Market Data

March 23, 2015

Currency Update for Steel Trading Nations

Written by Peter Wright

This month we will start with words from Armada Executive intelligence which sum up the present situation nicely:

![]()

“Last week it was made abundantly clear just how sensitive the markets are to the discussions at the Fed. There was a perception that Janet Yelled was pushing an interest rate increase off to at least September. Almost immediately the value of the dollar dipped dramatically. By the next day it was determined that she had said nothing of the kind and that a June hike was still in the cards. Just as swiftly the dollar made up some of its losses. When it becomes apparent that the Fed will actually hike rates the dollar will gain substantially against the other global currencies. What does the rest of the year look like? There is very little to suggest that anything substantial will change and that means that the dollar will get stronger. The Fed might well accelerate that gain with a rate hike but even without that decision the factors bolstering the value of the dollar are going to remain in place. Weak economic performance in Europe coupled with slower growth in Asia is leaving the US as the only game in town for investors and that puts pressure on the dollar. This is not going to be a good year for those that are competing with foreign companies exporting to the US and it is not good news for those in the US that are trying to export to the rest of the world.”

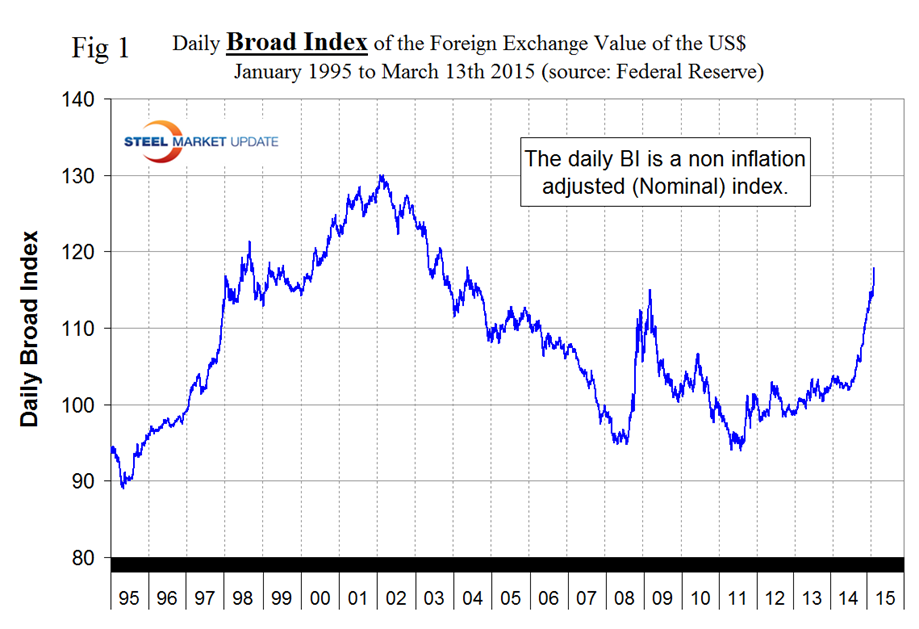

The monthly value of the Federal Reserve Broad Index value of the US $ against our major trading partners has continued to strengthen and in February reached 93.18 after breaking 90 in December for the first time since July 2009. The monthly BI is a “Real” inflation adjusted index. The Fed also reports a daily nominal (non-inflation adjusted) index. On February 3rd 2014, the value for the daily index was 103.803, the index then weakened and briefly broke through 102 on July 1st, and by March 13th this year (the last date published by the Fed) had risen to 117.92 Figure 1 shows the nominal daily index through March 13th, this was before the recent meeting of the Federal Reserve that led to the dollar’s decline as described by Armada at the start of this piece. Through the 13th the daily BI had strengthened by 14.5 percent in 12 months, by 6.0 percent in 3 months, by 3.4 percent in 1 month and by 1.3 percent in 7 days.

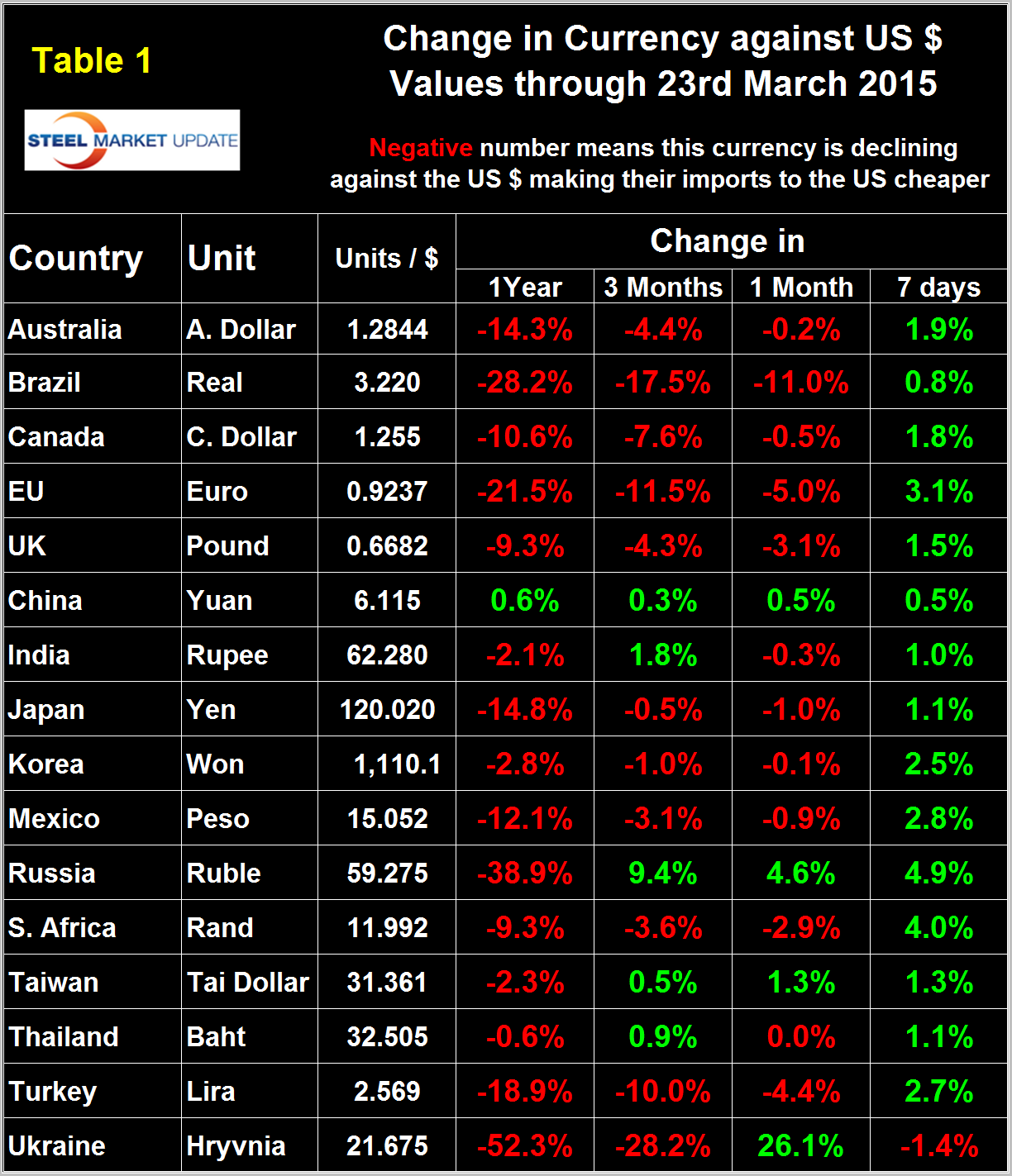

It does not necessarily follow that the currencies of the steel trading nations follow the Broad Index. Our data for the individual nations is 10 days more current than the daily BI and does reflect the global attitude change to the dollar. (Money flows into dollar denominated assets when there is an expectation of higher return or greater safety or both. When the Fed back peddled on a possible interest rate increase next June the dollar declined in value relative to other currencies.) Table 1 shows the number of currency units of steel trading nations that it takes to buy one US dollar and the change in one year, three months, one month and seven days.

Negative values for change indicate that the dollar is strengthening against a particular currency. An explanation of the source data is given at the end of this piece. In the last twelve months the dollar has strengthened against 15 of the 16 steel trading currencies and in the last three months has strengthened against 11 of them. In the last month the dollar has strengthened against 12 but in the last week there has been an almost universal move away from the dollar which weakened against 15 of the 16 steel trading currencies. The only currency to decline against the dollar in the last week was the Ukrainian Hryvnia. Table 1 is color coded to indicate strengthening of the dollar in red and weakening in green. We regard strengthening of the US Dollar as negative and weakening as positive because the effect on net imports.

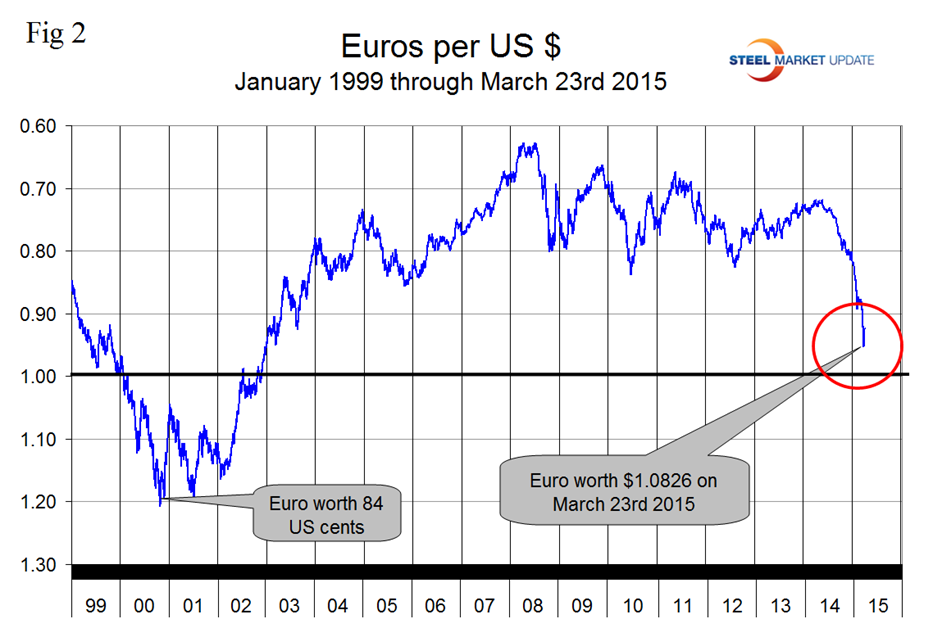

At SMU we continue to regard the saga of the Euro as having the most obvious and significant future impact on the US steel industry. On September 6th last year the Euro broke through the 1.3 US $/Euro level for the first time since July 11th 2013 and by January 15th 2015 had depreciated to a value of 1.121 US dollars, its lowest value since May 1st 2003. Since then the Euro has oscillated with a high of 1.145 on February 5th and a low of 1.050 on March 15th. Since the Fed’s meeting the Euro has recovered to 1.0826 (Figure 2).

A devalued Euro means that US exports will be more expensive in Europe and European imports will be cheaper here. This is particularly true for steel trade. In addition European scrap will be more attractive to Turkish buyers than supplies from the US which will put downward pressure on domestic scrap prices. Based on all we read it doesn’t seem possible that the Eurozone can continue to exist in its present form. The Euro has been poetically described as “One size fits nobody.” Trade imbalances between the members are tremendously to Germany’s advantage at the cost of the southern periphery. German unit labor costs are the lowest in Europe, 50 percent of Germany’s GDP is export oriented and German goods flood the rest of Europe. Under normal circumstances countries like Spain or Italy for example would simply de-value their currencies and the trade imbalances would be corrected. The common currency prevents such a measure. It seems to us that if the Euro is to survive, the only long term solution is the creation of a United States of Europe with common fiscal and monetary policies between members as we have in the US. The likelihood of this happening is extremely remote and would probably require an inconceivable financial catastrophe to force all member nations to agree. If member countries exit the Euro, again to use Italy and Spain ass examples, their currencies would devalue by at least 50 percent overnight. Since these countries have sizeable steel industries the implications are obvious.

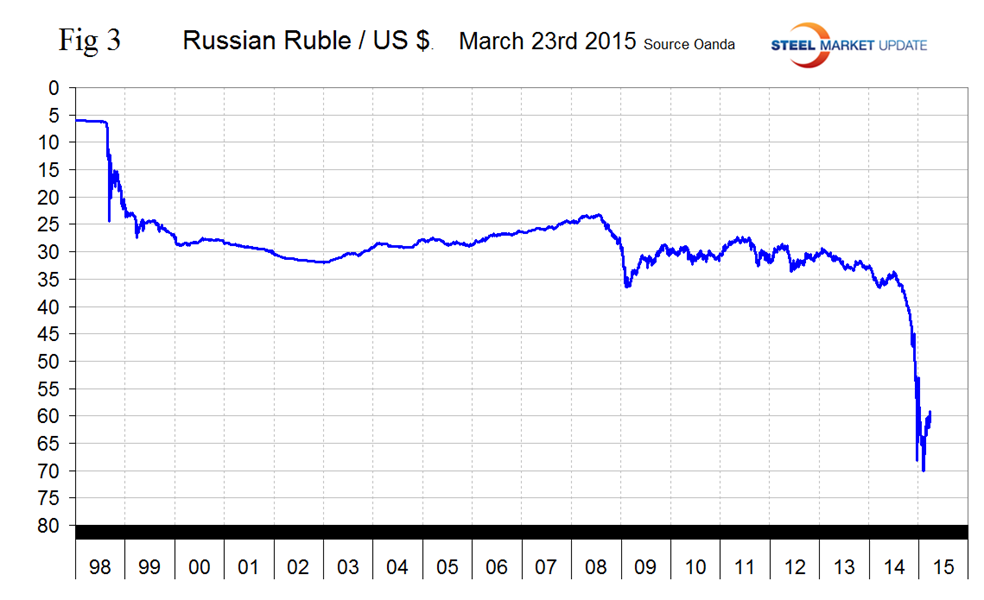

The surprise in this update is that the Russian Ruble which had declined to slightly less than 70 to the US $ on February 1st but has since bounced back to 59.27 in March 23rd (Figure 3).

The Ruble has declined by 38.9 percent against the dollar in 12 months but in the last three months has recovered by 9.4 percent. The future of the Ruble is heavily dependent on the price they can obtain for their oil and gas exports. Oil revenues are their greatest source of foreign currency reserves which it must have to service its international debt. If these reserves dwindle, another Russian debt crisis and possible default similar to the late 1990’s could occur. The global markets would plunge, but Russia would be hurt the most.

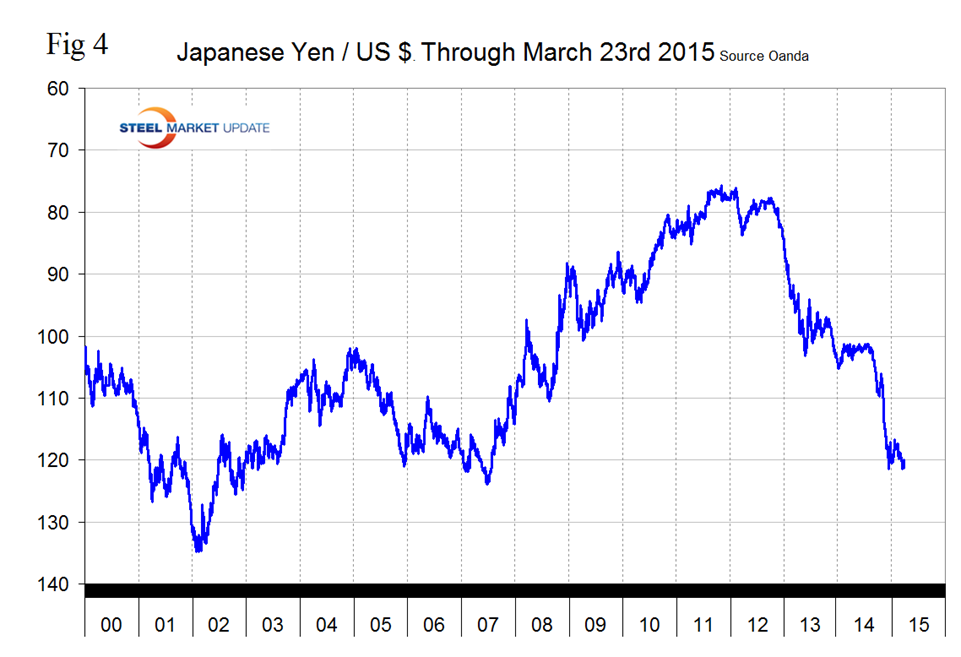

The Japanese Yen broke through the 120 level on December 6th and has been flirting with that level ever since closing at 120.02 on March 23rd (Figure 4).

It looks as though central bank intervention has had some success in breaking the Yen’s fall. Depreciation against the dollar has been 14.8 percent in 12 months, but in the last three months the decline has been only 0.5 percent. For years, traders big and small have used a tried, and usually true, way to make money: borrow cheaply in a country with low interest rates and a weak currency, typically Japan, and then invest in a country with higher rates such as Australia or South Africa. But a wave of central-bank moves and shifts in regional economies in recent months have upended the strategy, known as the carry trade. The Australian dollar and South African rand are tumbling, while the Japanese yen is rising against the euro. That is forcing money managers to go farther afield to find new ways to create the same trade. Today, many are borrowing in Europe to take advantage of anticipated future declines and the rock bottom interest rates.

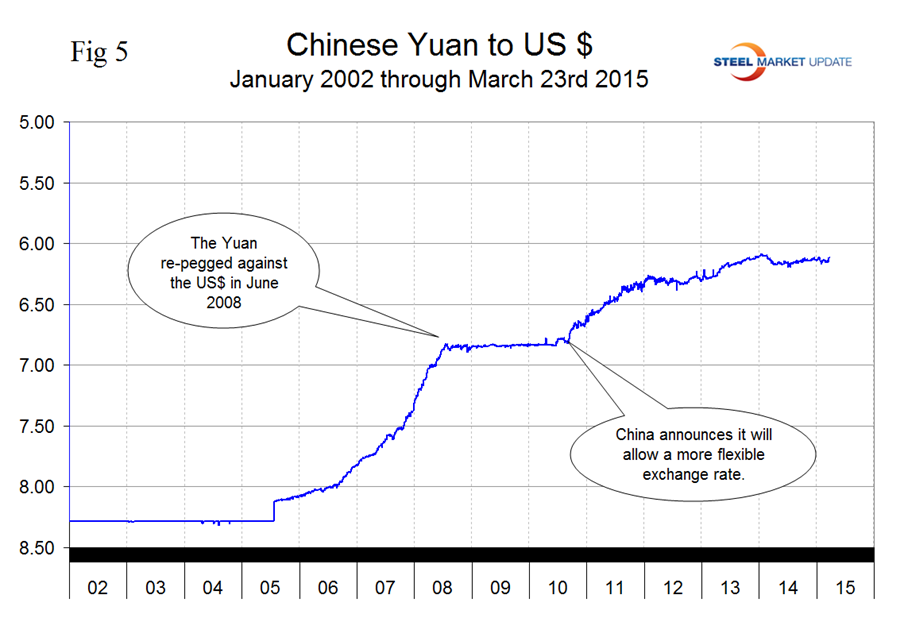

The Chinese Yuan closed at 6.115 on March 23rd with very little change in the last year (Figure 5).

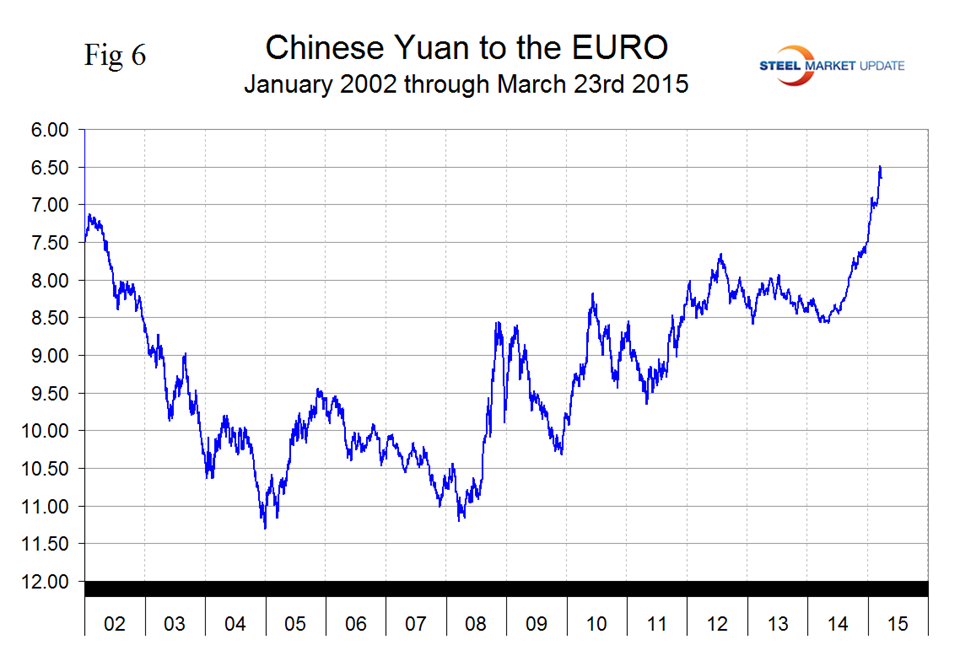

The view from inside China is that the peg to the US $ is making their exports much more expensive on the world stage. Figure 6 shows the Yuan against the Euro.

Europe is China’s # 1 trading partner. If China allows the Yuan to depreciate to maintain its export competitiveness then the BI value of the US $ will be driven higher faster. The World Bank warned in January against a “disorderly unwinding of financial vulnerabilities.” According to the Financial Times on February 6, there is a “swelling torrent of ‘hot money’ pouring out of China.” Guan Tao, a senior Chinese official, said that $20 billion left China in December alone and that China’s financial condition “looks more and more like the Asian financial crisis” of the 1990s, and that we can “sense the atmosphere of the Asian financial crisis is getting closer and closer to us.” The anticipated rise of US interest rates this year, even by a quarter point as the Fed is hinting at, would exacerbate this trend and hit the BRICS and other developing countries with an even more violent blow, making their debt servicing even more expensive.

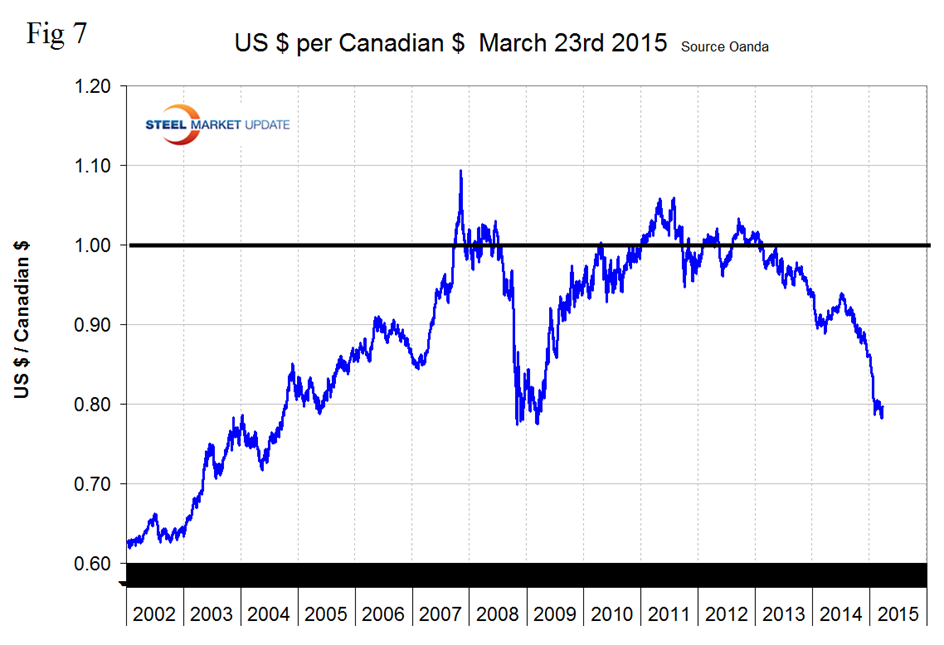

After trading in the mid to low 90 cent region for most of last year the Canadian dollar crashed through 80 cents on January 29th then stabilized and stood at 79.69 cents on March 23rd. This was a turnaround from the low point of 78.23 cents on March 15th. The Loonie was up by 1.82 percent in the last 7 days but is down by 10.6 percent in 12 months (Figure 7).

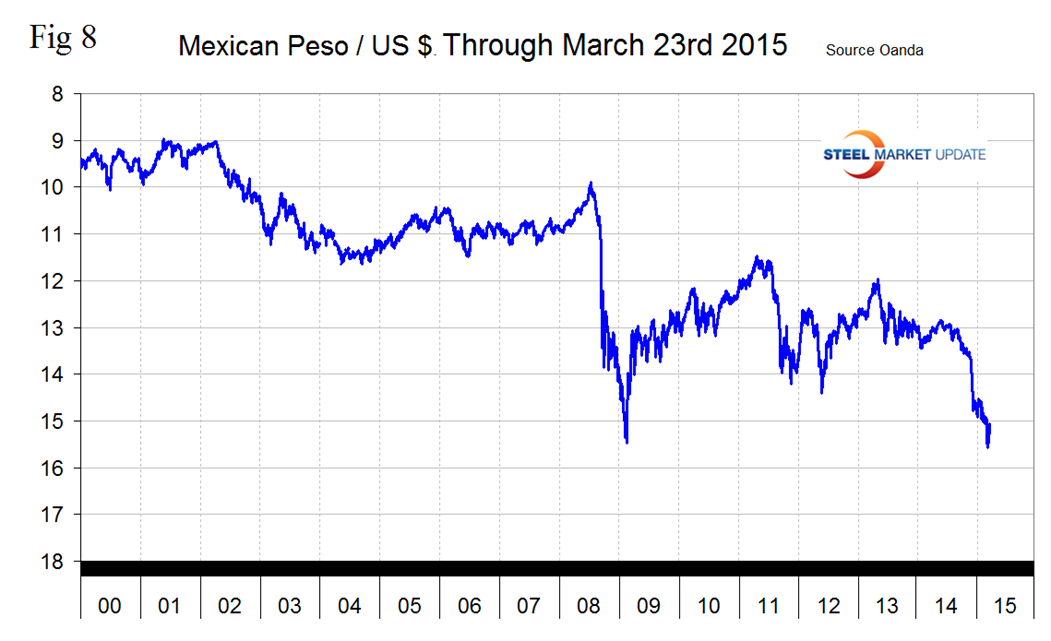

The Mexican Peso broke through 15 to the US Dollar on February 12th, bottomed out at 15.5786 on March 12th then recovered along with the rest closing at 15.0518 on the 23rd. The peso was down by 12.1 percent in 12 months but the recovery in the last few days ate up most of the decline that had occurred in the previous month (Figure 8). The Peso is weaker than at any time since early 2009 which has severe implications for the distribution of manufacturing within NAFTA.

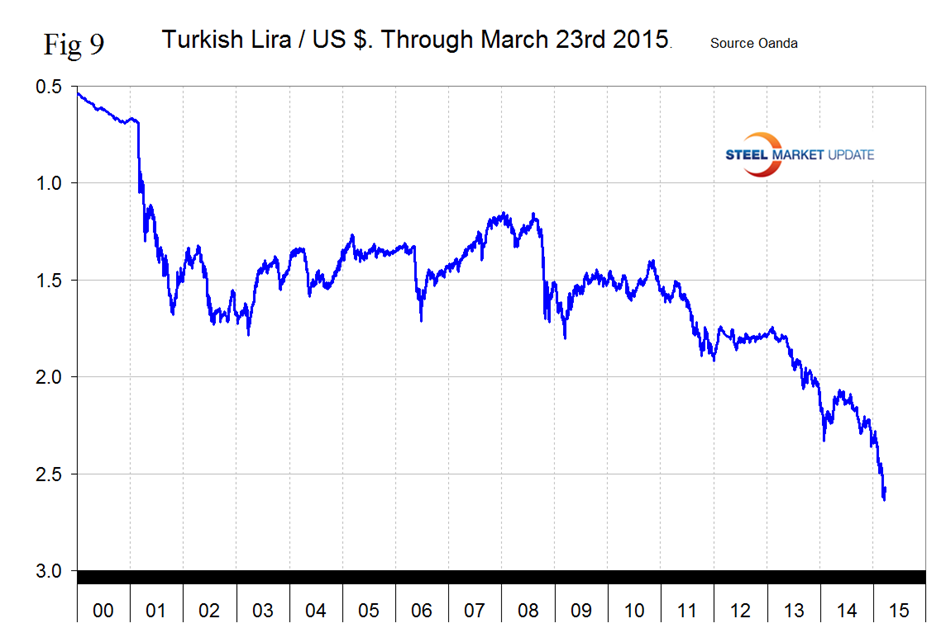

The Turkish Lira broke through 2.4 to the dollar on January 30th, through 2.5 on February 28th, through 2.6 on March 14th to bottom out at 2.6376 two days later. The Lira has recovered by 2.7 percent in the last seven days to close at 2.57 on the 23rd. The Lira has declined by 18.9 percent in the last year and by 10.0 percent in the 3 months (Figure 9).

The US position as a scrap supplier to Turkey has deteriorated strongly as the Dollar has strengthened against the Lira by more than it has against the Euro or the British Pound. Interest rates have greatly fluctuated in Turkey over the last year to initially deter capital outflows by raising rates, then cutting throughout the year to spur economic growth. This led to wide consumer price swings and declining consumption which weighed on economic activity as a whole. With Turkish policymakers still in a bind, it is likely the lira continues to decline against the U.S. dollar in coming months.

SMU Comment: There was a slight relief in the dollar’s climb in the few days after the recent announcement by the FOMC. Nevertheless longer term trends are not good for US steel producer competitiveness and will continue to attract imports and suppress both exports and raw materials prices. In this analysis we report on the currencies that we think have the most immediate significance, but all 16 steel trading nation graphs are available on request if any reader has a special interest that we haven’t covered.

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the US $ against that of sixteen steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion US $ are traded every day on foreign exchange markets.