Market Segment

October 14, 2014

Consolidation: Will it Impact the Way Steel Mills Go to Market?

Written by John Packard

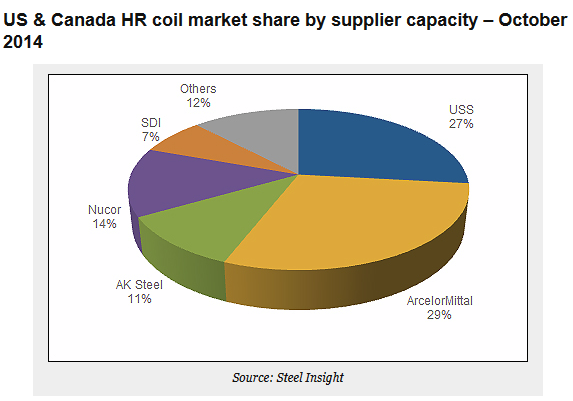

SMU was reading a blog post put up by Metal Miner this morning regarding the consolidation of the steel industry. The main premise of the guest article from James May of Steel-Insight out of Canada, was 81 percent of the hot rolled production in the United States and Canada is controlled by four companies: ArcelorMittal, US Steel, Nucor and AK Steel .

The second comment made by Mr. May in the Metal Miner article was that the Big 4 would be less likely to be disruptive and discount pricing in a down-cycle.

A down-cycle is defined as a point in time when service center inventories increase to a point where buyers no longer need to buy. This is due to a combination of extended lead times at the domestic mills causing buyers to increase their purchases and at the same time they are willing to pay higher prices to insure that they don’t run out of material. The higher domestic prices attract lower priced foreign steel with its longer lead times which when combined with domestic steel arriving early and foreign which cannot be delayed resulting in the increase in inventories.

Steel Market Update pointed this out in a recent Premium article analyzing August MSCI shipment and inventory data. Based on our projections, we believe service centers are moving into an over-supply situation (flat rolled) and we may see evidence of this as early as late this week when the MSCI data for September is released. If we are correct, then the building of inventories will most likely continue through the balance of this year due to the amount of foreign steel being brought into the ports which cannot be cancelled or delayed as much of it is either already produced or shipped.

We also have seasonal factors which come into play during the 4th Quarter. In normal cycles we see companies in states with inventory tax based on end of year inventory levels cut back on purchases. We also see markets such as the construction and related industries which tend to be less active during the cold weather months.

This year we are also seeing a number of equipment issues which either have been dealt with already or are close to completion which should result in more steel being available by late this year.

The result should be a reduction in lead times at the domestic mills. The shorter lead times increase the amount of discounting by the domestic mills in order to attract buyers.

We have seen some of that occurring over the past few weeks as SMU hot rolled coil pricing has dropped by $10 to $20 per ton for most spot buyers over this time period.

What we haven’t seen is the bottom falling out of the market, which is something that happens when one of the domestic mills makes a large move ($30+ per ton) in order to fill their order book before the other mills have time to respond. Will consolidation eliminate the practice of proactively taking prices down in order to beat the competition to market (and fill their order books)? Or, will we see the mills who have added more tons (AK Steel, SDI, ArcelorMittal & Nucor) have to react quicker in order to keep those order books full?

We will need to carefully watch both mill lead times and the number of customers who advise SMU that their mill orders are arriving early. We will also watch foreign imports carefully and then service center inventories to see if they are increasing and, if so, are they increasing at a pace which will impact future mill lead times.

Then we will see if the Big 4 (or Big 5 including SDI) have the ability to be less disruptive than what we have seen during down-cycles in the past.