Overseas

March 8, 2015

Reduction in Price Spread Affecting Steel Buying Habits

Written by John Packard

Over the past month we have begun to ask a new question of those responding to our flat rolled steel questionnaire. With the excessive inventories at service centers, and potentially some end users, created (in part) by high levels of imports, SMU wanted to know when we might see imports start to taper off. This will be an important ingredient to balancing inventories and allowing the mill order books to rebound.

We have been inquiring as to the competitiveness of foreign steel import pricing for many years. Now we want to know if the reduction of the spread between domestic and foreign pricing will result in a change in buying patterns.

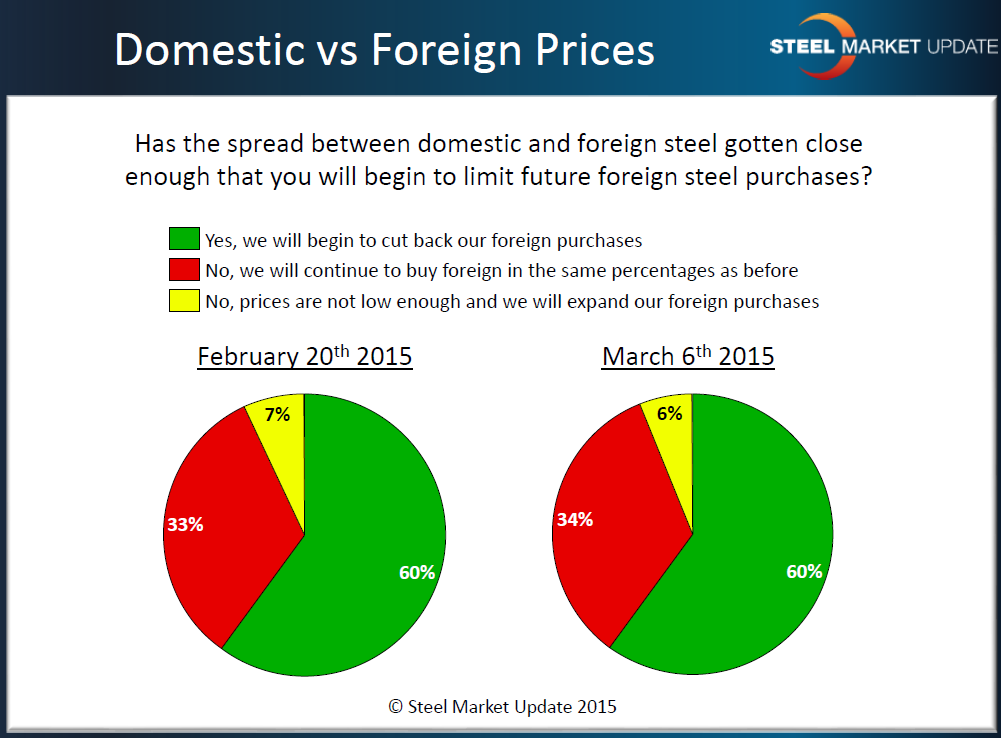

In the graphic below we ask all of our respondents to tell us if the reduction in the spread is enough to cut back on their foreign purchases. The results of the survey done in mid-February was remarkably close to the results from this past week. As you can see 60 percent of the respondents (all companies) reported they would cut back foreign purchases.

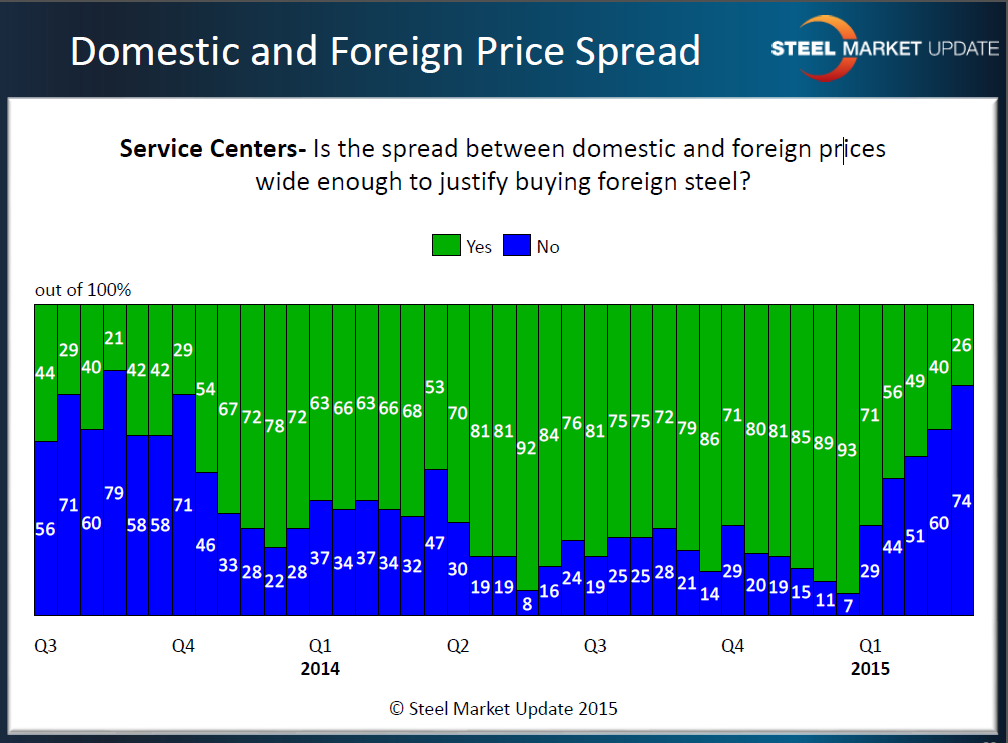

SMU mentioned above we have been keeping track of the spread between foreign and domestic steel pricing for quite some time. This has kept us on the cutting edge of changes as they occur. We want to watch the spread from both a manufacturing and service center perspective and the next two graphics will provide us some insights into the changes in the trend as both manufacturing companies and service centers become less enamored with foreign steel.

First, let’s look at the distributors who in the middle of December were reporting that the spread was wide enough to justify buying foreign steel. Now the vast majority have changed their minds with only 26 percent reporting.

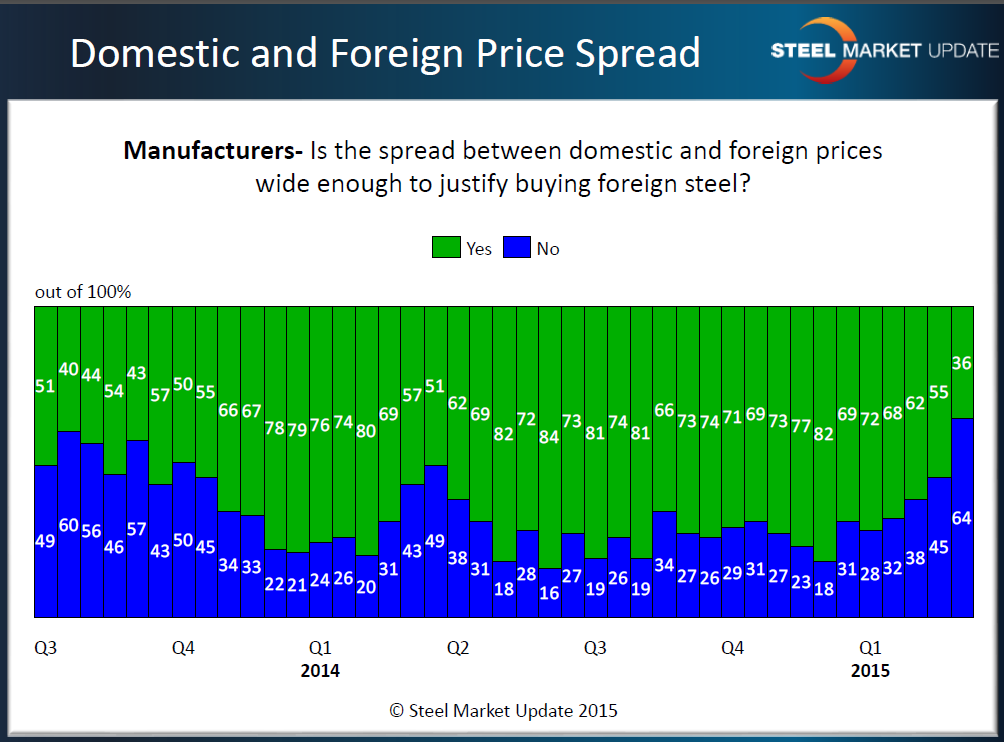

Manufacturing companies are also seeing the trend break, albeit at a slower rate than the service centers. Over history we have seen manufacturing as slower to pull back from foreign steel than distributors.