Prices

February 26, 2015

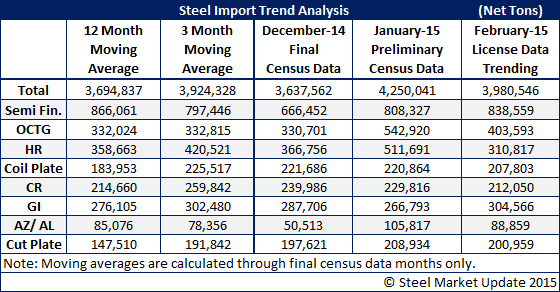

January Imports Top 4.2 Million Tons, February Trending Toward 3.9 Million Tons

Written by John Packard

The U.S. Department of Commerce released the latest steel import licensing data for February as well as the Preliminary Census Data for the month of January 2015. January imports are being reported as being 4,250,041 net tons (3.9 million metric tons). This is up 32.6 percent compared to one year ago. Hot rolled imports, even without Russian material, rose to their highest monthly level seen since 2006. OCTG continued to be strong, even with the crash in oil prices. These foreign tons will weigh heavily as inventories build at the docks and in the distributor’s warehouses.

The February license data through February 24th show a continuation of a strong import trend for the month. Our simple projection based on the daily licenses average has the month trending toward a 3.7-3.9 million net ton month.

The table below provides you with a look at the 12 month moving average (12MMA), 3 month moving average (3MMA), as well as the total imports for December (Final Census Data) and January (Preliminary Census Data through February 25th) and what we mathematically calculate as the trend for February. The February trend is done by taking the daily license rate and extrapolating it over the entire month.