by John Packard

This week Steel Market Update adjusted our Price Momentum Indicator to Higher from Neutral. Based on our checks of the steel buying community, prices are beginning to firm and the $20 per ton price increase announced by a number of the steel mills appears to be sticking. SMU is of the opinion as long as lead times continue to move out and the steel mills are able to control themselves, then flat rolled steel prices over the next 30 to 60 days should continue to move higher.

We have decided to make this move due to a number of factors which we see as working in the steel mills’ favor.

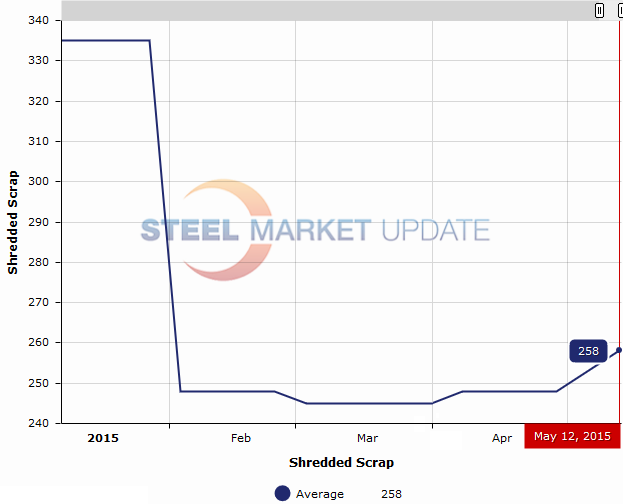

Scrap prices have firmed and, in some cases, have already started moving higher. We are seeing a strengthening of the markets on the east coast and south due to the return of Turkish and other ferrous scrap buyers. This has helped put a floor on scrap pricing. The flows into the dealers yards have also slowed since the big drop (see graph) in prices in February. This has tightened up supply, especially for shredded scrap which in many regions of the country is trading higher than prime grades of scrap (which is in over-supply). The expectation is for a number of the mills who have not been buying scrap over the last two months will return to the markets in the near future which will help tighten up the Chicago area which is the cheapest market at this time (with furnaces down at US Steel and ArcelorMittal).

We discussed lead times in Sunday evening’s newsletter. Mill lead times (lead time equals the promise date for shipment of a new order given to a mill today) started to move out in recent weeks and are expected to continue to tighten as buyers come back into the market. The longer the lead times, the more steel service centers and end users have to place to protect themselves against possible shortages.

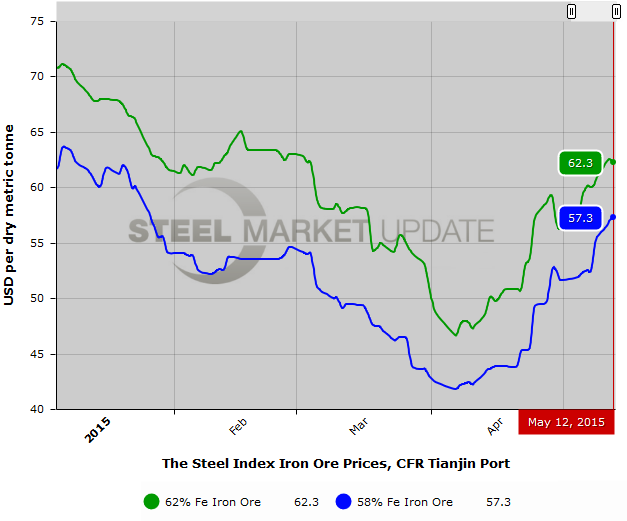

In China, iron ore spot prices have been moving higher with 62% Fe fines now selling for $62.3/dmt (dry metric ton) into the Port of Tianjin. This is a fairly significant move after dropping to almost $45/dmt earlier this spring.

Service centers are for the most part accepting the new base prices on hot rolled, cold rolled and coated products.

We have started to see service centers beginning to pass through price increases to their customers (see article in tonight’s issue). The support of the service centers is critical to the success or failure of any price increase.

One reason service centers are passing through some of the spot price increases are due to lower inventories. Service centers have been purging high priced inventories ever since the beginning of the 2015 calendar year. We are of the opinion that distributors are close to the point where they are needing to replenish inventories and the extra spark from a price increase may add a little extra incentive to do some buying (which impacts lead times).

Foreign steel prices are not as competitively priced as what we had seen a couple of months ago. We are also seeing a reduction in the amount of foreign tonnage being stored at the ports as buyers react to higher domestic by depleting any cheap foreign that may be laying around. The reduction of existing foreign puts a potential gap of one to four months in the available inventory pool. It is this gap which will help keep prices moving.

Then when we add in the “threat” of a anti-dumping (AD) and countervailing duty (CVD) trade suit on light flat rolled products, this will help keep prices firm for awhile. When a suit gets filed this will create an environment where the mills will be able to take prices higher than what might be considered normal. Should the mills fail to file suits then we could see the foreign market penetration grow in 4th Quarter 2015 and pressuring any gains the mills will have made between now and then.

What is the Steel Pricing Momentum Indicator?

Through the use of a directional arrow we are indicating the current trend of flat rolled pricing out of the domestic steel mills. The indicator is based on data collected from industry buyers and sellers of flat rolled steel products. Flat rolled steel products include hot rolled steel, cold rolled steel, galvanized and Galvalume steel in sheet and coil form. The indicator is reviewed on a daily basis and adjusted based on our discussions with industry participants as well as our most recent survey data.