Market Data

April 30, 2015

Gross Domestic Product for Q1 2015, First Estimate

Written by Peter Wright

The Bureau of Economic Analysis (BEA) released the first estimate of Q1 2015 Annual Revision of the National Income and Product Accounts on Thursday

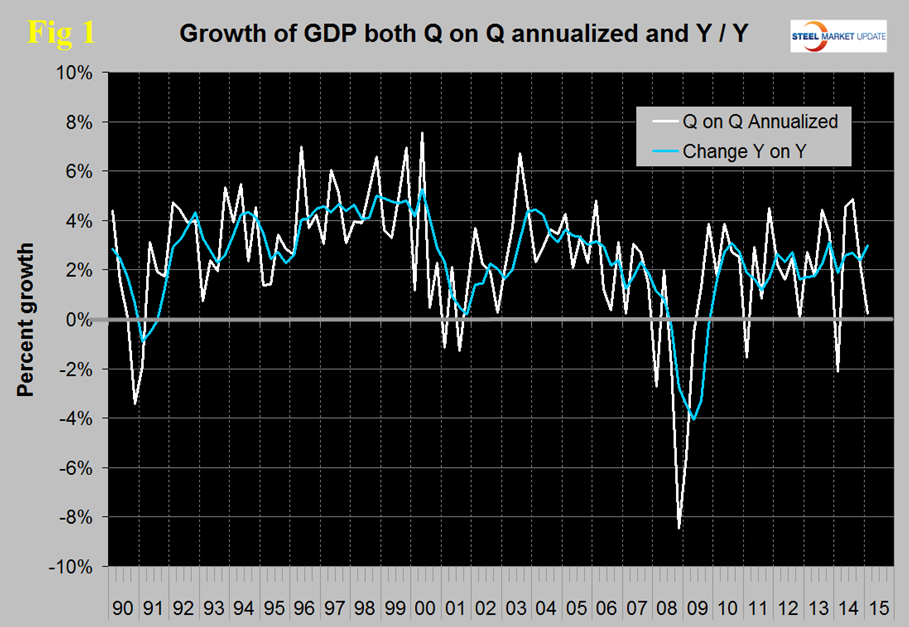

The annualized growth rate in the first estimate of Q1 GDP was 0.2 percent down from Q4 2014 which came in at 2.2 percent. GDP is measured and reported in chained 2009 dollars and in Q1 was estimated to be $16.305 trillion. The calculation is slightly misleading because it takes the Q over Q growth and multiplies by 4 to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect. The blue line is the trailing 12 months growth and the white line is the headline quarterly result.

On a year over year basis GDP was 2.99 percent higher in the first quarter than it was in Q1 2014 and that result is in line with performance since Mid-2010. Q1 of 2104 had negative 2.21 percent growth due to the appalling winter in the North East US and the second and third quarter results which were very strong were likely playing catch-up. The fact that Q4 2014 and Q1 2015 were close to the year as a whole tends to support that view.

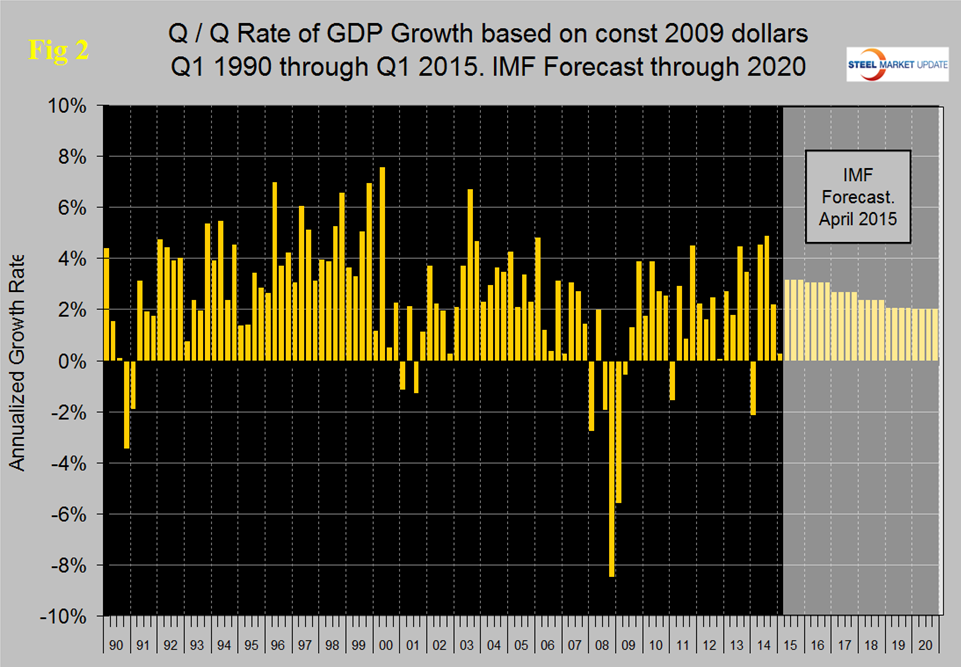

Figure 2 shows the headline quarterly results since 1990 and the latest IMF forecast through 2020 that was released earlier this month.

Taking 2014 as a whole makes the IMF forecast look reasonable with a quarterly growth rate of 3.09 percent forecast for 2015. Figure 3 shows the change in the major sub-components of GDP.

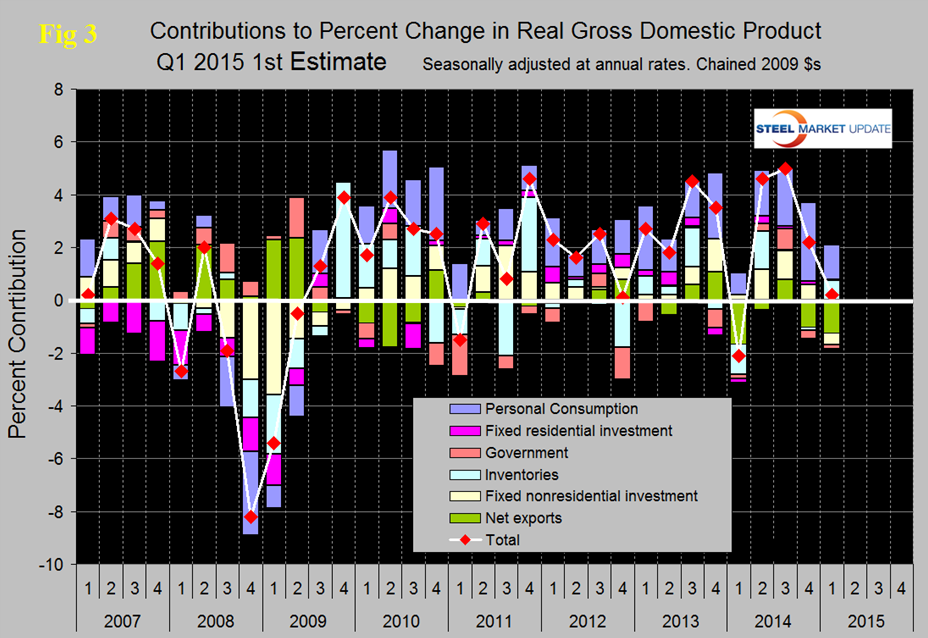

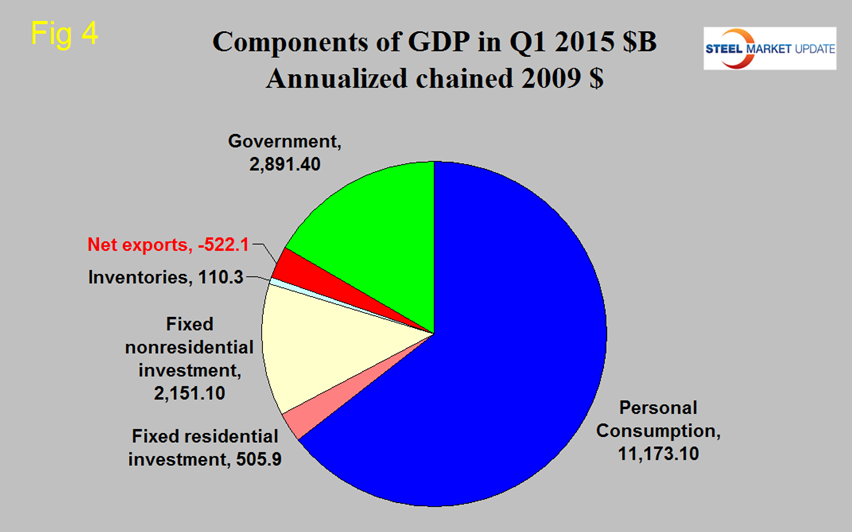

Comparing Q1 with Q4 2014 there were major changes in the sub-components. Personal consumption that had contributed 2.98 percent in Q4 2014 fell to 1.31 in the latest data. Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables. Net exports were the major negative, contributed – 1.25 percent to the total and have been gradually worsening as the dollar has strengthened. Government expenditures also yielded a negative growth of – 0.15 percent. The contribution of fixed residential investment declined to almost zero but the contribution of nonresidential construction declined from 0.6 percent in Q4 to negative 0.44 in Q1. In the first quarter personal consumption accounted for 68.53 percent of total economic activity. Inventories which had contributed negative 0.1 percent in Q4 contributed 0.74 in Q1. Increasing inventories make a positive contribution to GDP and over the long run inventory changes are a wash and simply move growth from one period to another. Figure 4 shows the breakdown of the $16 trillion economy.

The official press release from the BEA reads as follows:

Gross Domestic Product: First Quarter 2015 (Advance Estimate)

Real gross domestic product — the value of the production of goods and services in the United

States, adjusted for price changes — increased at an annual rate of 0.2 percent in the first quarter of 2015, according to the “advance” estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.

The Bureau emphasized that the first-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see the box on page 3 and “Comparisons of Revisions to GDP” on page 5). The “second” estimate for the first quarter, based on more complete data, will be released on May 29, 2015.

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE) and private inventory investment that were partly offset by negative contributions from exports, nonresidential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

NOTE: Quarterly estimates are expressed at seasonally adjusted annual rates, unless otherwise specified.

SMU Comment: We have reported frequently in the past on the relationship between GDP and steel consumption. Steel growth follows economic growth but is very much more volatile. In addition over the long run about a 2.5 percent growth of GDP is necessary to get any growth in steel consumption. Based on the trailing 12 month growth of GDP which in Q1 was 2.99 percent we can expect steel consumption to be fairly stable in H1 2015. The IMF forecast for 2015 at 3.09 percent growth if accurate suggests a moderate increase in steel demand.