Market Data

November 3, 2014

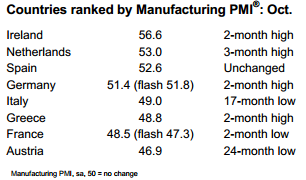

Global PMI Unchanged at 52.2 in October

Written by Sandy Williams

Global manufacturing continued to expand for the 23rd successive month according to JP Morgan and Markit. The JP Morgan Global Manufacturing PMI registered 52.2 in October, unchanged from September.

“The global PMI continues to signal 3-4% annualized gains in manufacturing output as we head towards year-end,” said David Hensley, Director of Global Economics Coordination at JP Morgan. “While the new orders data suggest that demand is generally holding up well, this good news is countered to some degree by indications in the survey that finished goods inventory is increasing rapidly.”

New export orders increased at its weakest rate since August 2013. Employment growth was unchanged from September.

Input prices rose at the slowest pace since April while average selling prices fell, primarily due to reductions in China and the Eurozone.

North America led global manufacturing growth in October with the Markit U.S. Manufacturing PMI posting a 55.9. The U.S. index fell from 57.5 in September and signaled a weakening in new orders and slower growth. Canada and Mexico showed strong improvement at 53.3 (up from 52.6) and 55.3 (up from 53.5), respectively.

In Asia, Japan rose to 52.4 from 51.7 in September for a seven month high boosted by increased demand. Manufacturing conditions worsened in South Korea as output declined for the seventh month. The HSBC South Korea PMI read 48.7, down from 48.8 the previous month. October data for China indicated only weak improvement with a nearly unchanged PMI of 50.4, up from 50.2 in September.

Hongbin Qu, Chief economist, China at HSBC said, “Overall, the manufacturing sector continued to stabilize in October, however the sequential momentum likely weakened,” said. “The economy still shows clear signs of insufficient effective demand. We still see uncertainties, given the property downturn as well as the slow pace of global recovery, and expect further monetary and fiscal easing measures in the months ahead.”

In Russia, the PMI remained above 50.0 but edged downward to 50.3. New orders slowed to a three month low with exports plunging at a fast rate. Alexander Morozov, Chief Economist (Russia and CIS) at HSBC said, “Overall, Russian manufacturing remained in stagflation in October, with the inflation component of stagflation becoming more pronounced. Import substitution seen in some industries on the back of the RUB depreciation and the Russian ban on imports as well as the improvements seen in the investment good sector may prevent manufacturing from sliding into a recession. Yet this will unlikely trigger an output recovery amidst falling export and consumer demand, we think.”