Market Data

March 23, 2015

Industrial Production and Manufacturing Capacity Utilization

Written by Peter Wright

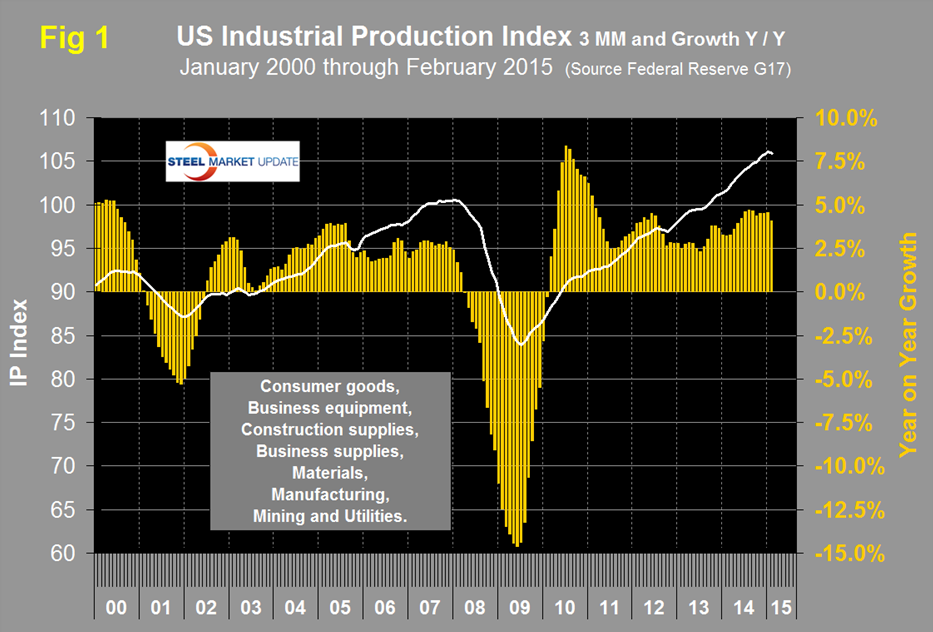

Both these data points are reported in the Federal Reserve G17 data base. The IP index was reported as 105.8 for February a slight increase of 0.08 from January. The three month moving average (3MMA) was 105.87, down by 0.17 from January which was the highest value ever and the ninth straight month where the growth of the 3MMA exceeded 4 percent year over year.

The last 12 months have experienced the best growth since immediately after the recession. The 3MMA was up by 4.1 percent y/y in February. Data is seasonally adjusted and the index is based on the July 2007 level being defined as 100 (Figure 1).

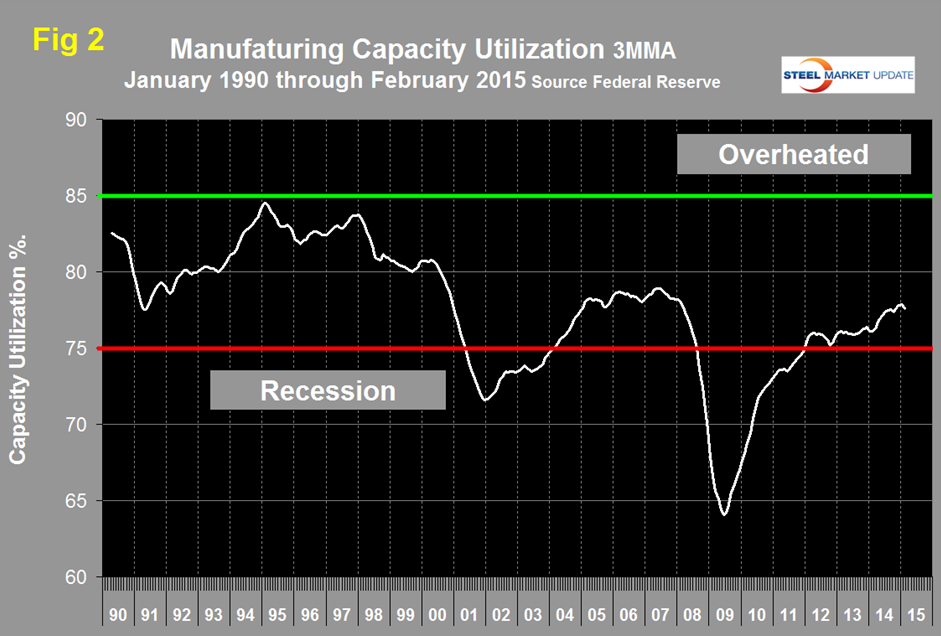

The bad news is that growth is slowing and the February growth rate was the lowest since May last year. This data parallels the ISM manufacturing Index which has been expanding at a decreasing rate since June last year. Manufacturing capacity utilization was 77.3 percent in February. The 3MMA at 77.59 declined by 0.28 from the January value (Figure 2). This dip does not change the improving growth trajectory that has existed for over two years.

The Federal Reserve Beige Book released on March 4th commented as follows on manufacturing activity: “Manufacturing generally increased since the previous survey, although the rate of growth varied across the Districts and sectors. The Atlanta District noted that manufacturing rebounded during the current reporting period following a modest slowdown in December. According to contacts in the Chicago and San Francisco manufacturing rose moderately, while contacts in New York noted modest gains. Contacts in Kansas City indicated slow growth, contacts in Philadelphia reported slight increases, and contacts in Dallas noted flat to positive growth. Reports from factory contacts in Cleveland District were mixed, while contacts in Richmond noted that activity weakened. Manufacturers had generally positive outlooks going forward. Firms in Atlanta expect production levels to increase over the next three to six months, some firms in Chicago expect steady growth in shipments for 2015. Manufacturers in Boston, Cleveland, and Richmond reported positive outlooks. In contrast, New York District contacts have grown less optimistic about the near-term outlook.

Automobile manufacturing output rose in the Cleveland, Chicago, and St. Louis Districts. Aerospace manufacturers in San Francisco expect 2015 to be a record year, and aerospace manufacturers in St. Louis reported plans to expand. Reports from primary and fabricated metals manufacturers were mixed. Firms in Chicago reported steady gains in new orders, firms in Dallas reported slower growth in demand, and firms in Philadelphia, St. Louis, and Kansas City reported weakness. In Cleveland, shipments for steel were softer than expected. Contacts in Cleveland, Chicago, and San Francisco cited increased competition from imports as a constraining factor for steel manufacturing. Industrial equipment manufacturing was mixed in Richmond and Dallas, while the Philadelphia, Chicago, and Minneapolis Districts reported gains in activity. Kansas City and San Francisco reported slower growth in machinery production.

Transportation demand generally improved. Contacts in Kansas City and New York noted increases in activity. Contacts in Atlanta and Philadelphia cited record shipping volume. Contacts in Cleveland and Richmond indicated that shipping volume has remained strong since the previous report. Contacts in Atlanta noted that disruptions at West Coast ports may be contributing to the increase in shipping volume. Drilling service firms in Minneapolis reported reduced demand due to lower oil prices, and oilfield services contacts in Dallas noted a sharp decline in demand.

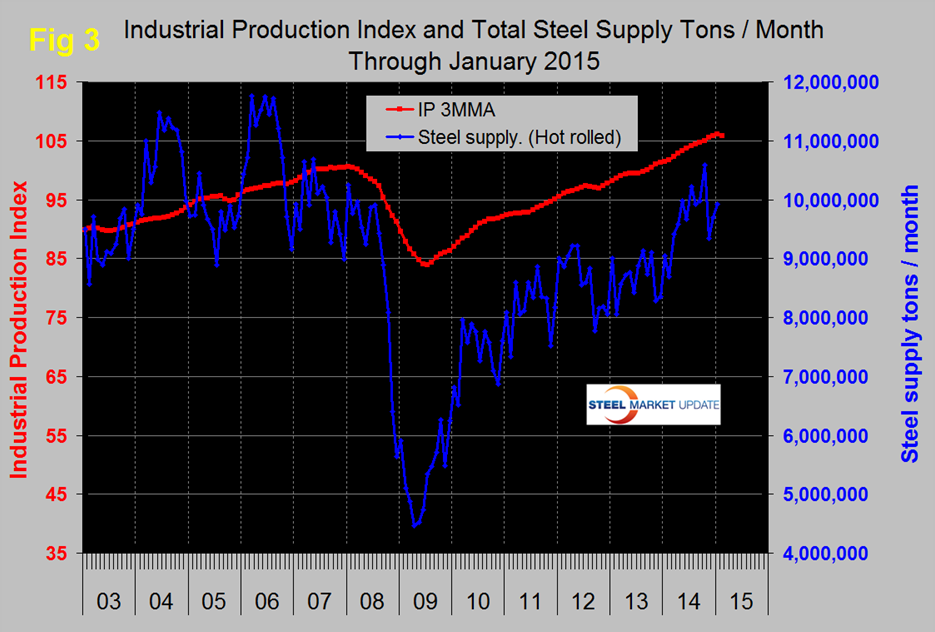

SMU Comment: There has been a lot in the press recently about the slowdown in manufacturing but we think this is overstated. Growth is still good by historical standards though it is true that growth is declining. The increasing value of the US $ compared to the currencies of our major trading partners which will eventually begin to eat into manufactured product exports. Prior to the recession there was a reasonable correlation between industrial production and steel supply, (including imports) though steel was very much more volatile in this comparison just as it is against GDP (Figure 3). Steel supply took its seasonal dive in December. We have many indicators that suggest that steel supply is lower than it should be at this stage of a recovery but the gap between steel supply and the industrial production index is closing. Manufacturing has been the growth engine of steel demand since the recession, housing and non-residential construction are still the drag and likely to be so for several years.