Prices

January 27, 2015

Foreign Steel Imports Continue Record Breaking Pace

Written by John Packard

AK Steel and Nucor spend time on their earnings conference calls earlier today to point out the negative impact imports were having on their business and steel pricing. James Wainscott talked about imports during his opening statements, “Between 2013 and 2014 flat-rolled finished carbon steel imports rose by some 60%. For the year, we saw more than 11 million net tons of flat-rolled carbon steel imports compared to less than 7 million tons in the prior year. To put that into perspective, it’s the equivalent of having a new 4 million-ton steel mill appear roughly overnight in the domestic carbon steel market. The increased supply has had a negative impact on pricing in the domestic market, especially in the spot market. In fact, it’s put undue pressure on carbon prices and we experienced a bigger price decline than we expected in the fourth quarter of 2014 as a result. It’s off this low base that we embark for 2015.”

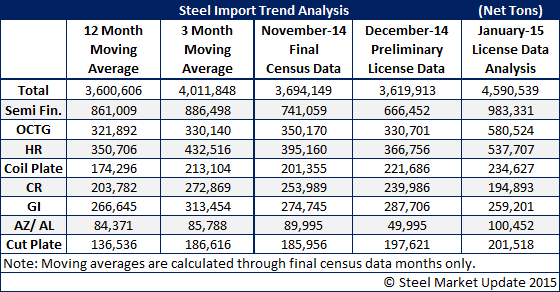

Late this afternoon, the U.S. Department of Commerce released Preliminary Census Data for December 2014 and updated the license data for the month of January 2015.

Total steel imports (all products) received during calendar year 2014 was 44,320,390 net tons. This is just behind the 45,273,032 net tons received during calendar year 2006. Total imports were up 38 percent compared to 2013 totals.

Looking at semi-finished imports, they totaled 10,392,733 net tons (Up 44 percent). Total finished imports came to 33,927,657 net tons and were up 36 percent compared to the prior year.

For the month of December total steel imports were 3,619,913 net tons (all products) with 666,452 tons of semi-finished included in that number.

January, based on license data, will be another very big month for imports as the license data suggests the month could exceed January 2006 3.5 million tons. January could exceed or come close to October 2014 total imports of 4.4 million tons. This is a huge number for the month of January.