Prices

September 23, 2014

Steel Import License Data Suggest September Will Be a Big Month

Written by John Packard

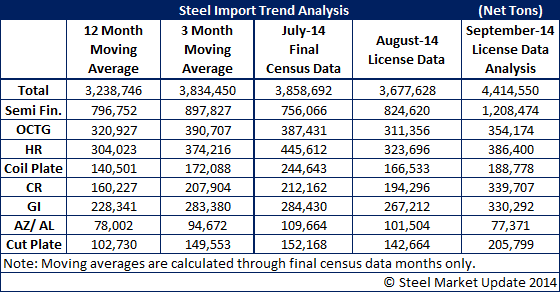

Through the 23rd of September foreign steel import licenses continue to suggest that September imports could exceed the 4.0 million net tons reported in the final census numbers for May 2014.

The license data suggests that the biggest surge in imports will move through the domestic steel mills as semi-finished import licenses are trending toward one quarter of all steel imported into the United States. Semi-finished steels are slabs, blooms and billets and each are used to produce flat (slabs) or long products including seamless pipe (blooms, billets). Semi-finished are on pace to exceed both the 12 month and 3 month moving averages for the product. The countries exporting the most semi-finished products to the U.S. are Brazil and Russia which combined have requested 84 percent of the licenses.

Hot rolled licenses are looking like they will come in somewhere between the 12 month moving average (304,023 net tons) and the 3 month moving average (374,216 net tons). At the moment, we believe HRC imports for September will be the higher end, exceeding August but not coming in quite as high as the final July numbers. The countries requested the most licenses are: South Korea (which supplies USS/Posco on the West Coast), Russia and the Netherlands. It appears HRC tons out of Brazil are on the rise.

Coiled plate which many buyers believe should be included in the hot rolled numbers appear poised to come close to the 3 month moving average of 172,088 net tons. At the moment we do not believe they will match the July levels of 244,643 net tons. Russia and Canada are the two largest suppliers with growth being seen out of Turkey, Netherlands and Mexico.

When September is finally put to bed and the final census numbers are reported, we believe the story on cold rolled will be all about China. The Chinese mills have already requested 139,000 net tons of cold rolled licenses. To put that into perspective, the 12 month moving average for cold rolled (total) is 160,227 net tons. Cold rolled imports are trending toward exceeding the biggest import month this calendar which was June with 233,790 net tons. The next largest exporting country during the month of September is the United Kingdom with 27,734 net tons of license requests to date.

Galvanized is another product which is looking like it will have another strong month for foreign steel and could challenge the May high of 294,306 net tons. China has twice the import license requests with 77,902 net tons compared to India and its 36,842 net tons. Italy continues to grow their tonnage with 26,364 net tons which is almost double their biggest month this year which was July at 14,143 net tons.

Galvalume licenses have actually begun to decline and they could actually come in at, or slightly below, the 12 month moving average. However, we are entering the slower season for the product so the victory may be hollow.

Please remember that our analysis is based on US Department of Commerce import license data. the US DOC updates their data every Tuesday evening (in metric tons – we convert it to net tons for our readers). Licenses are good for recognizing trends but can sometimes miss the final census mark by a wide margin. So, the last column of our table above provides a mathematical suggested total for the month based on licenses collect through September 23rd, but we do not quote those numbers in our commentary because more often than not they are wrong.