Prices

October 26, 2014

September Steel Imports Just Shy 4 Million Tons

Written by John Packard

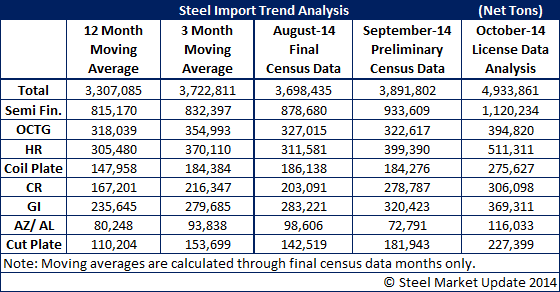

Total September steel imports were just shy 3.9 million net tons according to the Preliminary Census numbers just released by the U.S. Department of Commerce. Total steel imports were up 5.2 percent over August data, and up 38.0 percent year over year.

Semi-finished imports (mostly slabs) were up 6.3 percent month over month and 47.3 percent year over year. The domestic steel mills (who are the only ones who purchase slabs) accounted for 24 percent of the total imports just through the imports of semi-finished steels. Steel mills also imported hot rolled coil (USS/Posco, Steelscape and CSN) which takes total imports due to the domestic steel mills well above the 24 percent number.

Imports of oil country tubular goods were down 1.3 percent over August but up 26.4 percent over the same month one year ago.

Hot rolled imports rose 28.2 percent from August to September, and were 33.0 percent higher than levels one year ago. Russian hot rolled imports accounted for 16.3 percent of the total. It is expected that Russian imports of hot rolled coil will cease after December 16th when the termination of the suspension agreement takes effect and the 73 percent to 154 percent duties take their place.

However, if you look at the import data closely you will notice that the Brazilians are becoming major exporters of hot rolled having gone from essentially zero tons one year ago, less than 10,000 net tons six months ago and now, with one week left in October the Brazilians already have close to 40,000 net tons of licenses requests. South Korean tonnage is also growing.

Imports of cold rolled products were up 37.3 percent month over month and up 159.9 percent over September 2013 levels. Why was cold rolled up so much? China shipped 144,969 net tons of cold rolled in September. In September 2013 the Chinese exported 18,627 net tons of CRC to the U.S.

Galvanized imports increased 13.1 percent from the previous month and were up 75.9 percent year over year. Two countries stick out when looking at the data – China with 88,839 net tons and Italy with 29,032 net tons.

Imports of other metallic coated products (primarily Galvalume) declined 26.2 percent from August to September, but were up 39.8 over levels one year ago.

Plate in coil imports declined 1.0 percent over the month before but rose 43.8 percent over September 2013 levels.

Imports of plates cut lengths were up 27.7 percent month over month and up 106.3 percent year over year.

The license data is suggesting imports will increase dramatically during the month of October. Based on the average daily license requested rate extended over the remainder of the month we anticipate imports will reach 4.5 million tons (or more). If so, this would be the highest import levels seen in over 20 years.

Written by: Brett Linton & John Packard