Prices

November 25, 2014

Preliminary October Steel Imports at 4.4 Million Tons

Written by John Packard

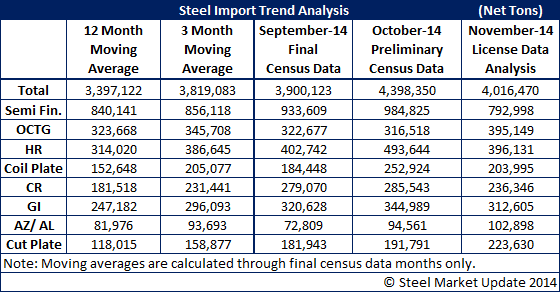

Preliminary October import figures show October as the second highest month in the 17 years worth of history we have at SMU. October steel imports were the highest figure since August 1998 when total imports were 4,417,811 net tons. We also address November 2014 imports which we believe will be approximately 3.7-3.8 million net tons (see below).

Finished imports jumped 11.6 percent over the prior month while semi-finished (mostly slabs going to the domestic steel mills) rose 2.5 percent.

Bank of America metals and mining analyst, Timna Tanners in a report to her clients said, “The largest five non-NAFTA exporters to the U. S. were: Brazil, up 38% m/m days-adjusted; Korea, up 37.1%; Russia, down 26%; China up 9%; and Turkey, up 81.9%.” Russian hot rolled imports, which totaled 57,520 net tons in October, should soon drop to zero due to the elimination of the duty suspension agreement on HRC. All Russian HRC will need to be received in the U.S. by no later than December 16, 2014.

November Imports Should be Approximately 3.7-3.8 Million Net Tons

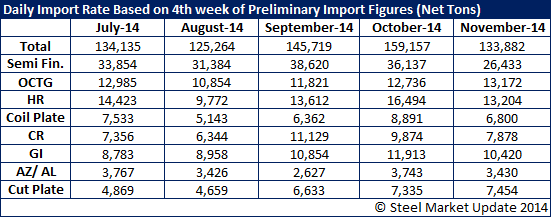

Looking back at the daily import rate we are seeing the month of November 2014 as being similar to that of July 2014 when the U.S. received 3.8 million net tons of imports (all products). Semi-finished imports (slabs) will be down. Surprisingly, oil country tubular goods (OCTG) are exceeding the daily receipt rate of October as South Korea continues to ship product despite the dumping duties. Brazil is now starting to ship more OCTG to the U.S. as well. No one is close, however, to the 140,000 net tons that the Korean’s are requesting.

All other products appear they will be lower than what was received in October. Here is the daily license request table based on four weeks worth of data for July, August, September, October and November: