Prices

November 13, 2014

November Steel Import Trend Analysis

Written by John Packard

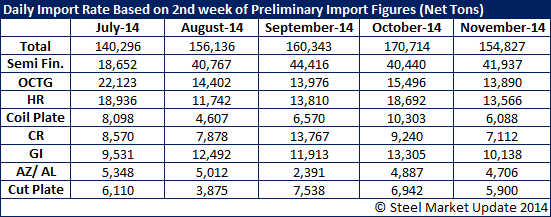

This week Steel Market Update is going to do something different with the import license data which has been released by the U.S. Department of Commerce through November 12th. Instead of us providing a projected total for the month of November, we thought it might be more worthwhile to compare the daily license average through the 12th of November with the averages from July, August, September and November at this same point of the month (2nd week of the month).

As you can see the daily average (all steel items) for November is quite similar to August. When August finally closed, the total imports were almost 3.7 million tons.

In the two tables listed below:

The first table shows the average daily license rate through the second week of the month for July, August, September, October and November (through the 12th).

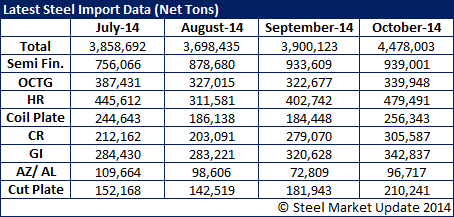

The second table shows the final census numbers through September and final license numbers for the month of October.

You can then make your own comparisons and determinations regarding whether November 2014 will be another major import month for the United States or are imports beginning to wane? In November 2013 the U.S. received 2,592,549 net tons. Our expectation is the U.S. will be in excess of 3.0 million net tons during the month of November 2014.