Prices

January 18, 2015

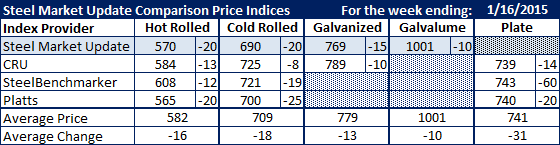

Comparison Price Indices: HRC Heading Lower Still...

Written by John Packard

All of the flat rolled steel price indexes followed by Steel Market Update saw benchmark hot rolled pricing as being down by double digits. Exactly where hot rolled prices are seems to be debatable as we have a $43 per ton spread between the low (Platts at $565) and the high (SteelBenchmarker at $608).

Since SMU upper range on hot rolled coil is lower than the SteelBenchmarker average of $608 we will eliminate them from consideration this week and concentrate our energies on the other three indexes: SMU, CRU and Platts.

The average of the SMU, CRU and Platts HRC pricing comes to $573 per ton. Platts and SMU were both down $20 per ton this past week while CRU declined by $13 per ton.

Flat rolled steel prices are dropping at an ever-increasing pace having already declined by $30 per ton since the end of December based on the SMU average for HRC. The industry is now close to the $565 number last seen on May 21, 2013. If HRC passes through $565 we will be in pricing territory not seen since November 2010 (HRC bottomed at $535 on November 2, 2010).

Other products are following hot rolled’s lead (albeit kicking and screaming) as the market searches for a bottom.

We will go back to a note that one steel service center executive who told SMU about a week ago: “The old adage “the only cure for low prices is low prices”, certainly applies now. Ironically, the mills would be better served by a more intense and quicker fall in prices, so that the imports quit getting booked. This will at least set the stage for a revival in the springtime. At the same time, they need to pull back production – now, if they hope to stem the fall in prices sooner vs. later. I think the market ought to forget using $600/ton HR as a sort of desired floor, a level which has been relative until now, based on the past input costs. We are in the midst of a mill cost re-set which will likely be sustained in 2015 and beyond….”

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.