Market Data

March 26, 2015

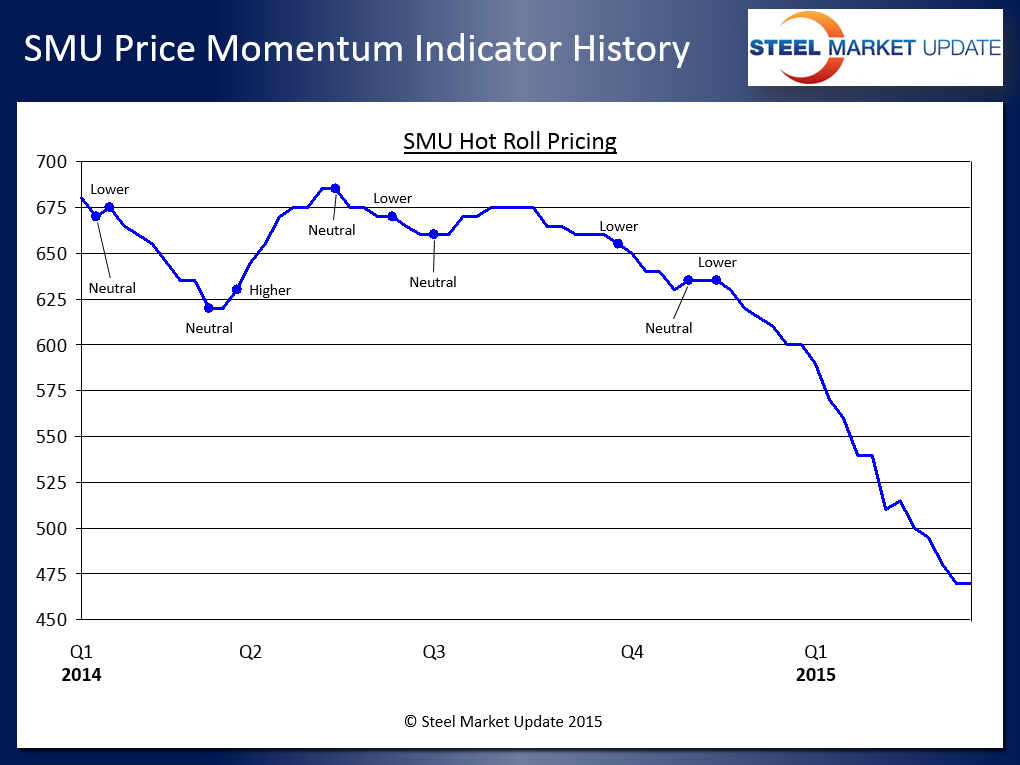

SMU Price Momentum Indicator Adjusted to Neutral from Lower

Written by John Packard

Earlier today, Steel Market Update adjusted our SMU Price Momentum Indicator from “Lower” to “Neutral.”

Since November 16, 2014 the SMU Price Momentum Indicator has been pointing toward “Lower” steel prices. Prior to November 16th we had a period of time where our Momentum Indicator vacillated between Neutral and Lower going back to May 2014. As our SMU MoMo Index shows, when averaged on a three week rolling basis, hot rolled prices have actually been declining for 31 straight weeks.

Have Prices Already Over-Shot the Low Point?

The current spread on domestic hot rolled pricing (according to our own index range) is $450 to $490 per ton ($22.50/cwt-$24.50/cwt) with an average of $470 per ton. We believe that over the next week or two prices could continue to drift lower and we may see the low end of the range hit $440 per ton. At this time we do not believe the low end will (or should) move below $440 per ton.

SMU is aware that there are a couple of mills who have put a bottom to hot rolled for most medium and smaller sized customers of $480 per ton.

This puts the downside risk at $440 to $480 per ton or a $460 average which is $10 below our current number.

The most recent SteelBenchmarker pegged the world export price at $414 per metric ton ($376 per net ton). On a theoretical basis this puts foreign import offers into the United States at approximately $440-$460 per ton which does not offer any inducement for domestic buyers to buy foreign steel unless there is a significant freight variation between the mill location and the port where the foreign steel would arrive.

Without the incentive to buy foreign it is only a matter of time when buyers will return to their domestic roots.

Removal of Excess Capacity

It’s all about the laws of supply and demand. If you can’t control demand then you must control supply.

SMU opinion is with the removal of excess capacity at US Steel, ArcelorMittal and other mills that there is a possibility of supply issues growing in the coming weeks. We are already hearing USS Fairfield customers as complaining of late May and June lead times on products which can be gotten in April at other mills.

We think there will be a period of time of adjustment as customers move orders around to those mills that have open space which will eventually push mill lead times further out.

When lead times start to move buyers have to adjust their buying programs and place more orders in order to make sure they are covered. This will also work to push lead times out.

Removal of Excess Inventories

Service centers are carrying too much steel on their floors. The excesses we have reported on to our Premium level members are being worked down and we anticipate, based on our most recent forecast, that it will be June or July before service centers will have to go to market to replenish inventories.

This forecast could be moved up should imports start to pull back in a big way in April and May. We won’t get a feel for that until the middle of April.

However, as we reported earlier this week, we are seeing out of the HVAC wholesalers the desire to place tons for April and May production and actually move toward building inventories as opposed to reducing inventories. Are the wholesalers a harbinger of what’s to come?

Trade Case Inevitable?

As we have discussed in some detail recently, the drums have been beating louder and louder against the rise of foreign steel shipments into the United States.

This scenario is not new and SMU has been aware of the possibility of a trade case for the past 18 months. What makes this time different in our opinion is: The percentage of the overall market now controlled by foreign steel.

For the month of January, SMU calculated finished imports as representing 34.1 percent of apparent steel supply (up from 29.6 percent in December). This is much higher than the more normal 22 to 24 percent we have seen in years past.

At 34 percent of finished steel (excluding slabs) it is SMU opinion that the domestic mills have no choice but to file against the foreign producers in order to recoup their lost market share.

The fact that these imports have occurred at a time when demand within the steel consuming sectors has been good and growing (with a couple notable exceptions) and the domestic mills have been unable to take advantage of their own home market growth has to be quite frustrating to the mill executives.

The industry seems determined to limit the amount of light flat rolled into the U.S. market and any trade case will create a hole which will push lead times out and prices higher.

The question is when. Although we are of the opinion it may not happen until the later part of second quarter we cannot ignore that there is a possibility it could be as soon as the domestic mills announce their losses associated with 1st Quarter earnings.

Our Opinion Is…

The SMU Price Momentum Indicator is looking out 30 to 60 days into the future. We are of the opinion that during this time period changes will be occurring within the flat rolled steel industry and prices will most likely trend sideways or maybe reverse course. We are therefore taking a “Neutral” view of price direction as we wait for the next directional signals the market will throw us to analyze.