Prices

April 21, 2015

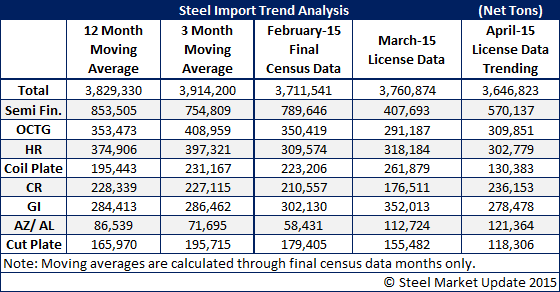

April Steel Import Licenses Trending Toward 3.5 Million Ton Month

Written by John Packard

As much as the steel industry would like to see foreign steel imports shrinking so far in April, that is not the case.

Based on steel import license data through Tuesday, April 23rd, imports are on pace to come close to repeating March’s 3.7 million tons. At this point in time Steel Market Update believes once all of the import data is collected and tabulated for the month of April that we will see imports coming in at 3.4-3.7 million tons.

The items which are attracting our attention as we look at the license data are:

Oil country tubular goods (OCTG): with the energy markets running at very low levels (new rigs) the tonnage continues to pour in. The major exporters are South Korea (even with dumping duties being assessed), Saudi Arabian (one year ago they were shipping zero tons to the U.S.), Japan and now Russia has become a larger OCTG supplier.

Hot Rolled: The Russians are out, the Brazilians and United Kingdom are moving in (along with the normal cast of characters: South Korea, Japan, Australia, Netherlands).

Cold Rolled: China continues to lap the field.

Galvanized: The numbers look like they will be down but only slightly.

Galvalume: Tonnage is building, not shrinking as the license data is suggesting AZ imports could be up significantly. Major exporters are South Korea and Taiwan with China a distant third.

We have provided the 12 month moving average, 3 month moving average, final February and license data through April 21st for March (Preliminary Census is due at the end of this week). We also show a projected number for April that is nothing more than taking the daily license receipt average and extending that average over the course of the month. We tend to see tonnage come in a little lower than what we are seeing with these numbers at this moment.

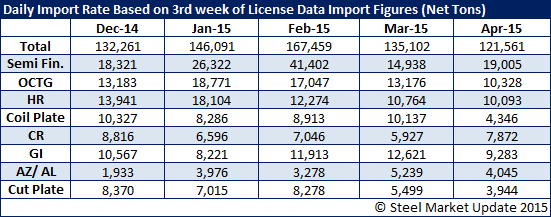

The table below shows import licenses for the last five months and is based off of license data recorded during the 15th-22nd day of it’s respective month. The data has been brought down to a daily rate for a more ‘apples to apples’ comparison.