Prices

May 7, 2015

Flat, Long, and Semi-Finished Steel Imports Analysis through April 2015

Written by Peter Wright

Licensed data for April was updated on May 5th through the Steel Import Monitoring System of the US Commerce Department. The SMU publishes several import reports ranging from this very early look using licensed data to the very detailed analysis of final volumes by district of entry and source nation which is available to our premium members. The early look, the latest of which you are reading now, has been based on three month moving averages (3MMA) using April licensed data and February and March final data.

We recognize that the license data is subject to revisions but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. The main issue with the license data is that the month in which the tonnage arrives is often not the same month in which the license was recorded. In 2014 as a whole, our data showed that the reported licensed tonnage of all carbon and low alloy products was 2.3 percent less than actually receipts, close enough we believe to confidently include licensed data in this current update. Total rolled product licensed imports in the single month of April were 2,625,543 short tons which was 14.5 percent less than the March final result. On this basis flat rolled was down by 21.1 percent, long products by 18.5 percent and pipe and tube by 2.2 percent. Rail product results look questionable with over a fivefold increase, but this was due to a very low number in March and a return to normal in April. At SMU we prefer not to dwell on single months results because of the extreme variability typified by rail products. In the comments below we rely on three month moving averages to get a more representative picture.

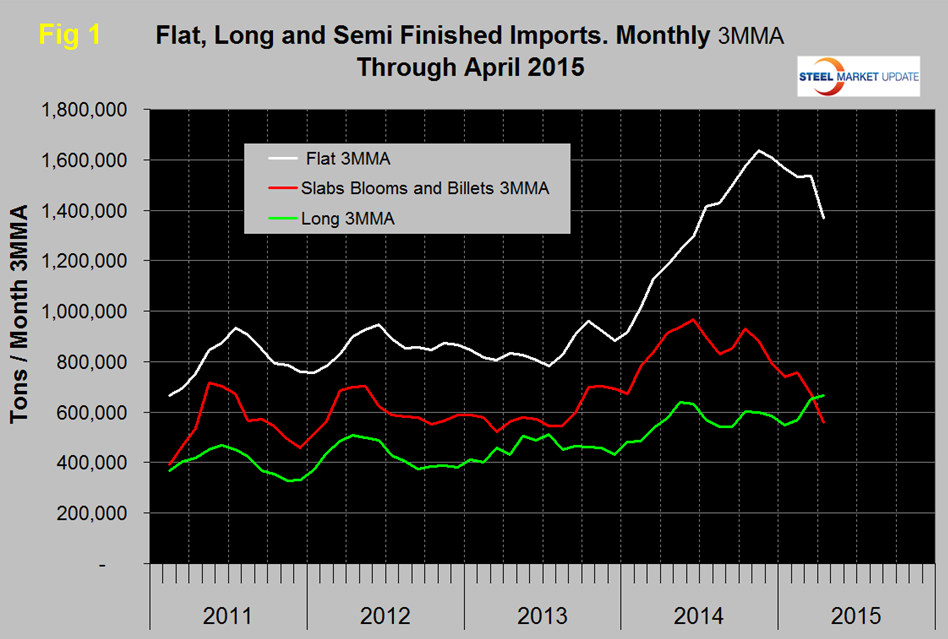

Figure 1 shows the 3MMA through April licenses for semi-finished, flat and long products. Flat includes all hot and cold rolled sheet and strip plus all coated sheet products including tin-plate plus both discrete and coiled plate. The import surge took a breather for flat rolled in December, the downward trend continued in January and February, stabilized in March then dived in April. Semi-finished has been declining since October. There has been no relief for long products this year, the 3MMA being up by 2.2 percent from March and by 15.8 percent from April last year.

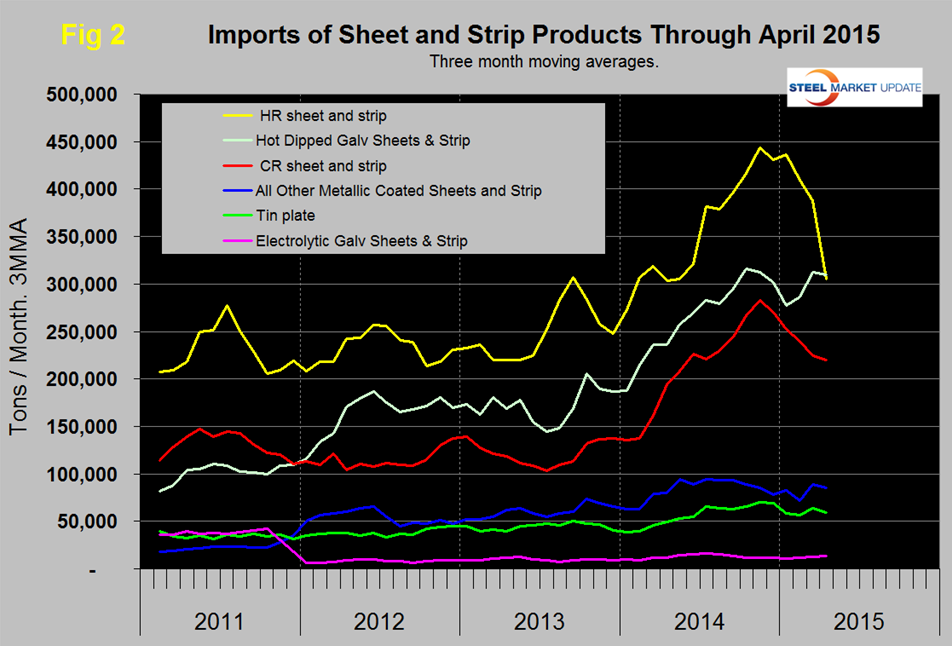

Figure 2 shows the trend of sheet and strip products since January 2011 as three month moving averages. Of the big three tonnage items, HR, CR and HDG, hot rolled was down by 21.2 percent from March, and cold rolled by 2.0 percent, hot dipped galvanized imports increased in both February and March but declined by 0.9 percent in April. All other metallic coated (mainly Galvalume), has been declining since mid-2014 but there was an increase of 7.4 percent in March followed by a 4.1 percent decline in April. Tin plate had been trending up for all of 2014 but has been flat this year. Electro-galvanized keeps on rolling along with little change in three years. In the single month of April, hot rolled sheet and strip licenses were 281,706 tons, down by 9.8 percent from March, HDG was 260,898 tons, down by 28.6 percent, and cold rolled came in at 228,333 tons, up by 10.7 percent.

Table 1 provides an analysis of major product group and of sheet products in detail. It compares the average monthly tonnage in the latest three months through April with both three months through January (3M/3M) and the same period last year (Y/Y). Semi-finished slabs and billets were down by 24.4 percent 3M/3M and by 38.9 percent Y/Y. The total tonnage of hot worked products was 2,833,173 tons in April on a 3MMA basis, up by 440,283 tons from April last year. The three month moving average was down by 6.6 percent from the average of three months through January and up by 18.4 percent from a year ago. These trends indicate that in the big picture the peak of import volume has passed but this is not necessarily true for individual products. The color codes in Table 1 for the three month and year over year change show which products are improving and which are still experiencing import volume increases. For example, total sheet products are past the peak but at the product level that is only true for hot rolled and cold rolled.

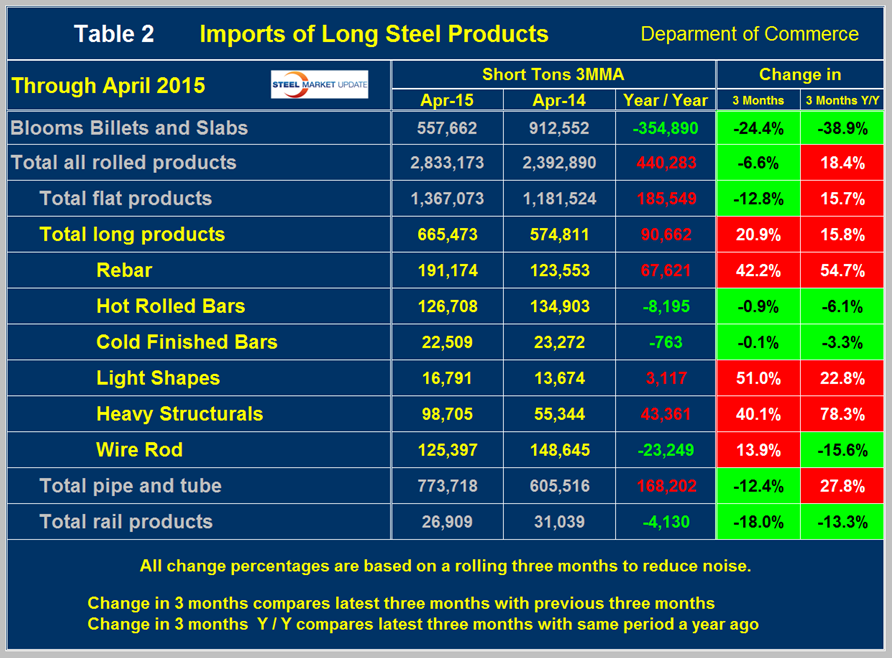

Table 2 shows the same analysis for long products. For total long products the tonnage was up by 20.9 percent 3M/3M and by 15.8 percent Y/Y which means that the situation is still deteriorating led by rebar and heavy structurals which between them had over 110,000 tons more imports in April than they did in April last year. Year over year wire rod imports were down through April but the situation took a turn for the worse in the latest three months which were up by 13.9 percent from the period November through January.

Imports of pipe and tube declined by 12.4 percent 3M/3M but on a Y/Y basis were up by 27.8 percent.

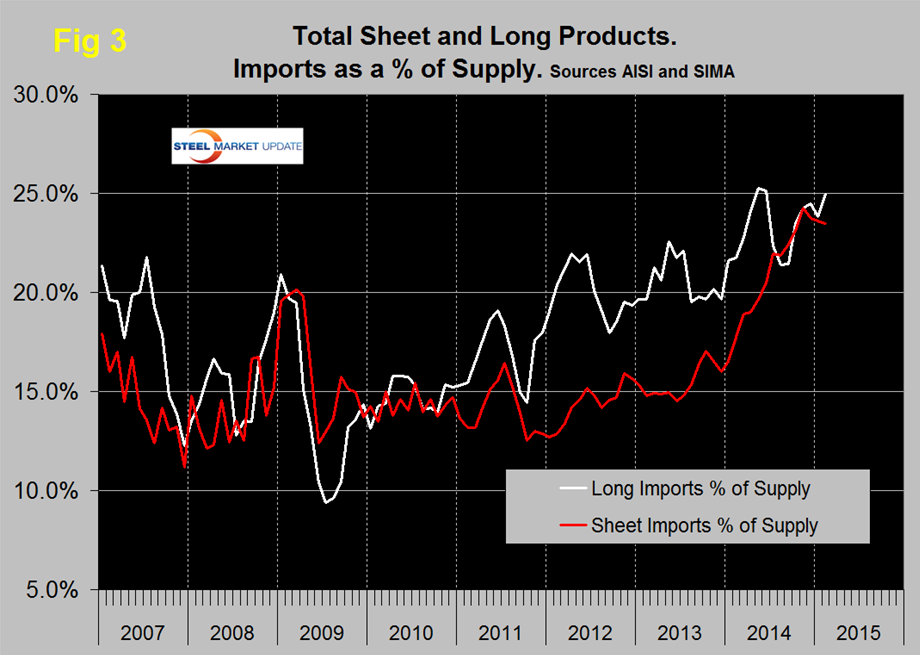

In eight months through February, which is the latest data we have for total steel supply, import market share for sheet and long products has been similar (Figure 3). Historically for the prior four years, import share of long products was higher than for sheet. In November last year sheet caught up but since then longs have once again taken the lead. In February the import share of long products was 24.9 percent and of sheet was 23.5 percent.