Market Data

March 6, 2015

Net Job Creation through February 2015

Written by Peter Wright

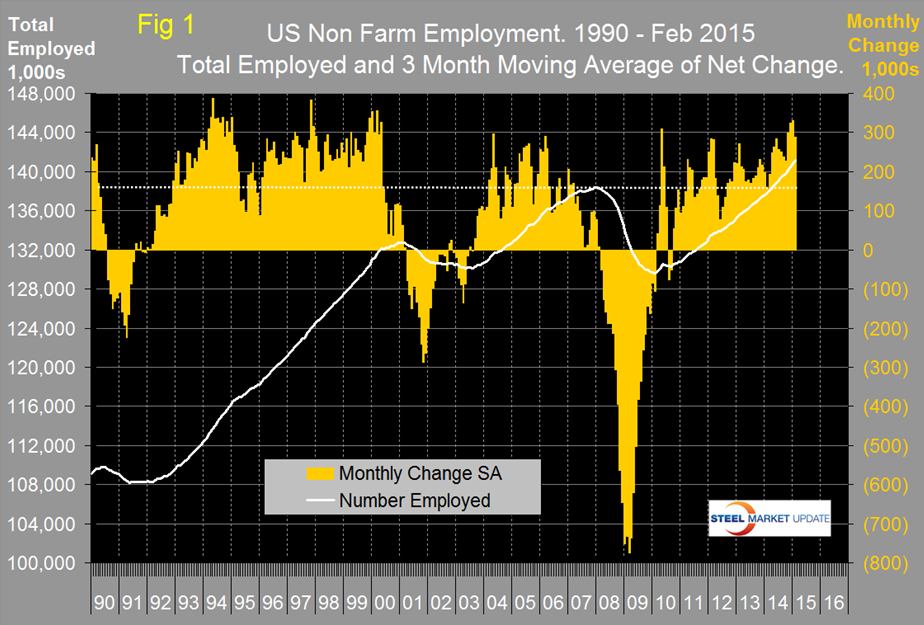

The Bureau of Labor Statistics (BLS) report on non-farm employment reported that 295,000 jobs were added in February, the January result was revised down by 18,000. The three month moving average, (3MMA) of gains through February was 288,000. This job recovery is now seen to be much stronger than was the case in the mid-2000s (Figure 1).

Total non-farm payrolls are now 2,761,000 more than they were at the pre-recession high of January 2008. November was the first time ever for total non-farm employment to exceed 140 million. In the last twelve months the average monthly job creation has been 275,000 per month. Another factor that must be influencing the population’s attitude to employment opportunities is that an estimated 10,000 baby boomers per day are retiring from the workforce. All numbers in this analysis are seasonally adjusted by the BLS.

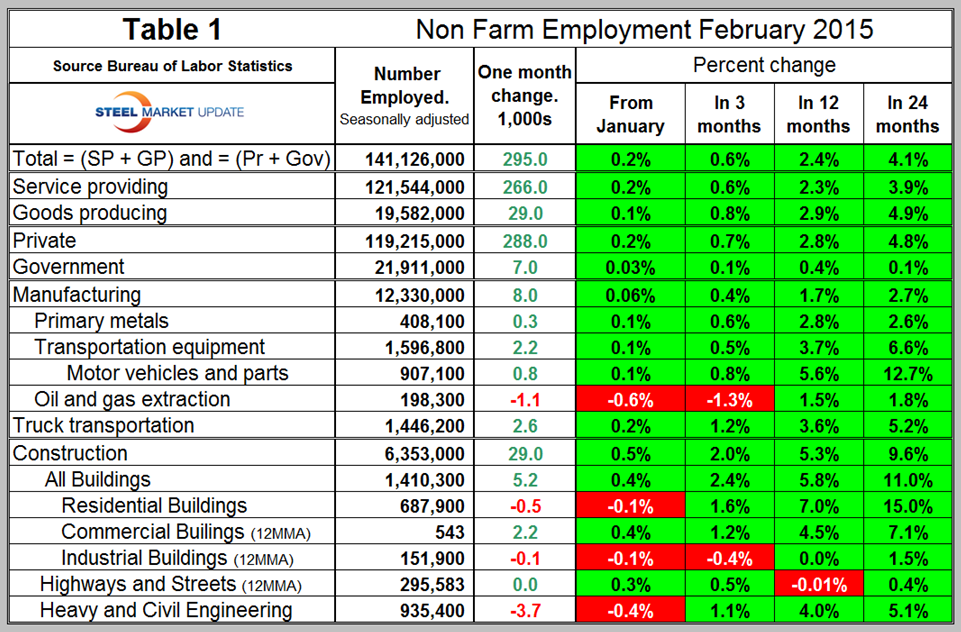

Table 1 slices total employment into service and goods producing industries and then into private and government employees.

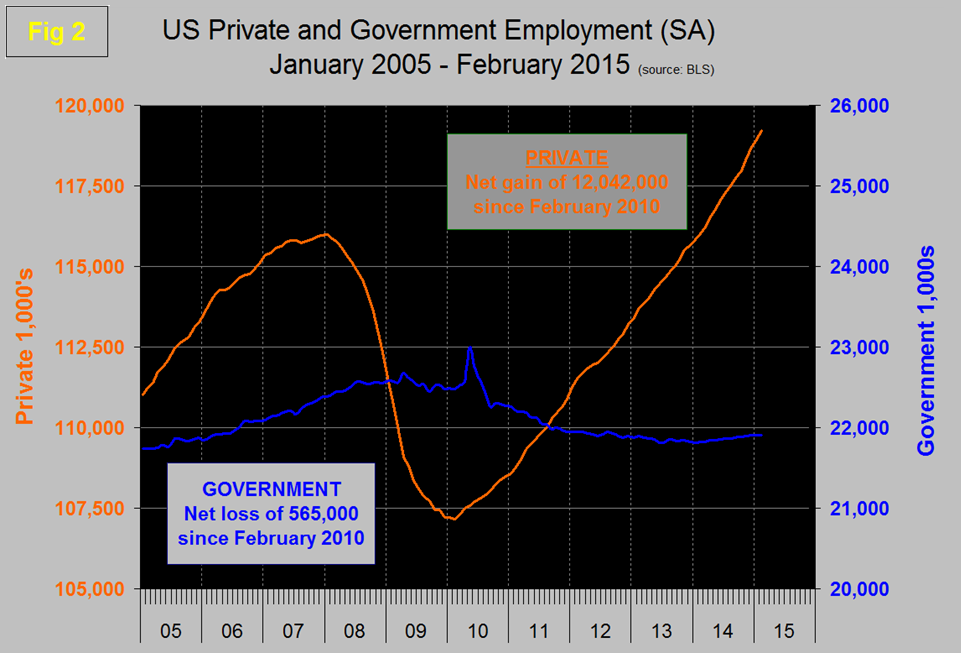

Total employment equals the sum of private and government employees. It also equals the sum of goods producing and service employees. Most of the goods producing employees work in manufacturing and construction and these sectors are further subdivided in Table 1. In February private employment grew by 288,000 and government by 7,000. Since February 2010, the employment low point, private employers have added 12,042,000 as government has shed 565,000 (Figure 2).

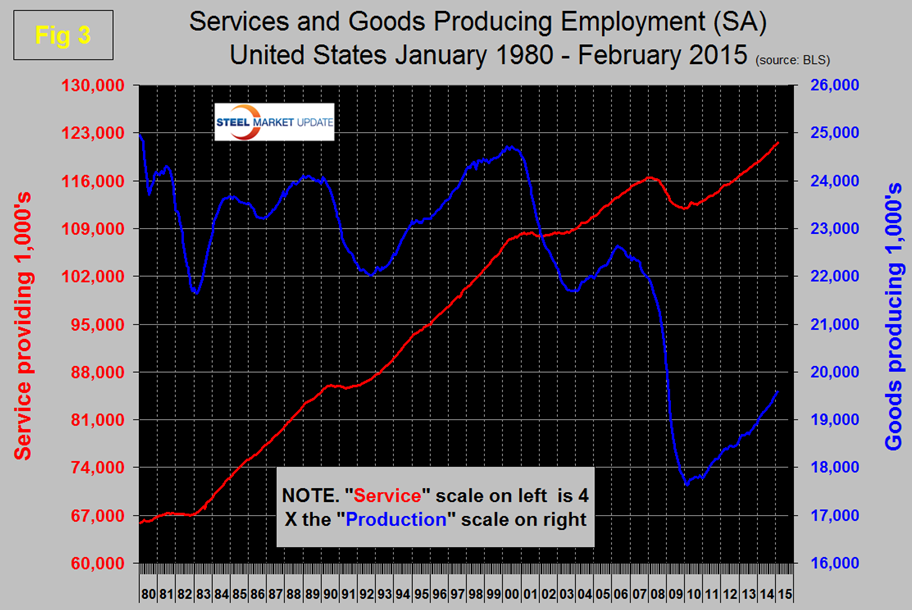

In February service industries expanded by 266,000 and goods producing by 29,000 people. Since February 2010, service industries have added 9,522,000 and goods producing 1,955,000 positions (Figure 3).

Manufacturing added 8,000 jobs in February. Transportation equipment which is mainly motor vehicles and parts was the strongest sector in manufacturing in February with 2,200 additions. Note; Table 1 only identifies the major sectors in manufacturing and construction so the totals don’t add up. Truck transportation added 2,600 jobs and is now back to the pre-recessionary peak of early 2007.

Construction added 29,000 jobs in February of which 5,200 were in building construction. An examination of Table 1 suggests that the result for total buildings compared to the individual results for residential, industrial and commercial looks too high. How can that be? The problem is that industrial and commercial buildings are reported one month in arrears so we have to work around that.

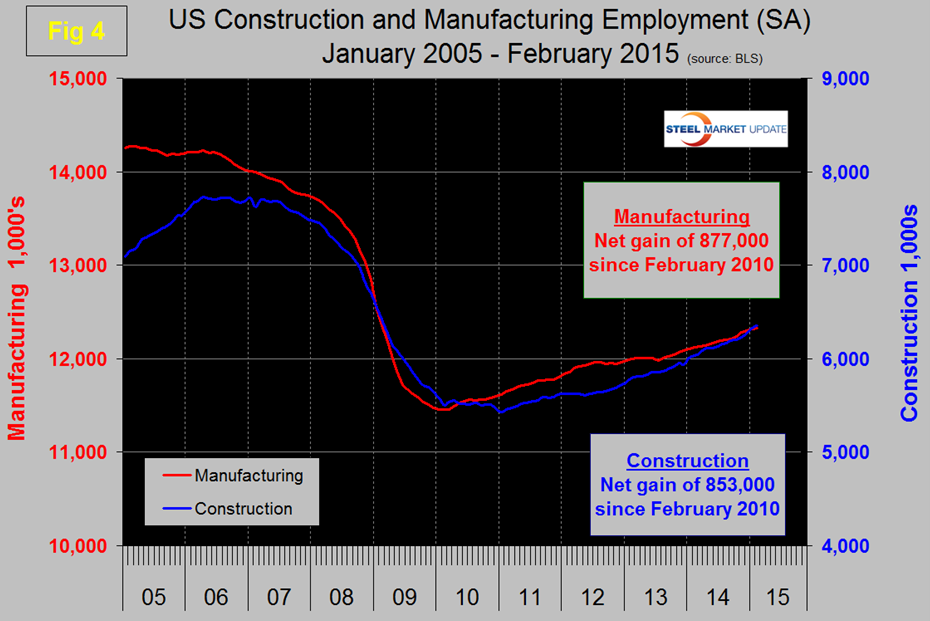

Since the bottom of the employment recession manufacturing has added 877,000 jobs and construction has added 853,000 jobs (Figure 4).

Clearly construction is catching up fast after a slower initial recovery from the recession and in the next couple of months should pass manufacturing as a job creator since the recession turnaround. This bodes well for the sector that has been holding back steel demand.

The collapse of the price of oil is now showing up in the employment statistics with a 1.3 percent reduction in the number employed in this industry in the last three months.

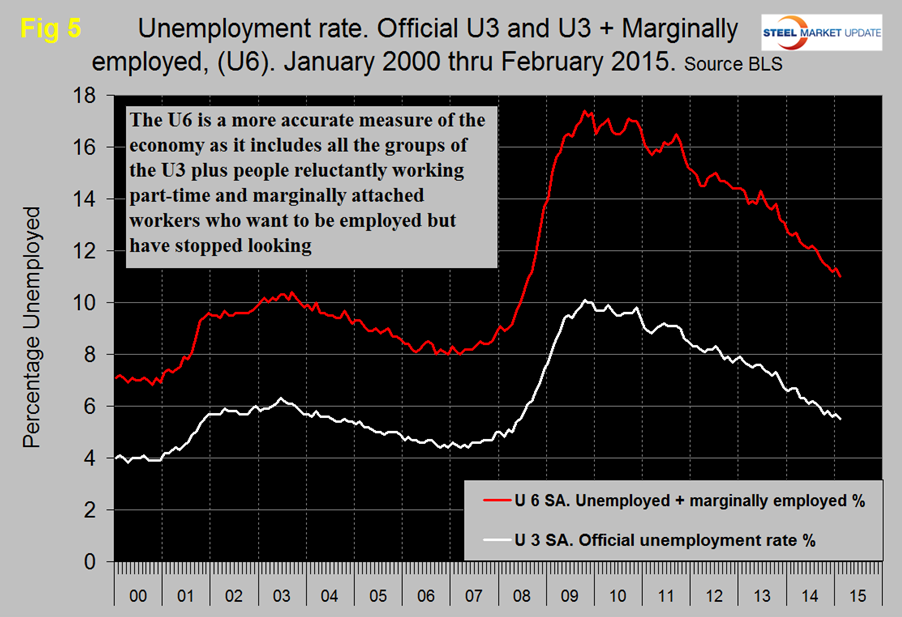

The official unemployment rate decreased from 5.7 percent in January to 5.5 percent in February. This number known as the U3 rate doesn’t take into consideration those who have stopped looking. The more comprehensive U6 unemployment rate also decreased from11.3 percent in January to 11.0 percent in February (Figure 5).

U6 includes workers working part time who desire full time work and people who want to work but are so discouraged that they have stopped looking. The differential between these rates was usually less than 4 percent before the recession but since June has averaged 5.76 percent. The good news is that the gap is slowly closing.

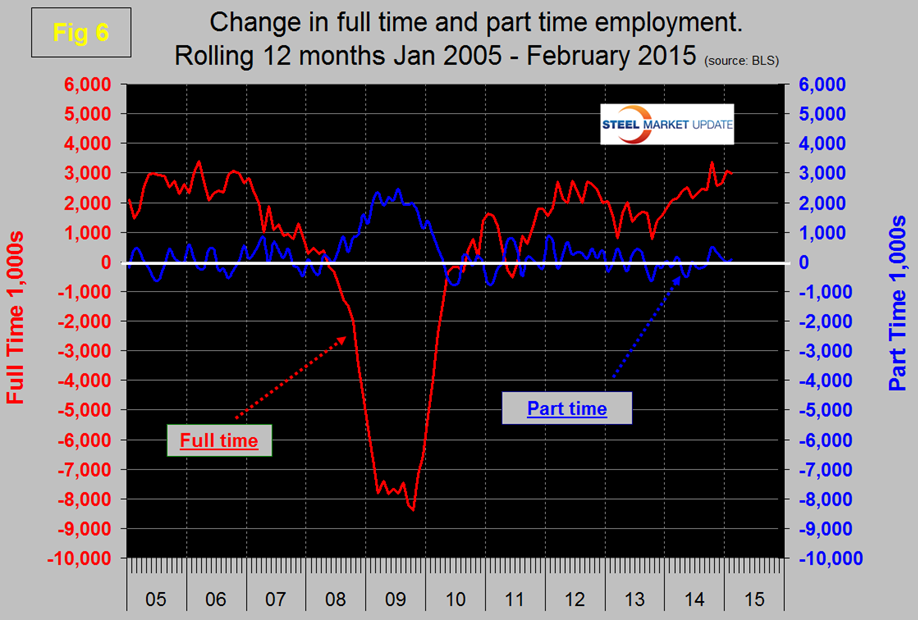

We read a lot in the press about full time and part time job growth, the reporting of which generally appears to us to be inaccurate. This data set is extremely erratic month to month so commentators can often pick up on a single number and run with it. At SMU we have concluded that the only way to get a realistic picture is to examine a 12 month rolling average which screens out most of the variability. By this reckoning the growth of part time employment hasn’t changed much in the last four years, the majority of the growth having been in full time, >35 hours per week (Figure 6). Since February 2010 the increase in full time employment has been 10,036,000 jobs as part time employment is down by 146,000 jobs.

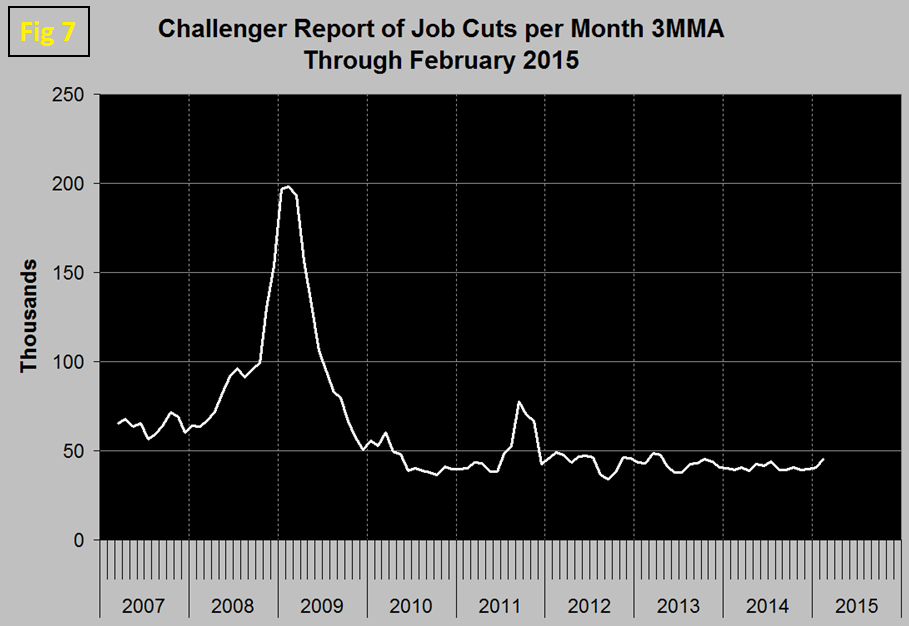

The global outplacement consultancy Challenger, Gray & Christmas, Inc. reported that employers shed 50,579 job positions in February. 2014 had the lowest total since 1997.

The report included below is rather pessimistic, it considers only monthly numbers and gives a useful perspective on the reduction in the price of oil. Our analysis reports a three month moving average and on this basis the layoff rate has been gradually drifting down for three years and is consistently lower than the pre-recession level (Figure 7). We include this analysis as a reality check for the government statistics.

2015 February Job Cut Report: 50,579 Cuts, 38 percent of All Cuts in 2015 Due To Oil Prices

Planned job cuts declined slightly in February, as US-based employers announced workforce reductions totaling 50,579, five percent fewer than the 53,041 in January, according to the report on monthly job cuts released Thursday by global outplacement consultancy Challenger, Gray & Christmas, Inc.

The February total was up 21 percent from a year ago, when employers announced 41,835 job cuts during the month. This marks the third consecutive monthly job-cut total that exceeded the comparable year-ago figure.

Employers announced 103,620 planned layoffs through the first two months of 2015, which is up 19 percent from the 86,942 job cuts recorded during the same period in 2014.

Once again, the energy sector saw the heaviest job cutting in February, with these firms announcing 16,339 job cuts, due primarily to oil prices.

Falling oil prices have been responsible for 39,621 job cuts, to date. That represents 38 percent of all recorded workforce reductions announced in the first two months of 2015. In February, 36 percent of all job cuts (18,299) were blamed on oil prices.

“Oil exploration and extraction companies, as well as the companies that supply them, are definitely feeling the impact of the lowest oil prices since 2009. These companies, while reluctant to completely shutter operations, are being forced to trim payrolls to contain costs,” said John A. Challenger, chief executive officer of Challenger, Gray & Christmas.

“While oil-related companies will see profits slide, the net impact of falling oil prices will likely be positive for the economy, as a whole. Some economists are estimating that GDP could see a 0.5 percentage point boost from low oil prices, due mostly to the extra spending power among consumers. Meanwhile, companies that are big users of oil, such as transportation firms, airlines, and manufacturers of plastic and paint products will see higher profits thanks to cheap oil,” noted Challenger.

Indeed, in a January survey by the National Association for Business Economics, 50 percent of in-house corporate economists said that falling oil prices have already had a positive impact on their firms.

Cheap oil does not yet appear to be helping stem the tide of job cuts in the retail sector, which saw the second highest number of job cuts in February with 9,163. Employers in the sector have announced 15,862 job cuts, so far this year. That is little changed from the 15,242 retail job cuts announced in the first two months of 2014.

“So far, falling oil prices have not resulted in higher retail spending. However, that is not necessarily the cause behind ongoing job cuts in retail. Falling oil prices might stave off job cuts for some retailers but, the fact is, some retailers are beyond the point where cheap oil will help turn things around. For example, the heaviest retail job cuts last month were the result of RadioShack’s long decline, which culminated in bankruptcy and liquidation,” said Challenger.

While retail has not yet been lifted by falling oil prices, recent hiring announcements indicate that automotive and transportation firms are starting to see the benefits. Last month, transportation firms announced plans to hire 5,236, while automotive firms plan to add 3,185.

“These reports probably represent just a small fraction of actual job creation, since most employers do not formally announce hiring plans,” noted Challenger.

In all, announced hiring plans totaled 14,574 in February, up 66 percent from 8,774 in January.

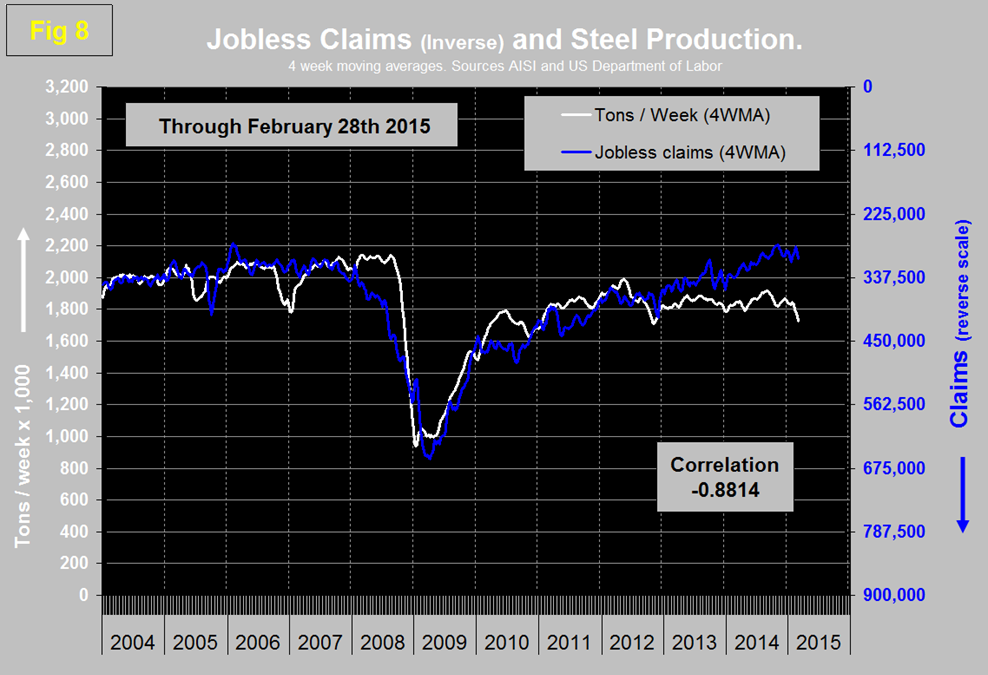

SMU Comment: The February employment report continues to look excellent and the job recovery is tracking much better than the recovery from the 2001 recession. Which of course it should be since the recessionary losses were much greater in 2008 and 2009. There is an inverse relationship between layoffs and steel production which has had a better than 88 percent correlation since January 2004. However in late 2012 the lines began to diverge (Figure 8).

The four week moving average of crude steel production on February 28th was the lowest since November 10th 2012. Two thoughts about this. Firstly we attribute the two year divergence to the delayed recovery of construction and the increasing share being taken by imports. Secondly based on our measure of current economic indicators that we use to measure the steel market we can see no recent weakening. We believe that the low output reported for February 28th is caused by an inventory reduction through the supply chain and not by a change in fundamentals. Note this long term relationship is not a cause and effect but simply a benchmark that has historically worked to show if steel production is where it should be given the state of the economy. The other interesting divergence in this graph is just before the recession when the labor and housing markets were clearly signaling impending doom eight months before steel demand tanked.