Market Data

October 30, 2014

Gross Domestic Product Q3 2014, First Estimate

Written by Peter Wright

The Bureau of Economic Analysis (BEA) released the third estimate of Q3 2014 Annual Revision of the National Income and Product Accounts on Thursday.

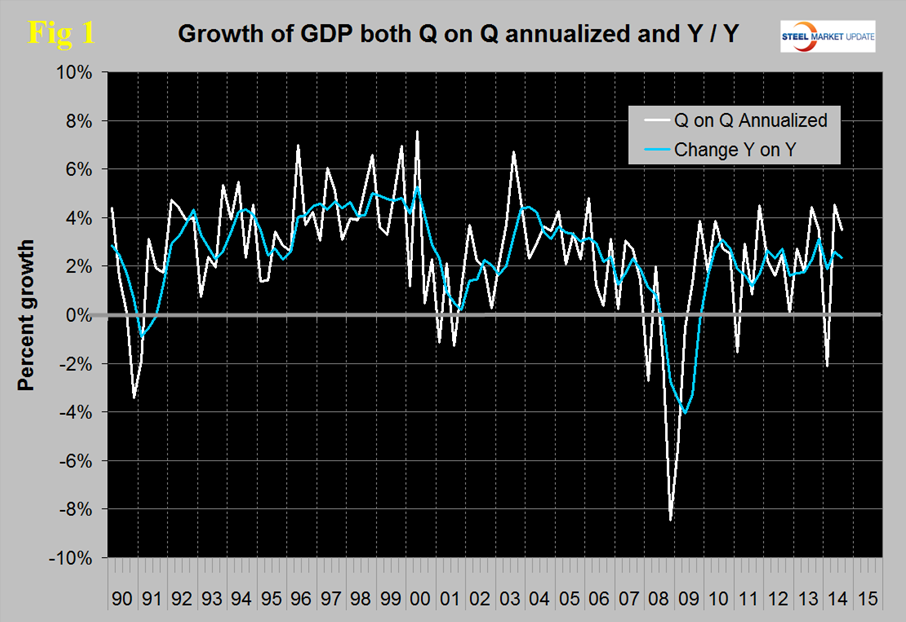

The annualized growth rate in the third quarter was 3.50 percent which was down from 4.51 percent in Q2 but still exceeded most analysts’ expectations. GDP is measured and reported in chained 2009 dollars and in Q3 was $16.151 trillion. The calculation is slightly misleading because it takes the quarter over quarter growth and multiplies by 4 to get an annualized rate. This makes the high quarters higher and the low quarters lower, (Figure 1). On a year over year basis GDP was 2.35 percent higher in the third quarter than it was in Q3 2013.

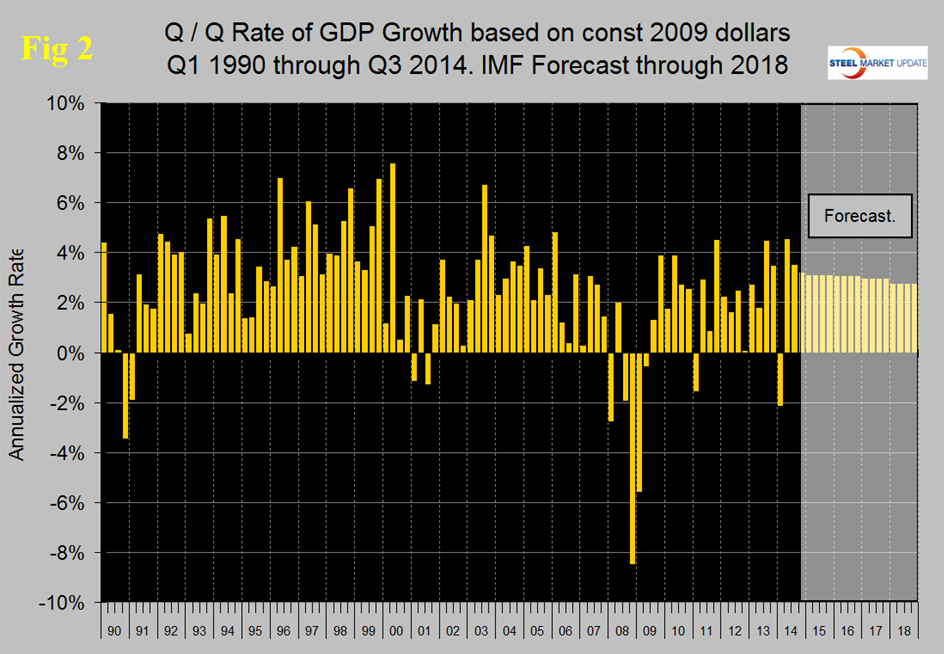

Figure 2 shows the publicized quarterly results since 1990 and the latest IMF forecast through 2018. The reported GDP growth in the second quarter was in line with Q3 and Q4 last year. As expected, based on the strong Q2 result, the IMF increased its forecast for the US in the October World Economic Outlook report.

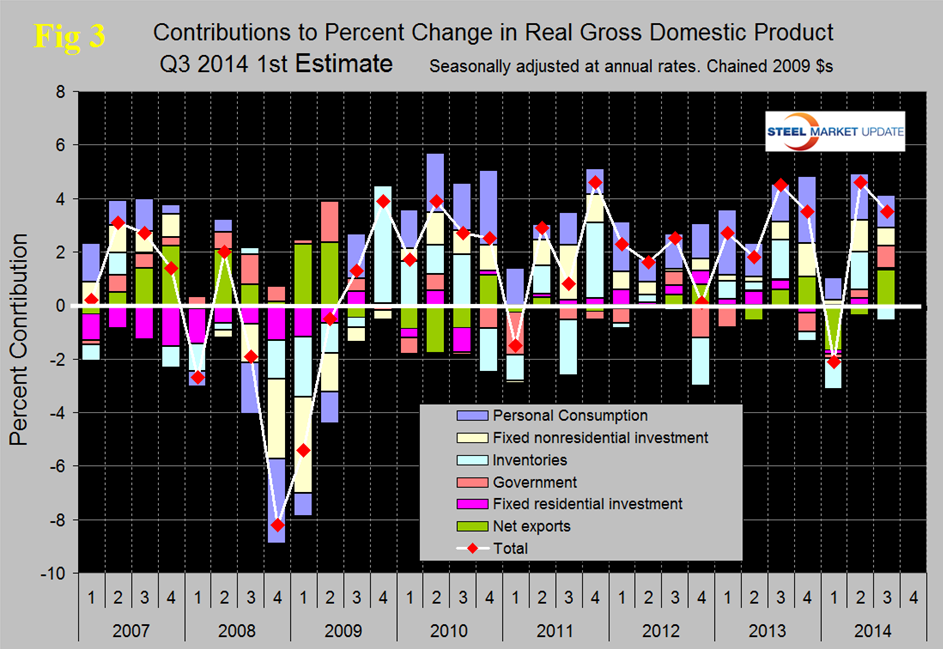

Figure 3 shows the change in the major sub-components of GDP. Comparing Q3 with Q2 there were major changes in the sub-components. Inventories and net exports did an equal and opposite reversal. Net exports changed from slightly negative to strongly positive. Inventories changed from strongly positive to slightly negative. Increasing inventories make a positive contribution to GDP and over the long run inventory changes are a wash and simply move growth from one period to another. Nonresidential construction contracted and government expanded, both more than could be expected on such a short term comparison. Residential construction contracted by $1.7 billion. The contribution of personal consumption shrank from 1.75 percent to 1.22 percent. Personal consumption includes goods and services, the goods portion of which includes both durable and non-durables. In the Q3 personal consumption accounted for 67.9 percent of total economic activity, exactly the same as Q3 last year.

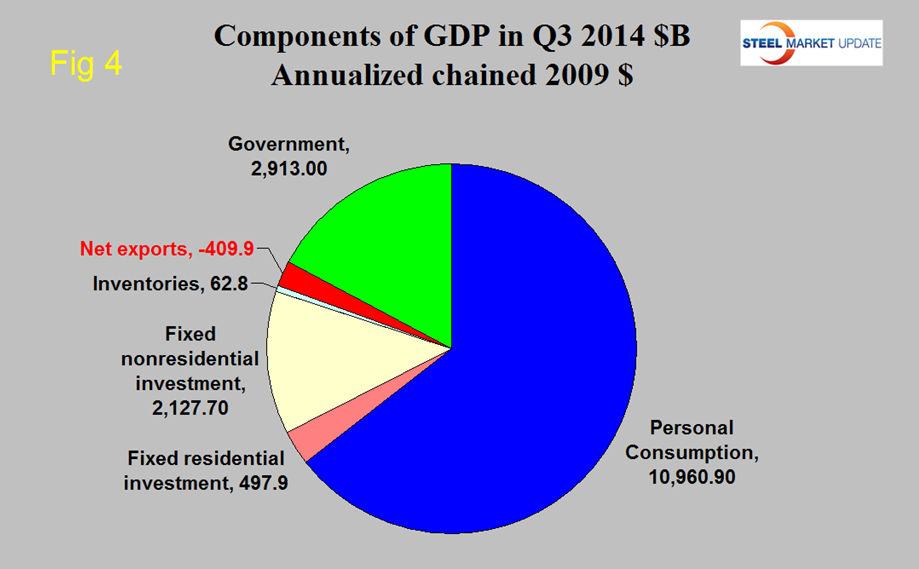

Figure 4 shows the breakdown of the $16 trillion economy.

The official press release from the BEA reads as follows:

Gross Domestic Product: Third Quarter 2014 (Advance Estimate)

Real gross domestic product — the value of the production of goods and services in the United States, adjusted for price changes — increased at an annual rate of 3.5 percent in the third quarter of 2014, according to the “advance” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.6 percent.

The Bureau emphasized that the third-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see the box on page 3 and “Comparisons of Revisions to GDP” on page 5). The “second” estimate for the third quarter, based on more complete data, will be released on November 25, 2014.

The increase in real GDP in the third quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, federal government spending, and state and local government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

The deceleration in the percent change in real GDP reflected a downturn in private inventory investment and decelerations in PCE, in nonresidential fixed investment, in exports, in state and local government spending, and in residential fixed investment that were partly offset by a downturn in imports and an upturn in federal government spending.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, increased 1.3 percent in the third quarter, compared with an increase of 2.0 percent in the second. Excluding food and energy prices, the price index for gross domestic purchases increased 1.5 percent, compared with an increase of 1.7 percent.

SMU Comment: We have reported frequently in the past on the relationship between GDP and steel consumption. Steel growth follows economic growth but is very much more volatile. In addition over the long run about a 2.5 percent growth of GDP is necessary to get any growth in steel consumption. In four of the last five quarters, GDP growth has been well above 2.5 percent which bodes well for future steel demand.