Market Data

May 10, 2015

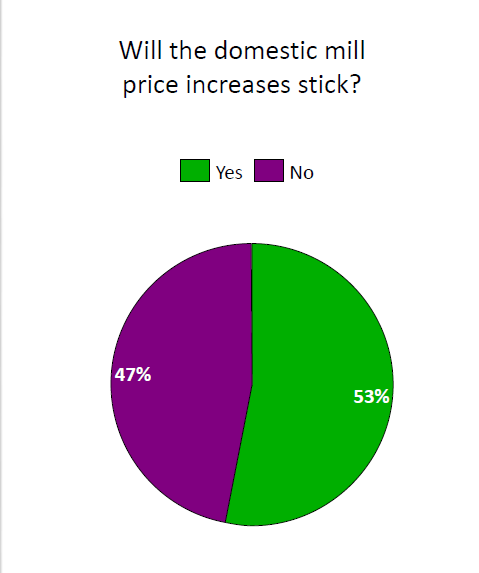

Buyers Split on Success of Domestic Mill Price Increases

Written by John Packard

Buyers and sellers of flat rolled steel are split over whether or not the price increase announcements of two weeks ago will actually be collected. This past week we invited approximately 600 companies to participate in our flat rolled steel market survey. Of the more than 100 companies who responded fifty-three percent told SMU that the steel price increases would indeed stick. The balance (47 percent) where more skeptical and do not believe the price increases will remain in the days and weeks ahead.

What Our Respondents Had to Say About Whether the Price Increases Would Stick?

“After they announce a second increase.” Trading Company

“That would be HELL NO.” Plate Supplier

“There really is no basis for the increase except yet another attempt to send a signal that the price is low enough now and they need the slide to stop.” Manufacturing Company

“NOT UNTIL EVERYONE GETS ON BOARD AND THE BACK ROOM DEALS ARE STOPPED.” Service Center

“An increase this early has only succeeded in pulling orders forward at the old prices but demand will now be softer in the summer months and prices will resume its slide. It may also encourage more imports to return.” Manufacturing Company

“Stop the decline at least.” Service Center

“I don’t think the increase was put out for an increase rather to stop the decreases!” Service Center

“If the mills hang together and not one weak link arises in their ranks.” Trading Company

“The increases are arbitrary. $20 – $30 from what base. If it helps the market to find a bottom – it’s a big positive.” Steel Mill

“I would like to qualify my answer by adding, will stick in part, and briefly.” Service Center