Prices

February 10, 2015

US Steel Scrap Exports Drop 17.1% During 2014

Written by Peter Wright

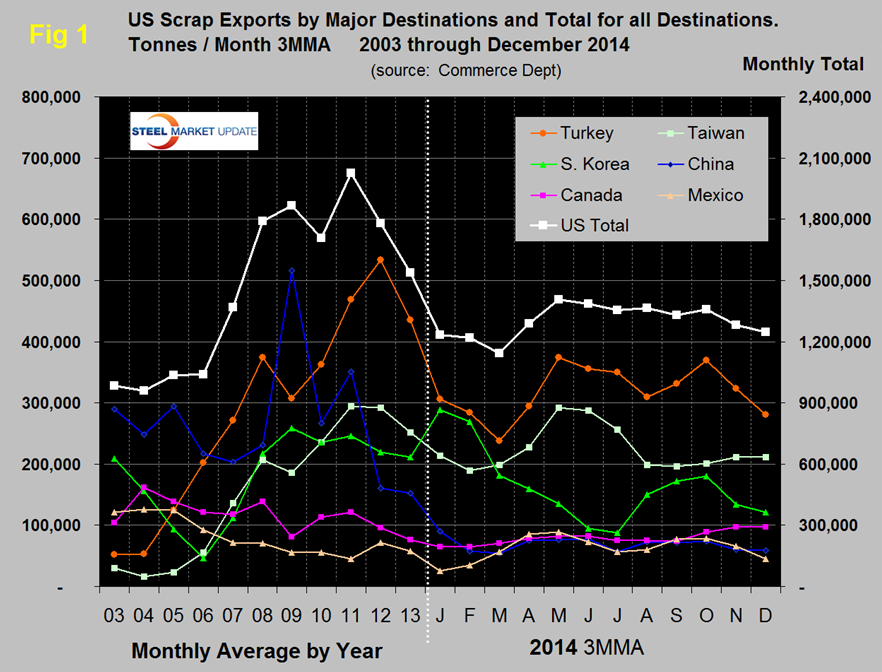

In the twelve months of 2014, ferrous scrap exports totaled 15,308,000 tonnes (metric tons), down by 17.1 percent from the same period in 2013. In the single month of December scrap exports were 1,056,570 tonnes, down 21.5 percent from November.

Figure 1 shows that the three month moving average (3MMA) has been declining slightly for the last eight months and has been unusually consistent during that time. The 3MMA continued to be lower than the average in any year from 2008 through 2013. The most obvious trends so far this year has been that Taiwan and Korea have been almost mirror images of each other. Shipments to Thailand quadrupled to 477,000 tonnes in 2014 compared to 2013. Turkey’s tonnage picked up in September and October then the 3MMA declined by 12.5 percent in November and 13.1 percent in December. Year to date Turkey is down by 1.613 million tonnes or 30.8 percent. On January 22nd AMM reported that Turkey had booked about 15 cargoes so far in the month and only two were from the US. The rest were mostly from the UK and Europe as currency conversion rates directed the buyer’s interest.

China’s tonnage has been quite consistently low this year on a 3MMA basis ranging from 53,000 to 90,000 tonnes per month. This is compared to over 500,000 tonnes per month in 2009 when they were the highest volume importer. In 2014 Chinese imports from the US were down by 1.041 million tonnes or 57 percent from 2013.

Tonnage to Canada and Mexico moved in opposite directions in Q4 2014 with Canada increasing and Mexico decreasing. Shipments to secondary buying nations in November were the highest of the year with a total of 211,000 tons, this decreased to 165,000 tonnes in December. Of this over 90,000 tone went to Saudi Arabia in December.

In YTD 2014 compared to the same period in 2013, the Far East as a whole was down by only 2.3 percent as increases to Indonesia and Thailand have balanced the decreases to China, Malaysia and South Korea. The decline of the Japanese Yen is a big factor in Far East trade in general though at this point we don’t know to what extent it is influencing international scrap trade. Tonnage moving North over the Canadian border in 2014 and South into Mexico increased by 6.2 percent and 9.2 respectively compared to 2013.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. This morning scrap prices crashed across the board including export prices from both coasts. The New York price fell by $50.59 to $236.72, Los Angeles fell by $40.34 to $226.83.