Market Data

February 3, 2015

The ISM Manufacturing Index Retreated Again in January

Written by Peter Wright

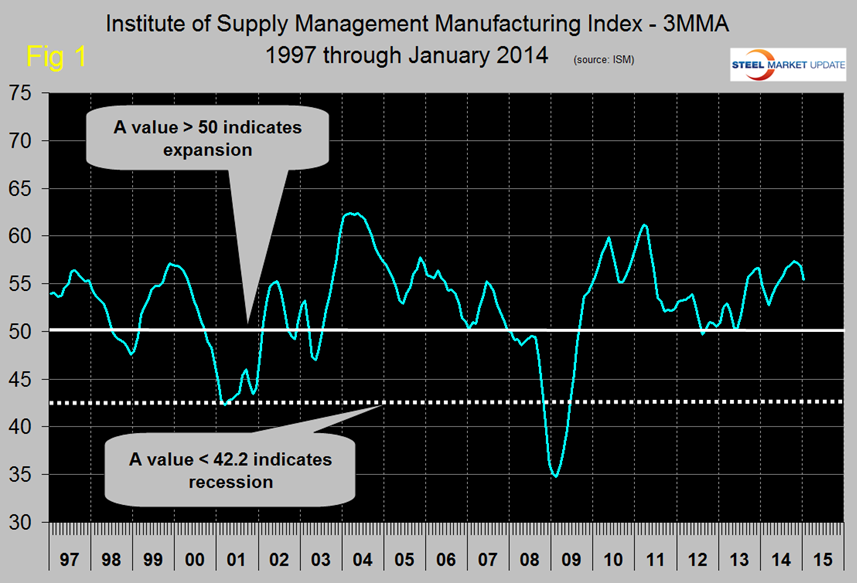

The Institute of Supply Management released their January report on February 2nd. An explanation of this data set is given at the end of this piece. After the October surprise on the upside, the index slid back once again from 55.1 in December to 53.5 in January. The three month moving average has declined for three straight months and now stands at 55.4, almost exactly the average for the last 13 months. This value is still indicative of an expanding manufacturing sector. Any number >50 indicates expansion and this was the 29th straight month for which the 3MMA indicated growth, (Figure 1).

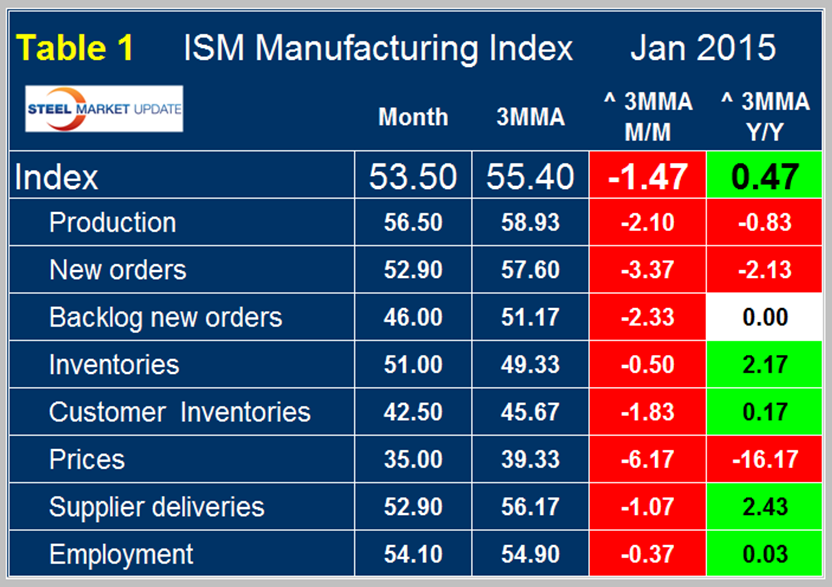

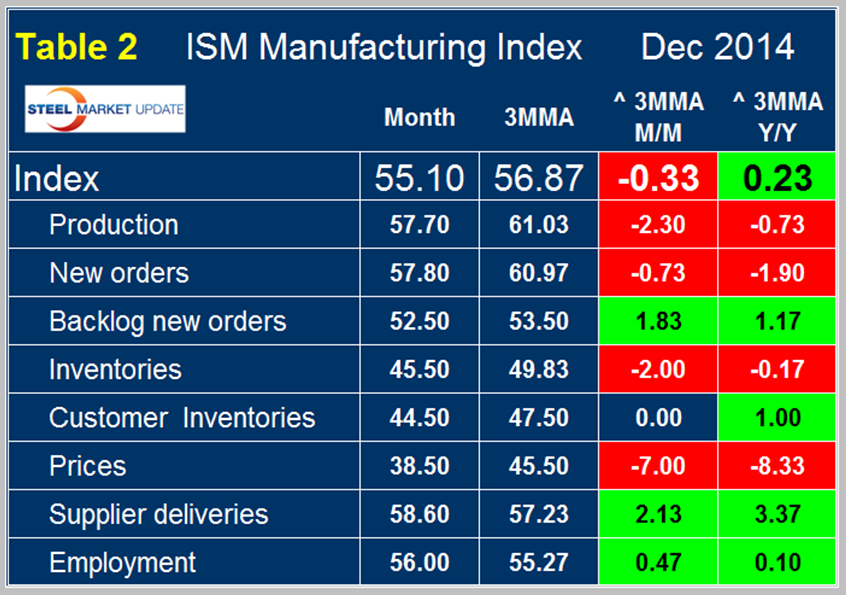

Table 1 shows the break down for January by sub component with the monthly result, the 3MMA, the growth of the 3MMA m/m and y/y for each.

To provide readers with a more expanded idea of the direction of the sub-components therefore have included here Table 2 as published last month for data released in December. Comparing these two versions of the table shows that the growth of the 3MMA y/y slowed from negative 0.37 in December to negative 1.47 in January. All sub-indexes had negative growth in three months through January compared to three months through December. Prices had the greatest negative growth in both December and January. Backlog, supplier deliveries and employment all reversed course from positive growth in December to contraction in January.

The official news release reads as follows:

January 2015 Manufacturing ISM Report On Business

PMI at 53.5 percent, New Orders, Employment and Production Growing Inventories Growing Supplier Deliveries Slowing

(Tempe, Arizona) — Economic activity in the manufacturing sector expanded in January for the 20th consecutive month, and the overall economy grew for the 68th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM Report On Business.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee. “The January PMI registered 53.5 percent, a decrease of 1.6 percentage points from December’s seasonally adjusted reading of 55.1 percent. The New Orders Index registered 52.9 percent, a decrease of 4.9 percentage points from the seasonally adjusted reading of 57.8 percent in December. The Production Index registered 56.5 percent, 1.2 percentage points below the seasonally adjusted December reading of 57.7 percent. The Employment Index registered 54.1 percent, a decrease of 1.9 percentage points below the seasonally adjusted December reading of 56 percent. Inventories of raw materials registered 51 percent, an increase of 5.5 percentage points above the December reading of 45.5 percent. The Prices Index registered 35 percent, down 3.5 percentage points from the December reading of 38.5 percent, indicating lower raw materials prices in January relative to December. Comments from the panel indicate that most industries, but not all, are experiencing strong demand as 2015 kicks off. The West Coast dock slowdown continues to be a problem, negatively impacting both exports and imports as well as inventories.”

Of the 18 manufacturing industries, 14 are reporting growth in January in the following order: Primary Metals; Wood Products; Printing & Related Support Activities; Miscellaneous Manufacturing; Fabricated Metal Products; Electrical Equipment, Appliances & Components; Petroleum & Coal Products; Paper Products; Transportation Equipment; Chemical Products; Machinery; Food, Beverage & Tobacco Products; Computer & Electronic Products; and Furniture & Related Products. The two industries reporting contraction in January are: Textile Mills; and Nonmetallic Mineral Products.

What respondents are saying:

– “Strong customer demand for our products continues to grow.” (Food, Beverage & Tobacco Products)

– “Customers are presenting many new opportunities.” (Fabricated Metal Products)

– “Consumer demand remains strong for automotive. Seeking alternatives to maximize production with existing production capacity.” (Transportation Equipment)

– “Chinese New Year, West Coast port dock slowdowns, coupled with railroad embargo are all creating logistical challenges and increased backlog of orders.” (Wood Products)

– “Sales have stayed very strong even with the dip in oil prices.” (Computer & Electronic Products)

– “Dock problems in California continue to delay shipment out of the West Coast. Most material prices are the same except resin prices are down.” (Chemical Products)

– “Business conditions are good, stable to improving.” (Miscellaneous Manufacturing)

– “West Coast port slowdown is getting serious. Mill has 40+ days of production at the ports and various warehouses.” (Paper Products)

– “Agriculture equipment production remains weaker than previous year as farm commodity prices remain low.” (Machinery)

– “Business in 2015 has started off on a fast pace. Very busy.” (Primary Metals)

Explanation: The Manufacturing ISM Report on Business is published monthly by the Institute for Supply Management, the first supply institute in the world. Founded in 1915, ISM exists to lead and serve the supply management profession and is a highly influential and respected association in the global marketplace. ISM’s mission is to enhance the value and performance of procurement and supply chain management practitioners and their organizations worldwide. This report has been issued by the association since 1931, except for a four-year interruption during World War II. The report is based on data compiled from purchasing and supply executives nationwide. Membership of the Manufacturing Business Survey Committee is diversified by NAICS, based on each industry’s contribution to gross domestic product (GDP). The PMI is a diffusion index. Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change and the scope of change. A PMI reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally declining. A PMI in excess of 42.2 percent, over a period of time, indicates that the overall economy, or gross domestic product (GDP), is generally expanding; below 42.2 percent, it is generally declining. The distance from 50 percent or 42.2 percent is indicative of the strength of the expansion or decline. With some of the indicators within this report, ISM has indicated the departure point between expansion and decline of comparable government series, as determined by regression analysis.