Prices

October 9, 2014

Ferrous Scrap Exports from the US through August

Written by Peter Wright

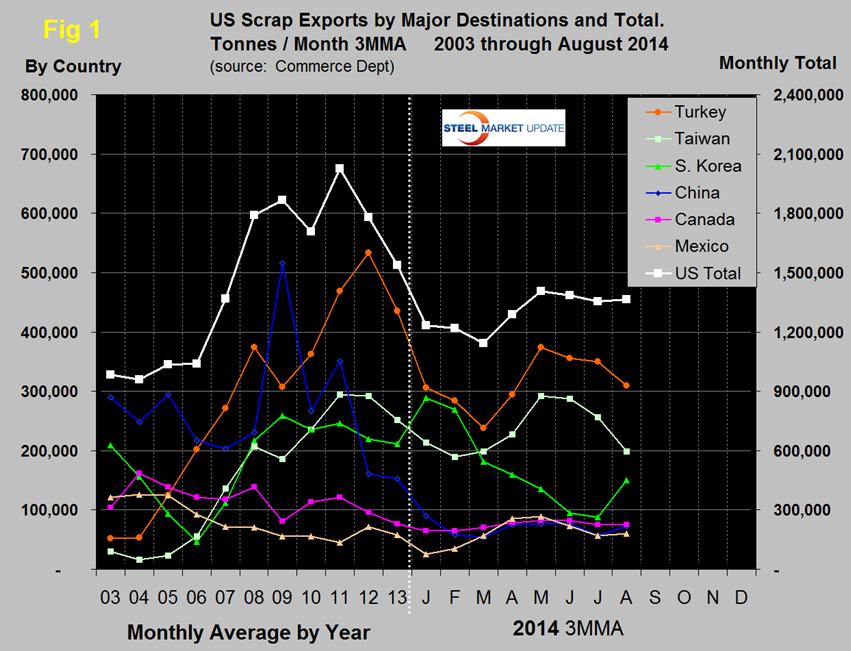

In the first eight months of 2014, scrap exports totaled 10,404,531 metric tons, down by 18.7 percent from the same period in 2013. In the single month of August exports were 1,575,716 tonnes, this was the highest volume month of the year, beating out May by 26,000 tons. Figure 1 shows that the three month moving average has been fairly consistent for the last four months through August and continued to be lower than the average in any year from 2008 through 2013. The most obvious trends so far this year are the decline of Turkey and Taiwan since May and the increase of Korea in three months through August. Year to date Turkey is down by 1.2 million tons or 33.8 percent. China’s tonnage has been quite consistently low this year on a 3MMA basis ranging from 53,000 to 90,000 tons per month. This is compared to over 500,000 tonnes per month in 2009 when they were the highest volume importer.

In YTD 2014 compared to the same period in 2013, the Far East as a whole is down by 12.6 percent and China is down by 59.4 percent. Other nations not considered in this analysis because they have been historically minor purchasers were down in total by 325,000 tons YTD. Some nations have taken more tonnage this year than last, Indonesia is up by 126,000 tonnes, Mexico by 89,000 tonnes, Vietnam by 92,000 tons and Thailand by 301,000 tonnes. Tonnage moving North over the Canadian border was down by 21,000 tons from last year.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. Prices on the both coasts have been in free fall since August 25th. In the time frame since then to October 6th, East Coast export prices were down by $43.41 to $324.25 and the West Coast was down by $33.50 to $321.00.

On September 30th, AMM reported that Turkish export rebar sales are down in the face of continued turmoil in Iraq and an influx of Chinese product into the region. Chinese steel was reported to be arriving all over the world at prices most can’t compete with. One Turkish trader said that the only way for the export oriented Turkish mills to be able to compete is for scrap prices to fall. In addition, currency volatility of as much as 1 percent in a single day in either direction between the US $ and the Turkish Lira makes it difficult to fix prices. In the Asian market Chinese billet sales have brought scrap purchases by such countries as Taiwan to a virtual standstill. Since most of the Chinese mills are iron ore based and most of the world’s rebar mills melt scrap in EAFs, the linkage between the prices of iron ore and scrap is in the process of reasserting itself.