Market Data

January 30, 2015

Gross Domestic Product Q4 2014 First Estimate

Written by Peter Wright

The Bureau of Economic Analysis (BEA) released the first estimate of Q4 2014 Annual Revision of the National Income and Product Accounts on Friday.

![]() The annualized growth rate in the 4th Q disappointed economic pundits by coming in at 2.64 percent after increasing by almost 5.0 percent in Q3. GDP is measured and reported in chained 2009 dollars and in Q4 was estimated to be $16.312 trillion. The calculation is slightly misleading because it takes the Q over Q growth and multiplies by 4 to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect. The blue line is the trailing 12 months growth and the white line is the headline quarterly result. On a year over year basis GDP was 2.48 percent higher in the 4th quarter than it was in Q4 2013 and that result is in line with performance since Mid-2010. Q1 of 2104 had negative 2.21 percent growth due to the appalling winter in the North East US and the 2nd and 3rd quarter results which were very strong were likely playing catch-up. The fact that Q4 was very close to the year as a whole tends to support that view.

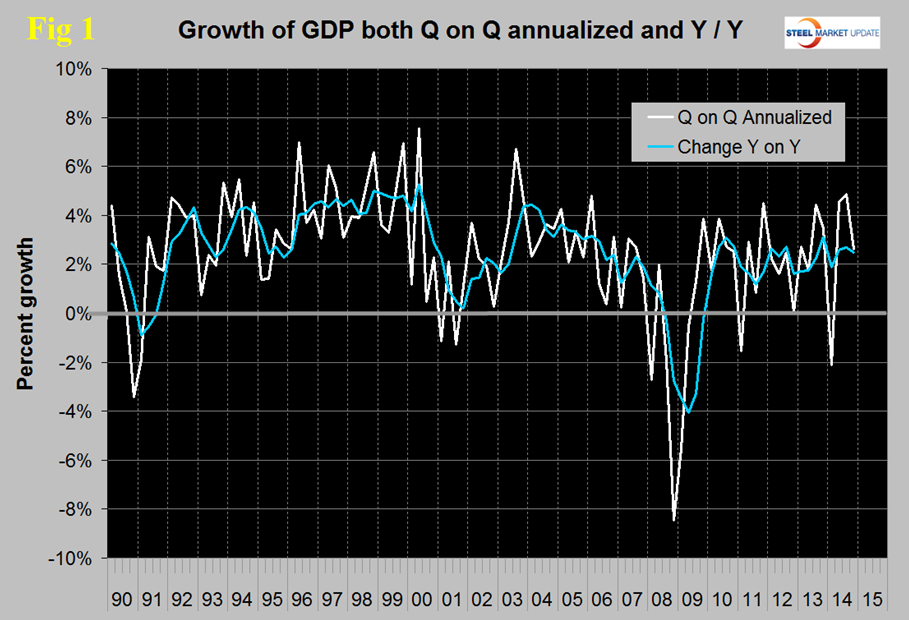

The annualized growth rate in the 4th Q disappointed economic pundits by coming in at 2.64 percent after increasing by almost 5.0 percent in Q3. GDP is measured and reported in chained 2009 dollars and in Q4 was estimated to be $16.312 trillion. The calculation is slightly misleading because it takes the Q over Q growth and multiplies by 4 to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect. The blue line is the trailing 12 months growth and the white line is the headline quarterly result. On a year over year basis GDP was 2.48 percent higher in the 4th quarter than it was in Q4 2013 and that result is in line with performance since Mid-2010. Q1 of 2104 had negative 2.21 percent growth due to the appalling winter in the North East US and the 2nd and 3rd quarter results which were very strong were likely playing catch-up. The fact that Q4 was very close to the year as a whole tends to support that view.

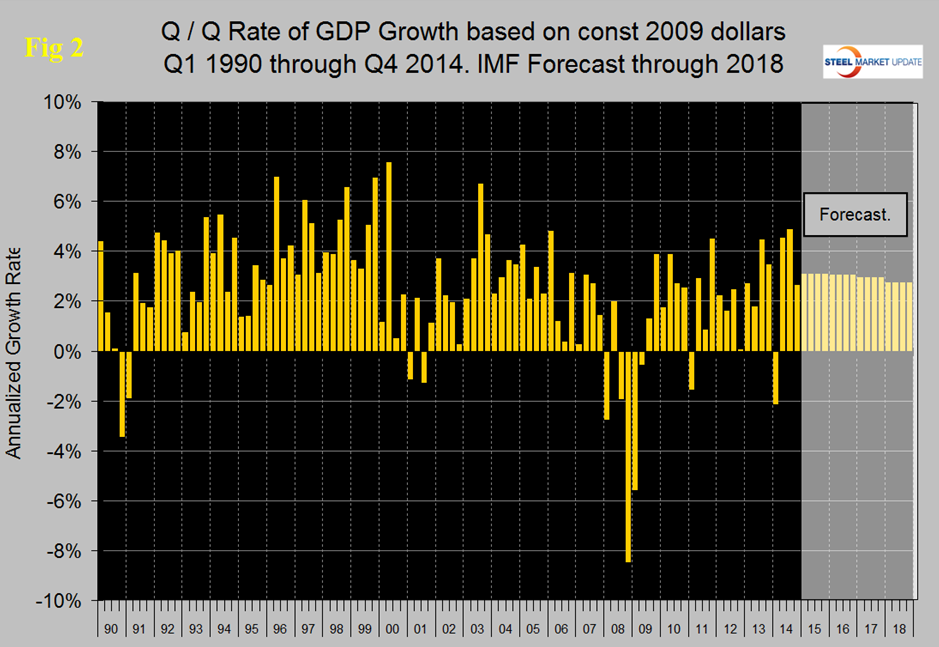

Figure 2 shows the headline quarterly results since 1990 and the latest IMF forecast through 2018. Taking 2014 as a whole makes the IMF forecast look reasonable with a quarterly growth rate of 3.09 percent forecast for 2015.

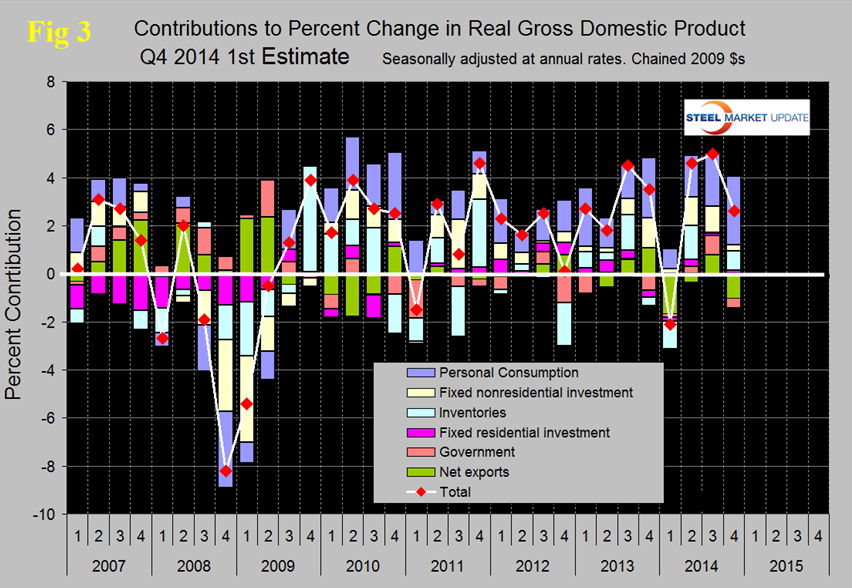

Figure 3 shows the change in the major sub-components of GDP. Comparing Q4 with Q3 there were major changes in the sub-components. Personal consumption contributed 2.87 percent to the growth meaning that all other major components were slightly negative in total.

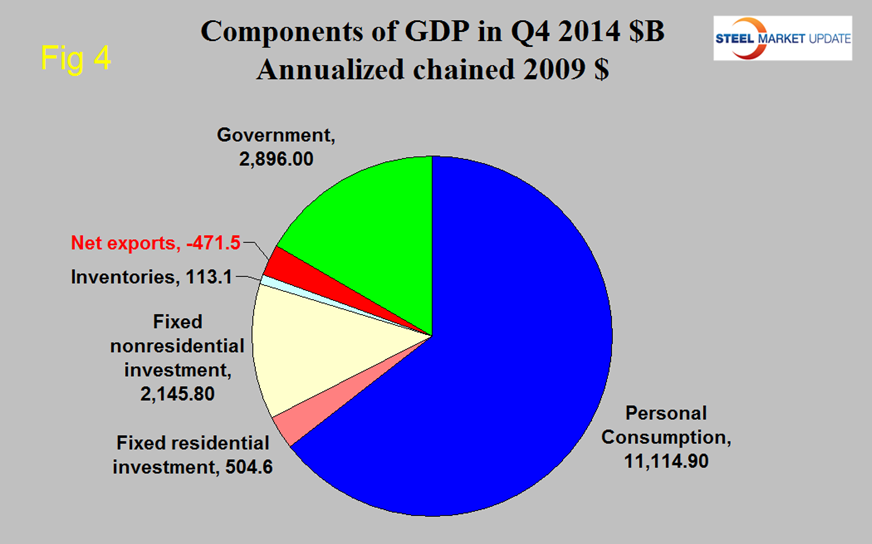

Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables. Presumably personal consumption is being driven by low gas prices. Net exports were the major negative and contributed – 1.02 percent to the total. This negative contribution can be expected to worsen as the US dollar strengthens. Government expenditures also yielded a negative growth of – 0.40 percent. The contribution of fixed residential investment was almost unchanged at 0.13 percent but the contribution of nonresidential construction declined from 1.1 percent in Q3 to 0.24 percent in Q4. In the 4th Q personal consumption accounted for 68.14 percent of total economic activity, up from 67.87 percent in Q3. Inventories which had contributed only 0.03 percent in Q3 contributed 0.82 percent in Q4. Increasing inventories make a positive contribution to GDP and over the long run inventory changes are a wash and simply move growth from one period to another. Figure 4 shows the breakdown of the $16 trillion economy.

The official press release from the BEA reads as follows:

National Income and Product Accounts – Gross Domestic Product: Fourth Quarter and Annual 2014 (Advance Estimate)

Real gross domestic product — the value of the production of goods and services in the United States, adjusted for price changes — increased at an annual rate of 2.6 percent in the fourth quarter of 2014, according to the “advance” estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 5.0 percent.

The Bureau emphasized that the fourth-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the fourth quarter, based on more complete data, will be released on February 27, 2015.

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, nonresidential fixed investment, state and local government spending, and residential fixed investment that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the fourth quarter primarily reflected an upturn in imports, a downturn in federal government spending, and decelerations in nonresidential fixed investment and in exports that were partly offset by an upturn in private inventory investment and an acceleration in PCE.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, decreased 0.3 percent in the fourth quarter, in contrast to an increase of 1.4 percent in the third.

Excluding food and energy prices, the price index for gross domestic purchases increased 0.7 percent, compared with an increase of 1.6 percent.

SMU Comment: We have reported frequently in the past on the relationship between GDP and steel consumption. Steel growth follows economic growth but is very much more volatile. In addition over the long run about a 2.5 percent growth of GDP is necessary to get any growth in steel consumption. Based on the trailing 12 month growth of GDP we can expect a slow improvement of steel demand in 2015.