Prices

April 26, 2015

US DOC Reports March Steel Imports at 3,587,949 Tons

Written by John Packard

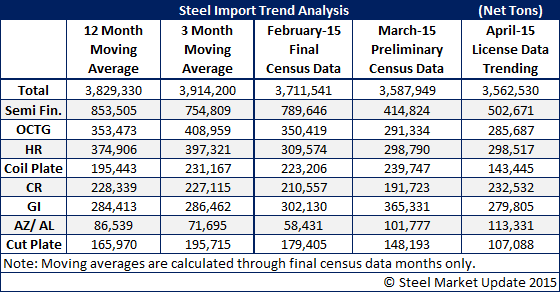

On Friday of this past week the U.S. Department of Commerce (US DOC) reported Preliminary License Data for steel imports into the United States. March steel imports (all products) were reported to be 3,587,949 net tons. This is down from the 3.7 million tons reported for February and below both the twelve month and three month moving averages as calculated by Steel Market Update using US DOC data.

The March Preliminary License Number is 200,000 net tons less than what the license data had been indicating over the past six weeks and is a good reason why we remind readers to review license data only as a “trend” and not reality.

As we look at April license numbers the data is suggesting April will be around 3.5 million net tons. However, we believe that when the final census data is reported that number will be 200,000 tons less. If we are correct then we will be able to state that the roll-back of the surge in imports has begun and our expectation is for May numbers to potentially drop below 3.0 million net tons.

However, as we look at the data in the table below, one thing that sticks out to us is the bulk of the tonnage reduction is due to lower semi-finished (slabs) imports and hot rolled coil. Both of these products are heavily imported by the domestic steel mills.

The products most often mentioned when hearing about possible trade suits are cold rolled and coated steels.

Coated products, galvanized and Galvalume (other metallic) rose significantly above both their 12 month and 3 month moving average and are still trending toward high numbers for the month of April.

Cold rolled tonnage was down slightly from its 12 month and 3 month moving average during the month of March but is trending higher so far based on license data for the month of April.