Prices

November 20, 2014

Skepticism Growing Regarding Flat Rolled Price Increase

Written by John Packard

On October 28, 2014 AK Steel announced a $20 per ton ($1.00/cwt) price increase on hot rolled, cold rolled and galvanized steels. Shortly after, ArcelorMittal and then Nucor advised their customers of specific base price levels on new spot flat rolled orders. Hot rolled was to be offered at $33.00/cwt ($660 per ton or higher) and cold rolled and coated products (galvanized and Galvalume) at $39.00/cwt ($780 base or higher).

Since then prices have stagnated on most flat rolled products. Steel Market Update hot rolled average went from $630 per ton on October 28th to a high of $640 per ton on November 13th and is now back down to $635 per ton.

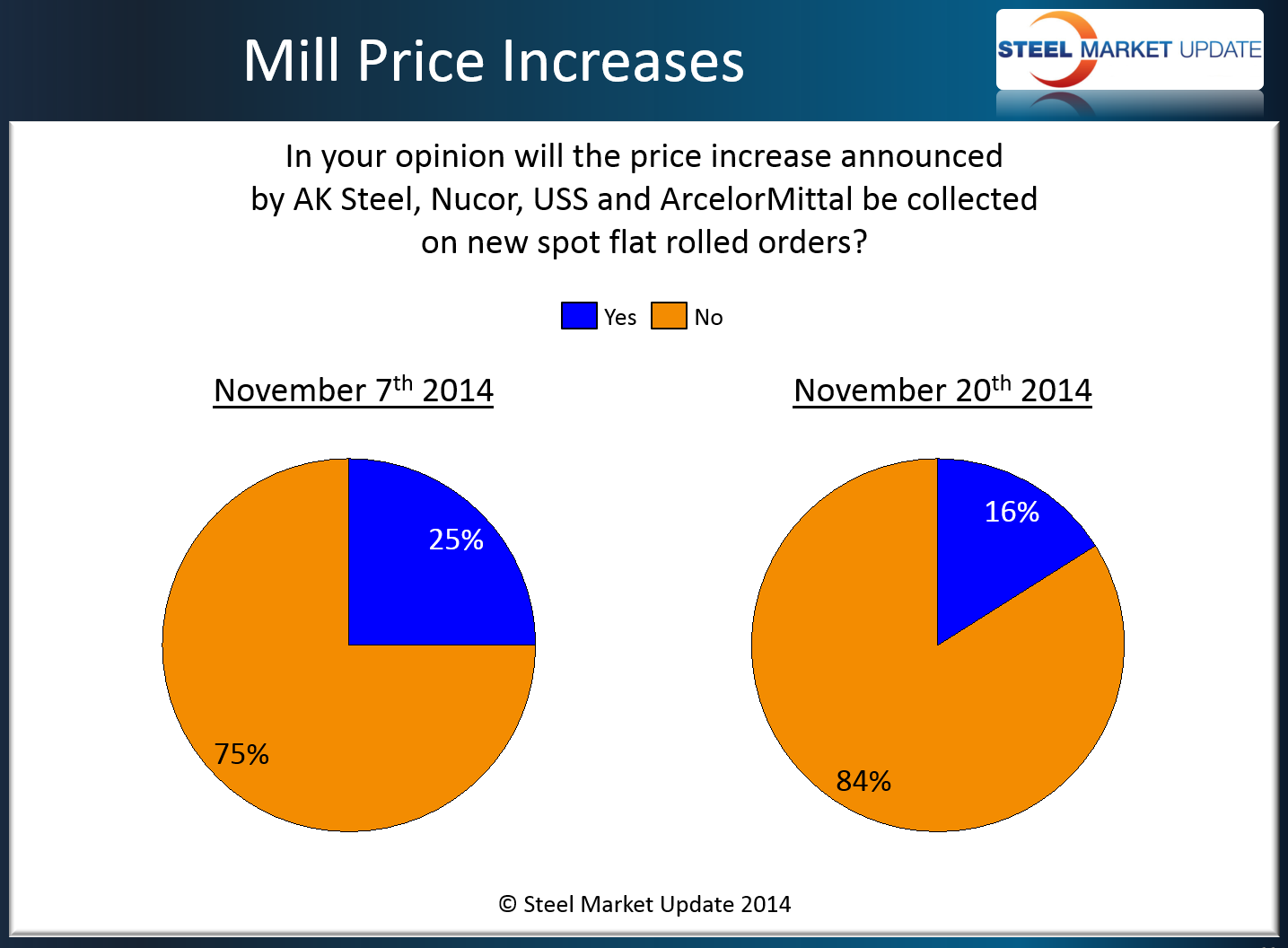

We have been asking buyers and sellers of steel, since the announcements were made, if the domestic mills would be able to collect the price increase. At the beginning of November 75 percent of the respondents to our flat rolled steel market survey responded that the mills would not collect the increase.

We asked the same question again this week during our mid-November survey and found the number of skeptics had increased to 84 percent with only 16 percent believing that the mills will be able to collect the increase.

There were a number of comments left behind during the survey process:

“Demand is slowing down, raw material prices going down, import still coming in, will be tough sell for domestic mills if they want to fill Dec, maybe Jan/Feb.” Manufacturing Company

“Stem the decline is the best they can hope for.” Service Center

“Make that absolutely not [able to collect price increase].” Service Center

“Not to their full extent, but expect that it does allow the market to firm up.” Service Center

“With the value of the dollar strong compared to other world currencies, imports will continue to land consistently in 2015. This continues to put pressure on domestic steel mills especially as their raw material input costs continue to drop. This price increase was to try and establish a floor in pricing.” Manufacturing Company

“They’ll try, but downward forces are too strong.” Manufacturing Company

“No way in hell.” Manufacturing Company