Prices

April 9, 2015

US Scrap Exports through February 2015

Written by Peter Wright

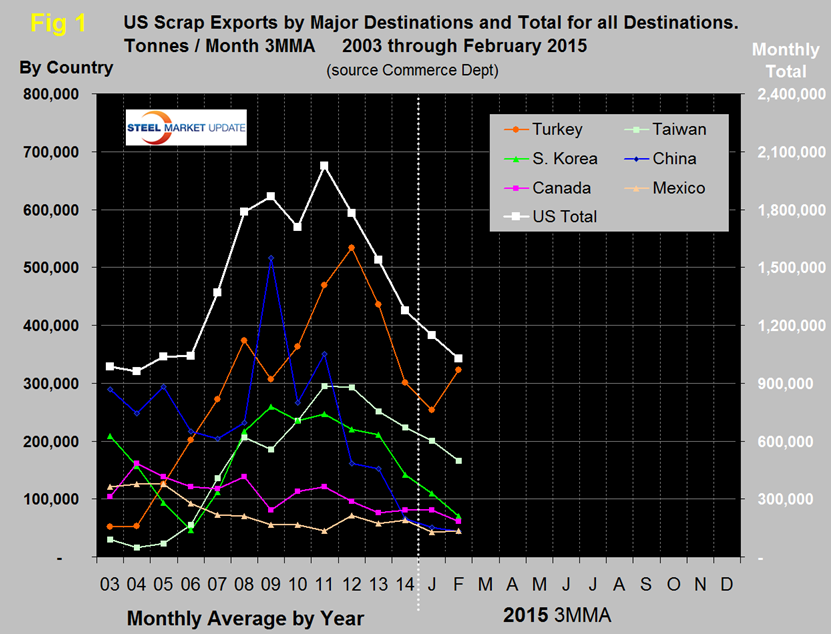

In the twelve months of 2014, scrap exports totaled 15,308,000 tonnes, down by 17.1 percent from the same period in 2013. In the first two months of this year exports were 2,026,675 for an annual rate of 12,161,050 tonnes. Figure 1 shows that the monthly average declined for three consecutive years, 2012 through 2014 and illustrates 2015’s continuing decline.

Monetary policy is being eased around the world as nations attempt to stimulate economic growth. The relatively strong US dollar is negatively impacting US trade by reducing exports and increasing imports. The decrease in scrap exports is a case in point. The Euro stood at 1.0833 on April 9th, down by 9.2 percent in three months making it tough for East Coast exporters to compete with European scrap sources for Turkish buyers. The Japanese Yen has stabilized in the last three months and on the 9th stood at 119.99 to the US $ but the Yen is down by almost 40 percent since 2012.

In spite of the Euro and Ruble effect, Turkey did increase its purchases of US scrap in February on a 3MMA basis, in fact YTD Turkish imports of US scrap are more than double what they were this time last year. YTD exports to China, Taiwan and South Korea are down by 24.2 percent, 20.4 percent and 62.2 percent compared with the same period last year. The West Coast labor disputes have undoubtedly influenced exports across the Pacific. YTD exports to Canada and Mexico are down by 17.1 percent and up by 24.8 percent respectively.

Shipments to secondary buying nations totaled 264,000 tonnes in February. Of this 48,000 tonnes shipped to Saudi Arabia and 32,000 tonnes to Peru.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. The price on both coasts has changed by less than a dollar in the last four weeks and today stands at $243.41 in the East and at $234 in the West. Chicago shredded was unchanged at $235 for April.

To view an interactive history of ferrous scrap exports, visit the Scrap Exports page on the Steel Market Update website here.