Prices

November 6, 2014

2014 On Pace to Blow Out Steel Import Records

Written by John Packard

In the AISI press release, which we have republished in this evening’s newsletter, they reported October finished imports as 31 percent of apparent steel supply. They also reported that year to date (YTD) finished steel imports (does not include semi-finished which are slabs, billets and blooms) are estimated to be 28 percent of apparent steel supply.

Steel Market Update was curious to learn more about the AISI numbers and we contacted them this afternoon and asked a couple of questions. We asked them if the 31 percent penetration rate for October was a monthly record. They responded with, “The SIMA finished import percentage for October is one of the highest on record.”

SMU noted that the year to date numbers are quite high from a historical perspective, we asked the AISI if they had the same take on the numbers to which they responded, “The surge remains the primary concern for AISI and our members, and we are seeing continued and rising levels of imports that are on track to reach historic levels.”

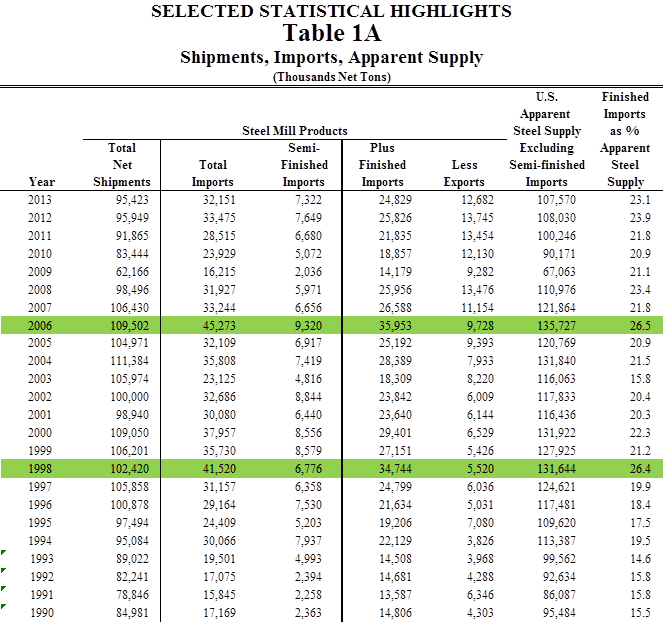

The AISI also provided the table below which provides finished import penetration into the domestic steel markets since 1990 through 2013. The two biggest years prior to 2014 were 1998 and 2006. We have discussed these years with our readers in the past but we thought a more detailed review might be of value.

We did some quick calculations to determine what the average finished steel penetration has been since 1990. The answer is 19.63 percent. Then we took a look at the finished steel penetration average over the past 13 years (since 2000) and the answer is 23.36 percent.