Analysis

January 30, 2015

Active Gas & Oil Rigs Continue to Decline

Written by Brett Linton

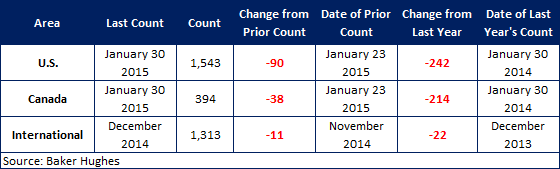

According to Baker Hughes data from January 30th, 2015, the U.S rig count for this week is 1,543 rigs exploring for or developing oil or natural gas. This count is a decrease of 90 rigs when compared to last week, with oil rigs down 94 to 1,223 rigs, gas rigs up 3 to 319 rigs, and miscellaneous rigs up from zero to 1 rig. Compared to last year the 1,543 count is a decrease of 242 rigs, with oil rigs down by 199, gas rigs down by 39, and miscellaneous rigs down by 4.

The Canadian rig count decreased by 38 to 394 rigs this week, with oil rigs down 23 to 200 rigs and gas rigs down 15 to 194 rigs. Compared to last year the 394 count is a decrease of 214 rigs, with oil rigs down by 204 and gas rigs down by 10. International rigs decreased by 11 to 1,313 rigs for the month of December, a decrease of 22 rigs from the same month one year ago. For a history of both the US and Canadian rig count click here.

About the Rotary Rig Count

A rotary rig is one that rotates the drill pipe from the surface to either drill a new well or sidetracking an existing one. They are drilled to explore for, develop and produce oil or natural gas. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies.

The Baker Hughes North American Rotary Rig Count is a weekly census of the number of drilling rigs actively exploring for or developing oil or natural gas in the United States and Canada. Rigs considered active must be on location and drilling. They are considered active from the time they break ground until the time they reach their target depth.

The Baker Hughes International Rotary Rig Count is a monthly census of active drilling rigs exploring for or developing oil or natural gas outside of the United States and Canada. International rigs considered active must be drilling at least 15 days during the month. The Baker Hughes International Rotary Rig Count does not include rigs drilling in Russia or onshore China.