Market Data

April 24, 2015

Industrial Production and Manufacturing Capacity Utilization

Written by Peter Wright

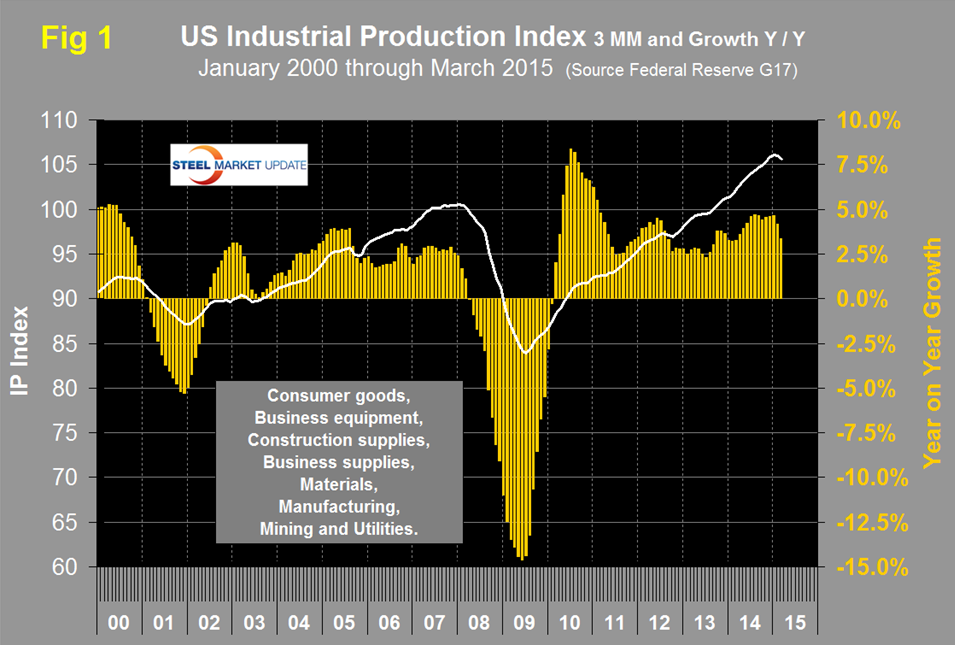

Both these data points are reported in the Federal Reserve G17 data base. The IP index was reported as 105.22 for March, down by 0.64 from February. The three month moving average (3MMA) was 105.63, down by 0.34 from February. January was the highest value ever of the 3MMA at 106.11. The Y/Y growth rate of the 3MMA was 3.3 percent in March which broke a string of nine months >4 percent. The last 12 months have experienced the best growth since the post-recession bounce. Data is seasonally adjusted and the index is based on the July 2007 level being defined as 100 (Figure 1).

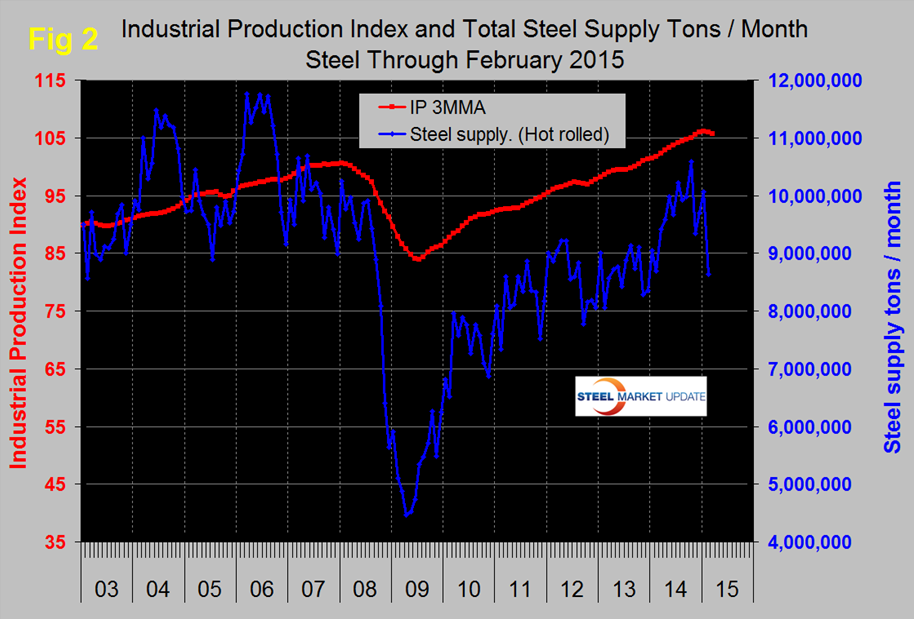

The bad news is that growth is slowing and the March rate was the lowest since March last year. This data parallels the ISM manufacturing Index which has been expanding at a decreasing rate since June last year. Prior to the recession there was a reasonable correlation between industrial production and steel supply (including imports), though steel was very much more volatile in this comparison just as it is against GDP (Figure 2).

Steel supply took its seasonal dive in December then a much bigger dive in February which is the latest steel data available. Manufacturing and energy have been the growth engines of steel demand since the recession. Energy projects are now suffering from the current oil and gas price decline. Housing and non-residential construction are still a drag and likely to be so for several years.

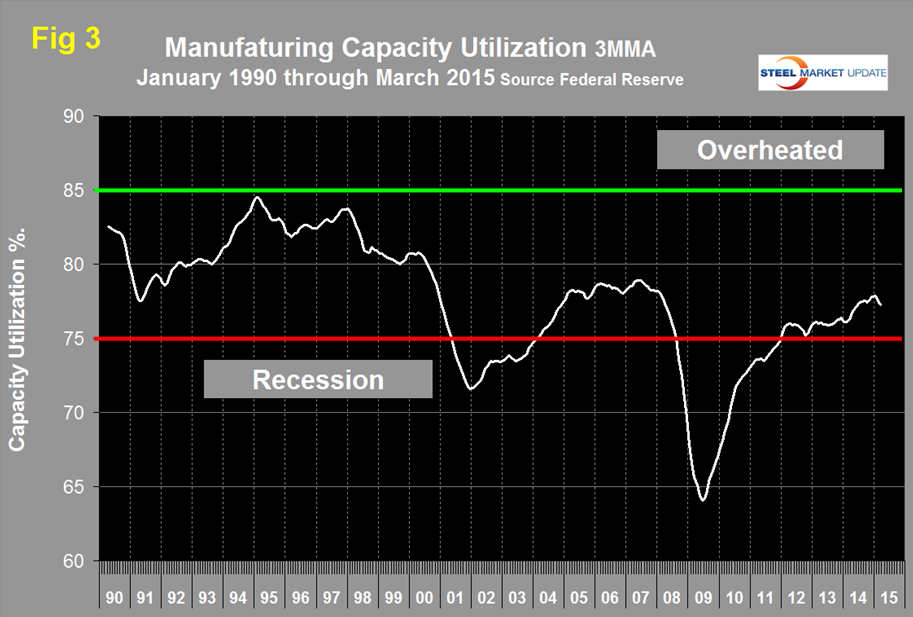

Manufacturing capacity utilization was 77.12 percent in March. The 3MMA at 77.23 declined by 0.24 from the February value (Figure 3). This dip does not ruin the improving growth trajectory that has existed for over two years.

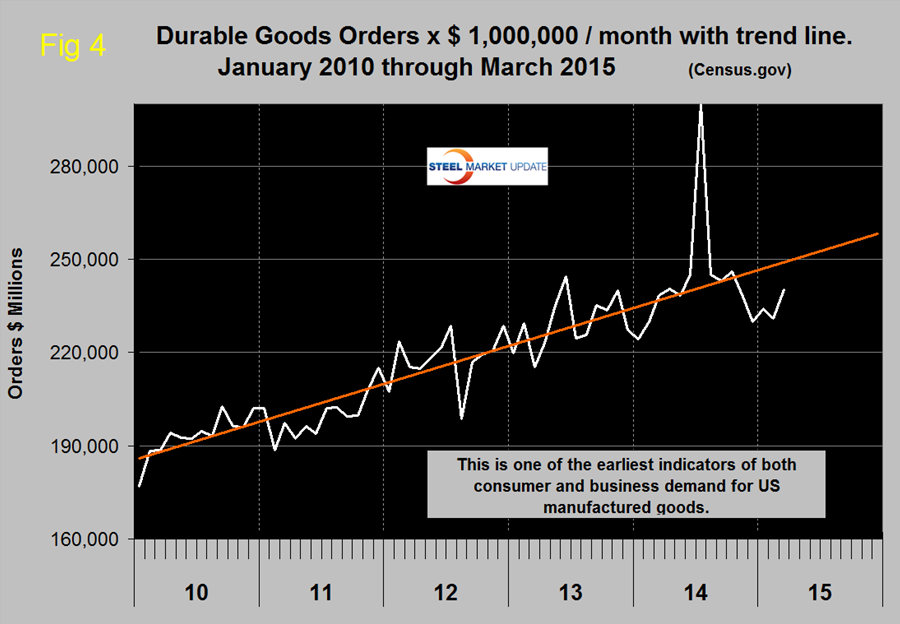

The advanced report of Durable Goods Orders was released on Friday and continued the recovery towards to the trend line following the December low point (Figure 4).

Orders were well above forecast due to a surge in civil aircraft. Motor vehicle and parts orders rose 5.4 percent and are now 13 percent above year-ago levels. Capital defense orders rose 17 percent during the month, building on their 7.7 percent gain in February. The bad news was that core capital goods orders (non-defense, excluding aircraft) which are a reflection of business investment declined by 0.5 percent.

The Federal Reserve Beige Book released on April 15th commented as follows on manufacturing activity: “Demand for manufactured products was mixed during the current reporting period. Boston, Philadelphia, Atlanta, Chicago, Dallas, and San Francisco reported an increase on net, while some weakening was observed in New York, Richmond, St. Louis, and Kansas City. Gains in activity among aerospace firms were reported in the Cleveland, Chicago, and San Francisco Districts. Philadelphia, St. Louis, and Kansas City noted weakening in the primary and fabricated metal products industry, while their counterparts in Dallas reported growth. A slowing in the chemicals industry was observed in St. Louis and Kansas City, while chemical producers in Dallas cited lower prices and margins, and lower exports, which they attributed to the strong dollar. Weakness in the steel industry was seen in Cleveland, Chicago, and San Francisco. The auto industry remained a source of strength in Cleveland and Chicago. Contacts in Boston, Philadelphia, Richmond, and Dallas believe harsh winter weather had a dampening effect on activity. Boston, Cleveland, Chicago, and Dallas attributed some weakening in demand to a strong dollar, which increased the risk to international sales. One firm in Boston noted that the changing value of the dollar increases incentives to minimize inventories. Falling oil prices had a negative impact on new orders to energy supplier companies in Cleveland, Chicago, Kansas City, Dallas, and San Francisco. Some firms in Cleveland and Philadelphia noted heightened uncertainty due to anticipated weak demand from customers serving the energy sector. However, an oilfield machinery manufacturer in Dallas expects that the energy industry will begin showing signs of improvement in the second quarter. Capital spending plans were little changed in Boston and Cleveland, but they declined in Philadelphia and Kansas City. Richmond and Atlanta reported a slight increase in inventories, whereas Boston reported no significant changes. The overall outlook by contacts in Boston, Philadelphia, and Dallas is positive. However, in Cleveland and Atlanta, optimism regarding the outlook has waned slightly during the last six weeks. In Kansas City, producers’ expectations for future activity moderated somewhat but remain slightly positive.

SMU Comment: Manufacturing is slowing but the sky is not falling. Growth is still good by historical standards. The elevated value of the US $ compared to the currencies of our major trading partners will eat into manufactured product exports but the dollar’s appreciation has reversed somewhat in the last few weeks. It remains to be seen when, (not if) expectations of a rate increase by the Fed will re-ignite the dollar’s appreciation.