Market Data

April 15, 2015

SMU Service Center Apparent Excess Shrinks to +554,000 Tons

Written by John Packard

SMU Service Center Apparent Excess

The Metal Service Center Institute (MSCI) released U.S. steel distributor shipments and inventories earlier today. We have a separate article which goes into detail in both flat and long products in this newsletter.

This article focuses on our flat rolled steel Service Center Inventory Apparent Excess/Deficit forecast for the month of March and our new forecast for April and beyond.

First the scorecard as to how we did with our forecast for March?

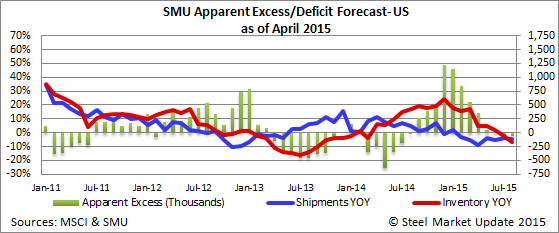

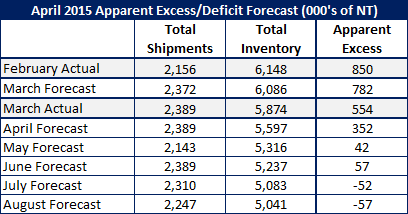

Our March 2015 forecast called for flat rolled shipments of 2,372,000 tons. Based on the just released MSCI data, actual flat rolled shipments totaled 2,389,000 tons or 17,000 tons more than forecast.

We projected total flat rolled inventories at the U.S. service centers would be 6,086,000 tons. According to MSCI data. actual inventories at the end of March were 5,874,000 tons. Inventories were reduced by 211,000 more tons than we expected and are down 274,000 tons from the 6,148,000 tons reported at the end of February.

Our initial March forecast called for the domestic service centers to have excess inventories of flat rolled steel totaling 782,000 tons at the end of March. This is based on our proprietary formula where we determine what “balanced” inventories should look like at this point in time.

Missing the forecast by 211,000 tons is a good thing for the steel industry. The actual excess, based on our calculations, is now down to 554,000 tons.

April Forecast

Our April forecast is for shipments to be flat against March at 2,389,000 tons for the month. Our forecast calls for flat rolled inventories to drop to 5,597,000 tons based on a daily receipt rate similar to that seen in March (96,000 tons/day). Our Apparent Inventory Excess is forecast to drop to 352,000 tons.

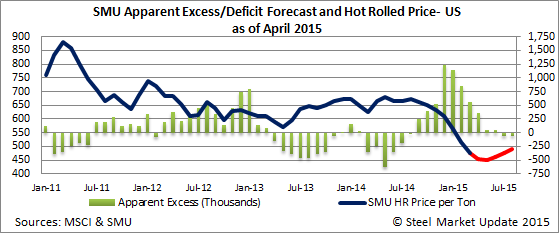

As we look out beyond April into the months of May, June, July and August we see excess flat rolled inventories drying up sooner than our previous forecast (which was calling for June before we saw a somewhat balanced inventory situation). We now see that occurring in May and then continuing to be in a relatively balanced situation through the month of August.

At the same time our forecast calls for steel prices to flatten out around $450 per ton (close to today’s levels) during that time period. We potentially could see prices drop to as low as $440 per ton before bouncing back.

Risks to Our Forecast

The biggest risk to our forecast would be the announcement of a trade case on flat rolled steel products. A trade case would push buyers back into the domestic market and our “balanced” numbers may actually begin to rise as buyers move to fill holes and build inventories in order to protect against future price increases.

We are making assumptions that foreign steel imports will decline gradually over time and pull back to the 2.7-3.0 million ton levels. If this comes true, and demand levels do not drop, we would see mill lead times move out and capacity utilization rates improve.

In both of these risk scenarios we would expect our Price Momentum Indicator to reverse direction and for flat rolled steel prices to rise.

As we get into the August time frame we also have to take into consideration the possibility of labor unrest and the larger OEM’s moving to protect themselves against any possible strike or lockout at US Steel and ArcelorMittal.

Price risk on the upside could be as much as $100 per ton during the May through August time frame. Downside risks seem to be minimal unless we see a new leg lower in foreign steel price offers to the U.S. (hot rolled consistently under $400 per ton).