Market Data

April 12, 2015

Foreign Steel Imports Took All Domestic Demand Growth & Then Some

Written by Peter Wright

The following article is was provided to our Premium customers on Friday afternoon, and we felt it would be a good article to share with our Executive members as an example of what a Premium level membership has to offer. We also published Imports by Product, Port, and Country and our Market Survey Results to our Premium members on Friday. If you are interested in our Premium product, feel free to contact us at (800) 432 3475 or info@SteelMarketUpdate.com.

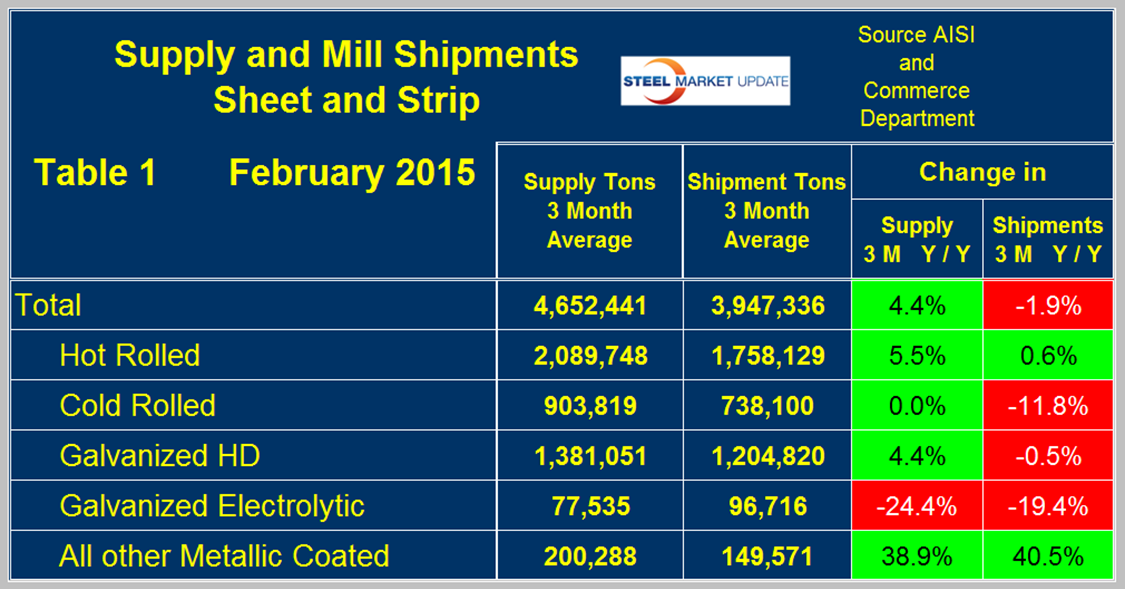

This report compares domestic mill shipments and total supply to the market to enable a side by side comparison and the degree to which foreign steel imports have absorbed demand. Sources are the American Iron and Steel Institute and the Department of Commerce with analysis by SMU. Table 1 shows both supply and mill shipments of sheet products, (shipments includes exports) side by side as a three month average for the periods December 2014 through February 2015 year over year. Comparing these two periods total supply to the market was up by 4.4 percent as mill shipments were down by 1.9 percent. In other words, imports took all of the demand growth and then some. Table 1 breaks down the total into the individual sheet products.

The very strong supply and shipment results for other metallic coated products (mainly Galvalume) was driven by an extremely strong January in which both imports and domestic mill shipments were double the volume of both December and February. Domestic cold rolled came under the most pressure in the three months through February with zero growth in supply but a decline of 11.8 percent in mill shipments. At first glance the numbers for electro-galvanized (EG) look strange with supply being less than shipments. This is because EG still has a positive trade balance where exports exceed imports. Both supply and shipments of EG are down significantly from the same period a year ago. A review of supply and shipments separately for individual sheet products is given below.

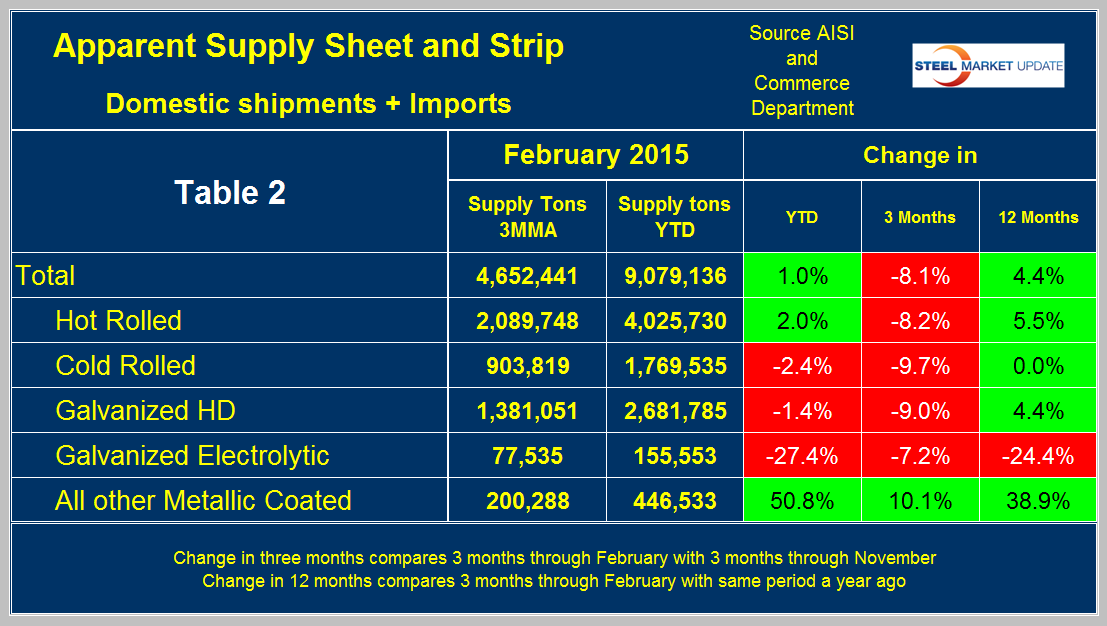

Apparent Supply is a proxy for market demand and is defined as domestic mill shipments to domestic locations plus imports. In the three months December 2014 through February 2015 average monthly supply of sheet and strip was 4,652,441 tons, down by 8.1 percent from the previous three month period, September through November 2014 but up by 4.4 percent year over year. Table 2 shows the change in supply by product on this basis plus YTD which includes January plus February. All individual products except Galvalume declined in three months through February compared to three months through November.

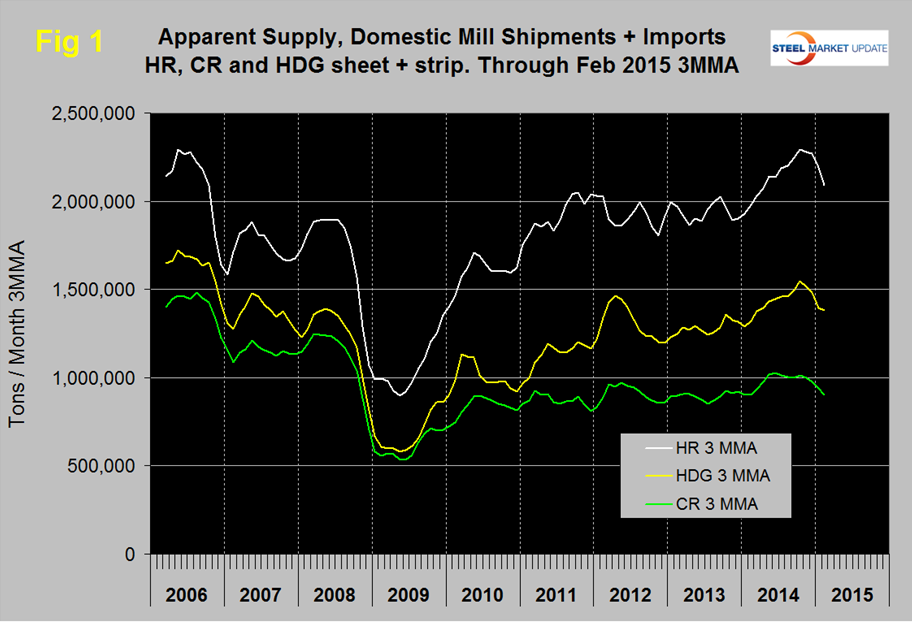

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2006.

All three products declined in February, particularly hot and cold rolled after being in higher demand in late last year than at any time since the recession. Hot band was range bound for 2 ½ years until April 2014 when it broke out and advanced through October followed by a small decline in November and December and a more rapid decline in January and February. Cold rolled supply fell below a million tons to 977,452 tons in December (3MMA) after being above that threshold for six of the previous seven months and continued to decline in January and February. Prior to this recent past the last time cold rolled exceeded a million tons was in October 2008 as we prepared to go over the cliff. Hot dipped galvanized had a strong bump in H1 2012, declined in H2 2012 and steadily improved for 22 months with a small decline in November and December and a more rapid decline in January. The decline slowed in February. In three months through February the supply of HDG averaged 1,381,051 tons/month.

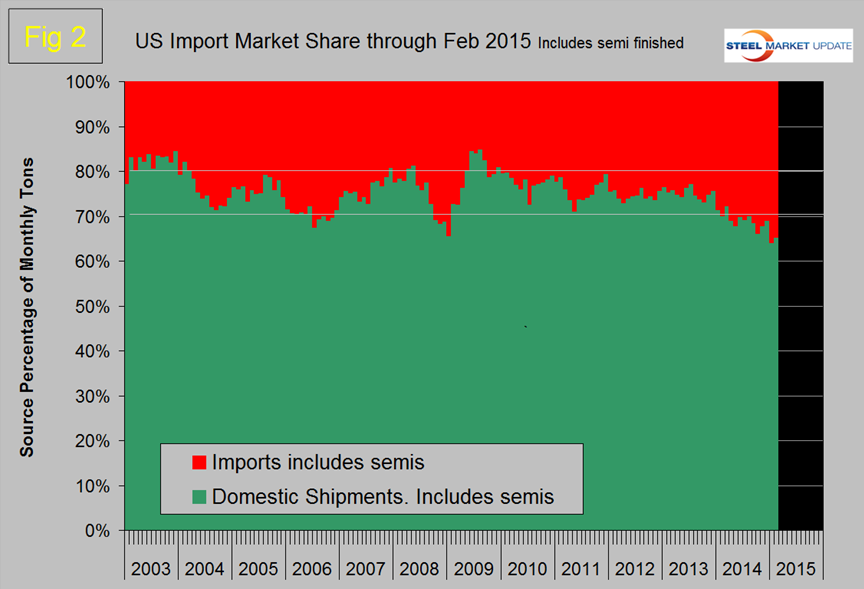

Figure 2 shows import market share of all steel products including semi-finished. There have been only three periods since 2003 when the domestic mills have commanded less than 70 percent of the market and of those three periods the current one is the most sustained.

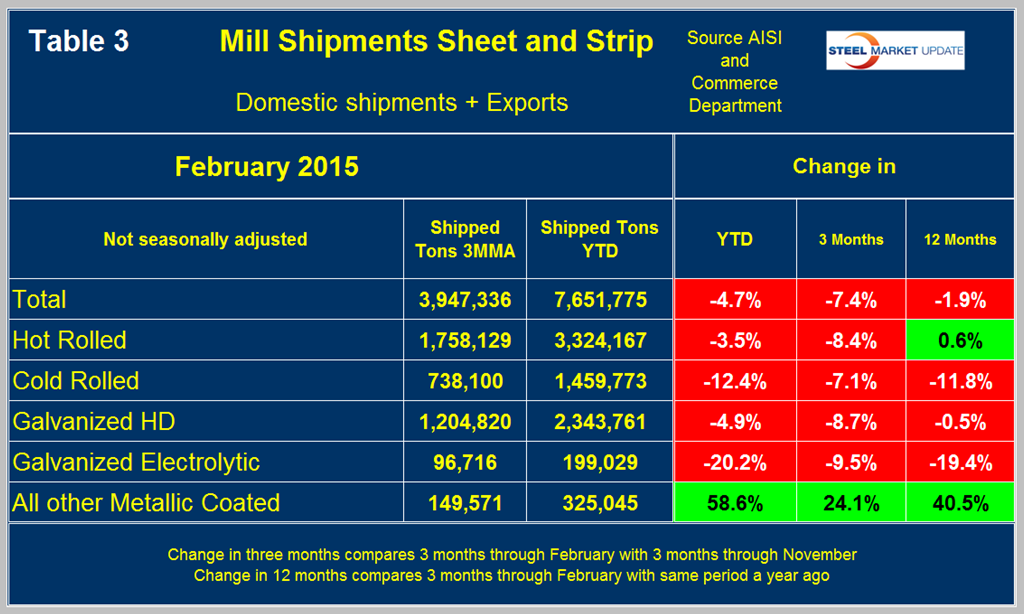

Mill Shipments Table 3 shows that total shipments of sheet and strip products including hot rolled, cold rolled and all coated products were down by 7.4 percent in three months through February compared to three months through November.

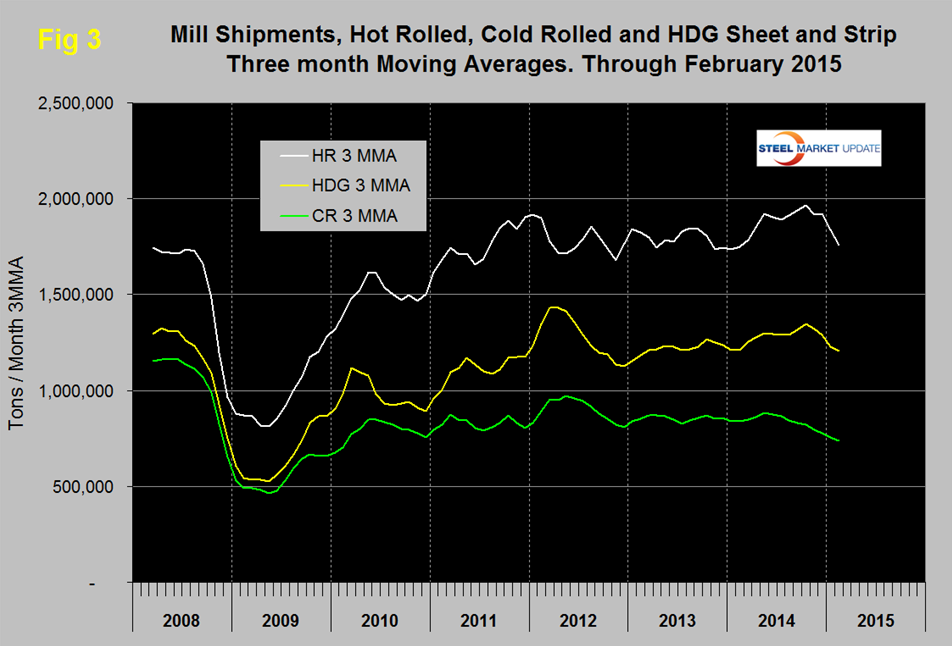

On this basis all products except ‘Other metallic coated’ were down. The same is true of YTD through February year over year. As mentioned above, mill shipments of other metallic coated products had a huge surge in the single month of January with a simultaneous surge in imports. Figure 3 shows the shipment situation by product since January 2008. All three of the major product groups declined in December, January and February.