Prices

November 23, 2014

Ferrous Scrap, Iron Ore & Steel Prices

Written by John Packard

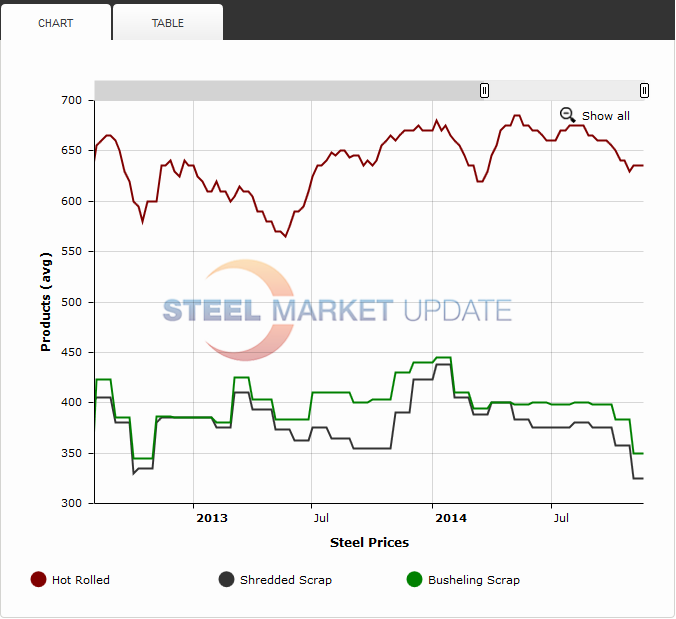

We ended the article above talking about the tight range we have seen on hot rolled coil over the past 12 months. Total price movement from low to high during that time period has been $65 per ton.

The question is, will U.S. hot rolled coil prices break through the low of the past 12 months ($620) and could it possibly break through $600, testing the lows not seen on HRC since the summer 2013 ($570 per ton)?

SMU Note: To those who are buying cold rolled or coated products (galvanized or Galvalume) – those products tend to have their base prices average $100 to $120 per ton higher than hot rolled coil. $635 per ton HRC should equate to CR and GI base price levels of $735-$755 per ton. SMU current CR average is $755 per ton. Second, remember that the numbers used in our calculations are averages, not the low or high of the SMU range.

During the past 12 months we have seen shredded scrap prices, which were $390 per gross ton during the middle of November 2013, peak at $438 per gross ton during January 2014 and drift lower. Recently scrap took a strong move lower and shredded scrap in the Chicago area is now at $325 per gross ton. Over the past 12 months from peak to trough there was $113 per gross ton in price movement in shredded scrap pricing.

Number 1 Busheling, which is used extensively at the electric arc furnace (EAF) mills making sheet products, was trading at $430 per gross ton in mid-November 2013, peaked at $438 per gross ton in January 2014 and, like shredded scrap above, has taken a new leg lower and is now at $350 per gross ton in the Chicago area markets. From peak to trough a move of $88 per gross ton.

Both shredded and busheling scrap prices have dropped more than HRC prices which have fallen by $65 per ton during this same time period (peak to trough).

As we look forward to December our sources are advising us that the best case scenario is for scrap prices to move sideways. We heard from a dealer on the East coast on Friday and he was in the optimistic camp when he told us, “My sense is that December scrap is largely unchanged from November, could be a bit higher – $5 or $10 in some regions, maybe a bit softer in others. Export has not really rebounded at all and is lower than at the beginning of November. So that’s going to keep the market from moving too much higher despite the fact that scrap flows are weaker than they have been too. But over the next 60 days, I would not be surprised to see us move a little higher.”

However, there are those within the industry who think there is yet another leg lower coming in December, by perhaps by as much as $15 per gross ton.

Mike Marley of SteelPrices.com and a well known scrap expert told his clients on Friday, “Pricing Outlook: Expectations that ferrous prices have bottomed and will soon rebound are fading away like drifting smoke. Now, many are hoping for a price floor that will last for several months.”

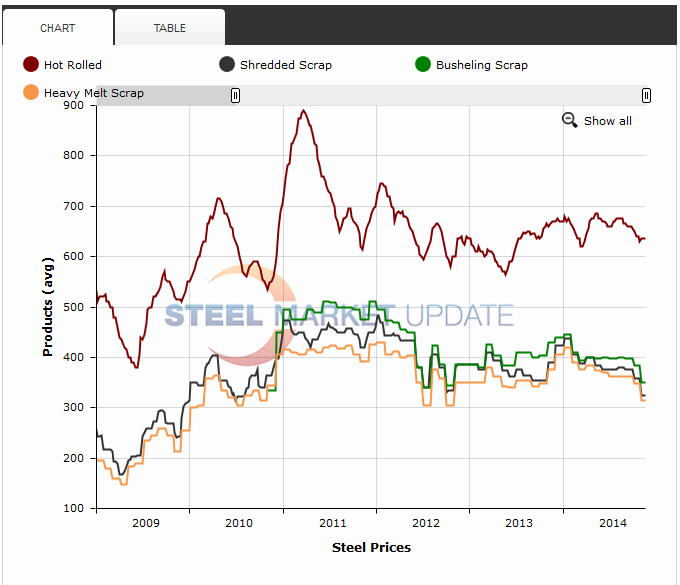

So, we wanted to know when the last time shredded scrap and Busheling broke through $350 per gross ton. The answer, according to our interactive graph which is available under the Pricing tab (Pricing History) on our website, is October 2012. At that time shredded scrap was $335 and Busheling was $345 per gross ton. Hot rolled prices bottomed at $580 per ton during October 2012.

During “normal” years it is common for scrap prices to begin to rise in December and into the 1st Quarter due to the colder weather (weaker collections of new scrap) and improving demand as steel mills move into 1st Quarter. In normal years we also ship significant amounts of scrap to Turkey off the east coast. You can clearly see the trend for 2012 and again 2013 on our graph.

There is a question as to whether we will get the kick up in scrap prices that we normally see at this point in the year. Fundamental demand has shifted due to the strength of the U.S. dollar which makes U.S. scrap more expensive when exported combined with Chinese sales of billet and rebar into the Mideast which is negatively impacting Turkish mill demand for scrap.

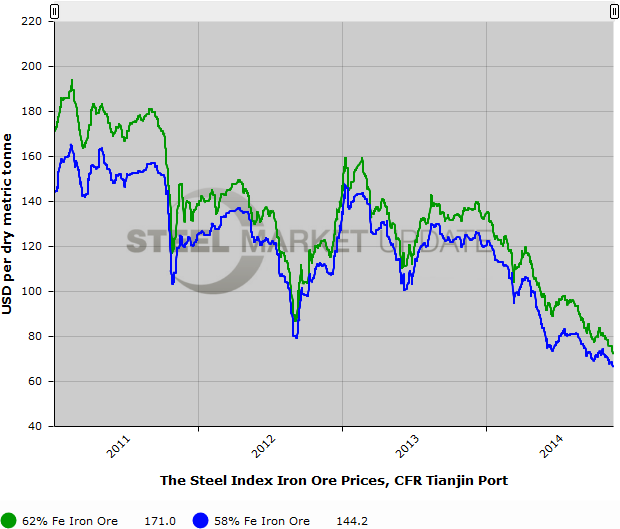

Another reason is the spread between “iron units” which takes into consideration where spot iron ore prices are in China. Recently, SMU spoke on a panel which included a number of iron ore experts including Serafino Capoferri from CRU who provided a formula you can use to calculate where scrap prices should be based on iron units:

“Serafino Capoferri of the CRU Group (iron ore consultant) provided those listening to the Steel & Raw Material Supply Chain a formula for calculating where scrap prices should be. He took the cost of 62% Fe fines of $80 (as an example, the cost of iron ore in China right now is closer to $75) plus the cost of metallurgical coal which he pegged at $120. Then you add $100 to cover conversion costs. This leaves you with a $300 cost of iron units. That is also the number where scrap should bottom.” (SMU November 13, 2014)

Since the Cowen & Company conference, the price of 62% Fe fines have dropped to $70/dmt. This would put the bottom of the scrap market at $290. If iron ore were to drop to $60/dmt next year as some suggest then scrap should bottom next year at $280. The market has not seen #1 heavy melt scrap below $300 since December 2009 (by the way, HRC was $550 at that point in time) when the economy was stuck in the teeth of the Great Recession.

Iron ore spot pricing has been tumbling in China having recently broken through $70 per dry metric ton for 62% Fe fines, CFR the Port of Tianjin (The Steel Index).

Spot iron ore pricing in China were trading at $139.2/dmt on December 6, 2013 (TSI) and have been falling ever since reaching $70.0/dmt on November 19, 2014. Essentially, iron ore at the end of last year was trading at twice the number it is now.

We received an email over the weekend from one of our iron ore trading sources in Asia with his projection for iron ore prices as we move into 2015:

“Please take note that Ore has met the USD70/mt CNF FO level, slightly below, and watch to see if it starts to move to the USD75/mt CNF FO level next week… When this happens, when it gets to the USD75/mt CNF FO, then watch to see the 2-3 weeks stability, and when it starts to drop, you will see USD60/mt CNF FO.”

SMU Note: SMU looks back to comments made by Keith Busse when he was the CEO of Steel Dynamics regarding how much it cost SDI to make a hot band. His short response was to take Busheling and add $150 per ton to the number in order to reach an “approximation” of their cost to produce a hot rolled coil.

At $350 busheling, this hypothetically puts HRC production costs at $500 per ton at the EAF mills and we may be heading for a slightly wider spread between Busheling and hot rolled prices come December (without a drop in HRC pricing).