Market Segment

March 26, 2015

Three Scenarios Associated with US Steel Granite City Announcement

Written by John Packard

First, before everyone goes completely crazy regarding the US Steel announcement to “idle” the Granite City Works steel plant, SMU has been told by Courtney Boone, US Steel media spokesperson, that the plant would not go down prior to May 28, 2015. A lot can happen (and will happen) in the industry prior to that date.

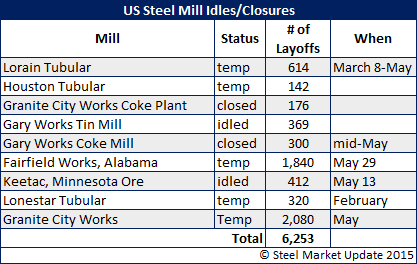

A WARN notice is required to give the workers a 60 day notice of possible layoffs. In the case of Granite City the layoff notice could potentially impact 2,080 workers.

More than likely, as with past WARN notices, not all workers will be affected as various pieces of equipment continue to produce products. If the company’s order books change between now and the WARN date (in this case May 28th), then the mill has the ability to adjust with the market.

Steel Market Update has spoken to a number of US Steel customers who have told us that all is not etched in stone and the shutdown may be postponed or cancelled depending on what happens between now and May 28th.

We heard from one US Steel customer who laid out three scenarios that we thought we appropriate to discuss in tonight’s issue.

“1) Because of the dependence of GC on the OCTG market, idling the plant is a clear sign that the OCTG sector is in for a very long drought. Given the collapse in oil prices and rig counts, as well as the surge in imports of OCTG, USS sees no near-term signs of recovery in the sector.

“2) Shutting down an entire integrated steel plant operation is a major decision, with many complexities involved. It could mean that USS is focused more on loss prevention and cash conservation, and is less concerned about market share loss. Longhi is pulling every lever he can to get USS to break even/profitability, and this move shows that “everything is on the table.” 1st Qtr results must be quite bad, and Longhi needs to be able to show the financial market that USS is taking whatever steps they can to stop the bleeding.

“3) This move along with many others, would likely help to support any trade cases that may be filed.”

Oil Country Tubular Goods Scenario

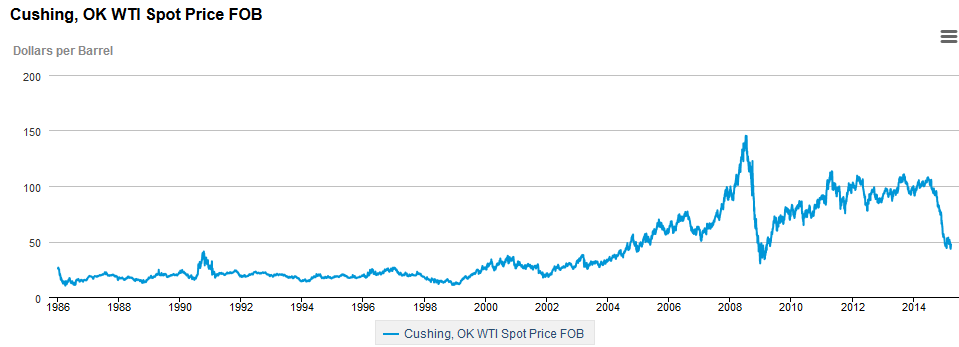

There is no denying that the oil and gas industry is experiencing a dramatic shift away from new oil and gas drilling rigs due to the low price of oil. The Cushing, Oklahoma West Texas Intermediate (WTI) oil spot price was $107.95 per barrel on June 20, 2014. Since then oil prices have cratered with the Cushing, OK spot price on WTI being $47.40 per barrel as of the 23rd of March.

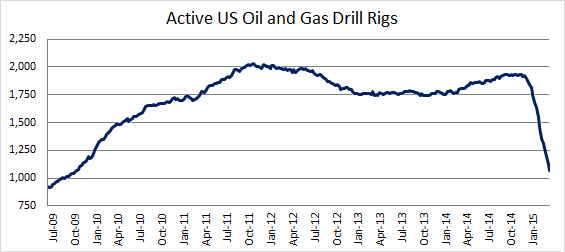

As you look at the chart above you will notice that rigs follow the trajectory of oil prices. Prices are now getting very close to the 2009 lows and the number of oil and gas rigs are also close to 2009 lows. The fewer the number of rigs the less steel needed to drill for oil. The less steel needed to drill for oi,l the less hot rolled coil needed to make OCTG and line pipe.

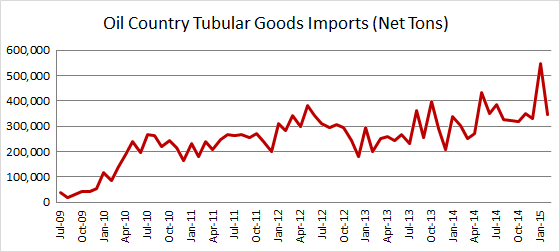

U.S. Steel has had to adjust to the new realities of not only oil & gas prices but the fact that imports of OCTG and other products related to the drilling industry have not adjusted lower as they should have by now (see graphic below).

The net result is U.S. Steel has had to make significant adjustments in their tubular and steel mill operations over the past six months.

As mentioned previously, WARN notices do not necessarily mean a plant will be shut down or that all of the employees will be affected. Each plant and product line is assessed based on the company’s order book and ability to continue to run (and make money). In the table above the potential impact is on 6,253 workers but it is doubtful that many workers will actually be laid off.

Financial Community Scenario

In speaking with members of the financial community we were told that the US Steel announcement was not “posturing” by the company. The financial community understands that USS order books are “terrible” and the company is trying to be proactive in getting out ahead of their fixed cost absorption issues.

However, just because a facility has a WARN notice does not mean that all of a facility will close. An analyst told SMU that US Steel has WARN notices on 5 million of their 19 million tons of capacity.

It is not totally understood where US Steel capacity utilization rates are and the financial community does not expect to learn more until 1st Quarter 2015 earnings conference call in late April.

Metals & Mining analyst, Chuck Bradford of Bradford Research advised SMU that, “Granite City has been a questionable plant for a number of years as a producer of commodity flat rolled and directly a competitor with the Nucor thin slab flat rolled plants in the south…” He went on to say, “The Granite City closure might have had more to do with the upcoming labor negotiations, with the USW likely, in my opinion, to seek an especially large wage package, to support the President and his wage increase demands.”

A third analyst told SMU, “The new Carnegie Way is shutting stuff down rather than waiting.” They went on to explain, “I [US Steel] have no business making steel if I have no order book.” This analyst also is of the opinion that the mill is not posturing but instead reacting to the realities of the current market environment.

The question our third analyst had was, “Is it good economic sense to shut down just as the market is about to change?”

Trade Case Scenario

The flat rolled steel market has become “riled up” again as speculation grows that trade cases will be coming against the Chinese and probably other countries on light flat rolled products (cold rolled and coated).

U.S. Steel has been a leader in the charge against imports and the potential closure of yet another steel mill would be beneficial to any trade case filing. SMU is not of the opinion that US Steel would potentially close a plant in order to better a position they may have against foreign imports.