Market Data

December 15, 2014

Industrial Production and Manufacturing Capacity Utilization

Written by Peter Wright

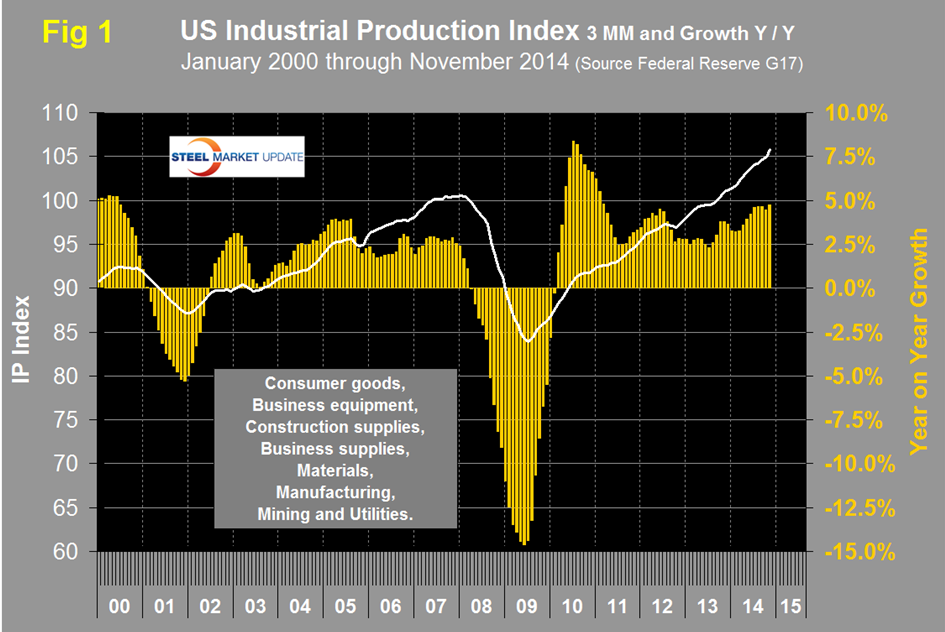

Both these data points are reported in the Federal Reserve G17 data base. The IP index was reported as 106.66 for November an increase of 1.26 percent from October. The three month moving average (3MMA) was 105.75 which was the highest value ever and the sixth straight month where the growth of the 3MMA exceeded 4 percent year over year. This was the fourteenth consecutive month for the index to exceed the pre-recession peak of September 2007. The 3MMA is up by 4.7 y / y. Data is seasonally adjusted and the index is based on the July 2007 level being defined as 100, (Figure 1).

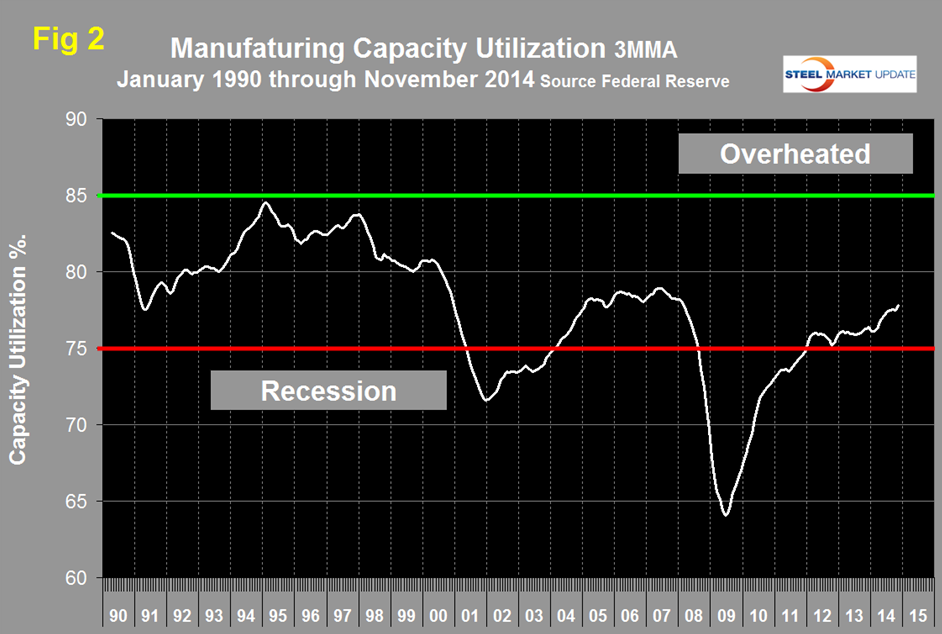

Manufacturing capacity utilization was 78.36 percent in November, this was the first month to exceed 78 percent since December 2007. The 3MMA in November was 77.81 percent, up from 77.47 in October, (Figure 2). The 3MMA is now the highest since February 2008.

MAPI (The Manufacturers Alliance for Productivity and Innovation) presented the following observations last week:

Reasons for Optimism in 2015 (by Daniel Mecksworth, MAPI Vice President, Chief Economist and Purchasing Council Director)

Earlier this week I presented at TRENDS Annual Nonprofit Forecast and Risk Review at the University Club in D.C. The event focused on risk management strategies for 2015 and a review of association executive plans and sentiment. I joined speakers from the Nonprofit Risk Management Center and ORI. As I noted to the audience of COOs and CFOs, I see no indication of an imminent U.S. recession. In the last three quarters, most of the growth has come from consumers and business investment. One very positive development is that oil prices have dropped sharply since June and are likely to remain low through 2015. This is equivalent to a tax cut for consumers and should boost spending. Other encouraging factors in the outlook for next year are job growth–driven consumer spending, strong investment in equipment and structures, and a recovery in housing investment. Recreational equipment should be a major spending growth area; I anticipate a strong advancement in recreational vehicles, information processing equipment, and software. Net exports, however, will be a negative contribution to growth until 2019. The manufacturing trade deficit became more negative this year.

Key geopolitical risks to the outlook come from outside our borders, including:

• China’s banking crisis

• Deflation in the Eurozone

• Threats to oil supplies in the Middle East

• Escalation of the crisis in Ukraine and sanctions on Russia

• Land disputes among China, Japan, Korea, and Vietnam

• Iraq and ISIS

• Ebola

Traditional (non-high-tech) U.S. manufacturing is not recovered from the recession but should achieve a full recovery in the third quarter of next year. The manufacturing sector will continue to grow faster than the overall economy through 2016. Globally, manufacturing growth is mixed. The purchasing manager’s indexes are strongest in the U.S., Canada, Mexico, the UK, and India; the Eurozone and China are near recession; and Brazil and Korea have already entered recessions.

MAPI Foundation Economic Forecast: Jobs, Replacement Demand Highlight Growth

Strong growth in jobs plus replacement demand for equipment from businesses will provide a stable base for overall economic growth, according to a new report.

The MAPI Foundation, the research affiliate of the Manufacturers Alliance for Productivity and Innovation, released its quarterly economic forecast, predicting that inflation-adjusted gross domestic product will expand 2.8 percent in 2015 and 3.0 percent in 2016. Both are declines from the August report—of 3.0 percent and 3.3 percent, respectively. Manufacturing production is expected to outpace GDP, with anticipated growth of 3.5 percent in 2015 (a decrease from 4.0 percent in the previous forecast) and 3.9 percent in 2016 (an increase from 3.6 percent in the August report).

The November 2014 report forecasts a five-year horizon in which GDP is expected to average 2.8 percent and manufacturing production to average 3.26 percent growth.

“We will have full employment in 18 months and manufacturing is already there,” said MAPI Foundation Chief Economist Daniel J. Meckstroth. “With the unemployment rate continuing to fall, the pain and suffering from the recession is dissipating. Why are businesses spending? Because consumers are spending. Also, the drop in energy prices is essentially a tax cut for us. Lower prices are a positive development.”

Production in non-high-tech manufacturing is expected to increase 3.8 percent in 2015 and 3.7 percent in 2016. High-tech manufacturing production, which accounts for approximately 5 percent of all manufacturing, is anticipated to grow 8.2 percent in 2015 and 10.0 percent in 2016.

The forecast for inflation-adjusted investment in equipment is for growth of 6.9 percent in 2015 and 7.3 percent in 2016. Capital equipment spending in high-tech sectors will also rise. Inflation-adjusted expenditures for information processing equipment are anticipated to increase by double digits in each of the next two years—12.1 percent in 2015 and 12.3 percent in 2016. The MAPI Foundation expects industrial equipment expenditures to advance 7.6 percent in 2015 and 3.6 percent in 2016. Conversely, the outlook for spending on transportation equipment is for decreases of 0.8 percent in 2015 and 0.4 percent in 2016.

Spending on nonresidential structures is anticipated to improve by 2.6 percent in 2015 and 4.2 percent in 2016. Residential fixed investment is forecast to increase 10.2 percent in 2015 and 10.9 percent in 2016. Meckstroth anticipates 1.2 million housing starts in 2015 and 1.4 million in 2016.

Inflation-adjusted exports are anticipated to increase 3.3 percent in 2015 and 3.9 percent in 2016. Imports are expected to grow 3.6 percent in 2015 and 6.6 percent in 2016. The MAPI Foundation forecasts overall unemployment to average 5.6 percent in 2015 and 5.3 percent in 2016.

The outlook is for an increase of 202,000 manufacturing jobs in 2015, a decrease from 315,000 in the August report. Meckstroth envisions 16,000 manufacturing jobs to be added in 2016, down from 86,000 in the previous forecast. Over the five-year period from 2015 to 2019, the MAPI Foundation forecasts an average annual increase of 66,800 manufacturing jobs.

The Federal Reserve Beige Book released on December 3rd reported as follows. “Manufacturing activity generally advanced during the reporting period. The automotive and aerospace industries continued to be sources of strength. Steel production increased in Cleveland, Chicago, and San Francisco. Fabricated metal manufacturers in the Chicago and Dallas Districts noted widespread growth in orders. Dallas reported that domestic sales for plastics were strong, while demand for plastics was steady in Richmond and declined in Kansas City. Chemical manufacturers in the Boston District indicated that the falling price of oil relative to natural gas had made U.S. producers less competitive, because foreign chemical producers rely more heavily on oil for feedstock and production. St. Louis, Minneapolis, and Dallas reported that food production was little changed on balance, but production in Kansas City continued to decline. Chicago and Dallas indicated that shipments of construction materials increased. Manufacturers of heavy machinery in the Chicago District cited improvements in sales of construction machinery, but reported ongoing weak demand for agricultural and mining equipment. High-tech manufacturers in Boston, Dallas, and San Francisco noted steady growth in demand. Biotech revenue increased in the San Francisco District.

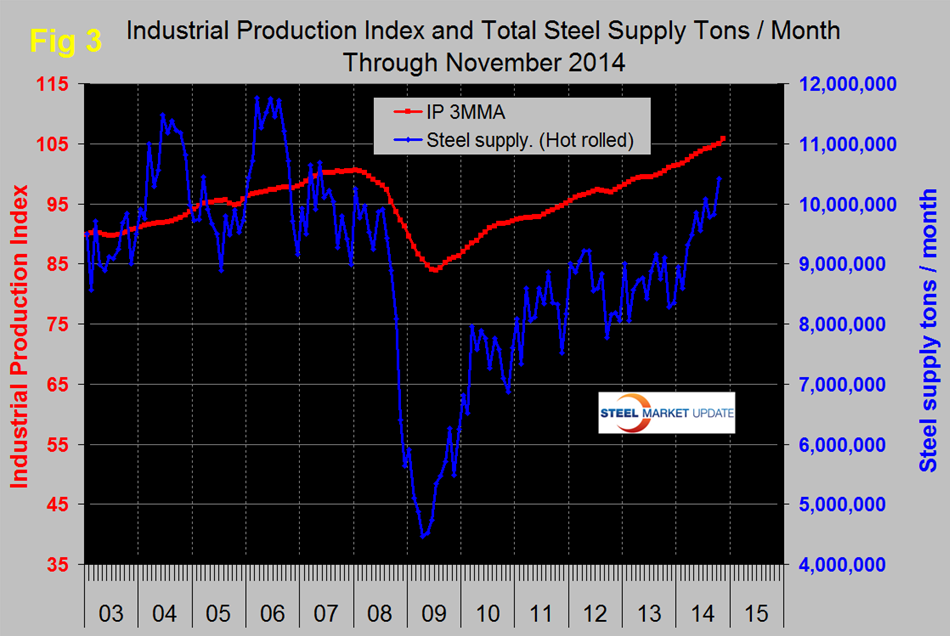

SMU Comment: We are very encouraged by the MAPI quarterly update and by the continued growth in industrial production and the ISM manufacturing index. Prior to the recession there was a reasonable correlation between industrial production and steel supply, though steel was very much more volatile in this comparison just as it is against GDP, (Figure 3). We have many indicators that suggest that steel supply is lower than it should be at this stage of a recovery but there has been a recent surge which we attribute to both strength in manufacturing and to growth in total construction which has been >5 percent annualized for over two years. The gap between steel supply and the industrial production index is closing and based on current rates could converge sometime next year. This is faster than, as we have reported elsewhere, housing and non-residential at their present rates of growth will have recovered.