Prices

September 14, 2014

Sheet Products Expanding Strongly But Domestic Mills Participation Level is Not

Written by Peter Wright

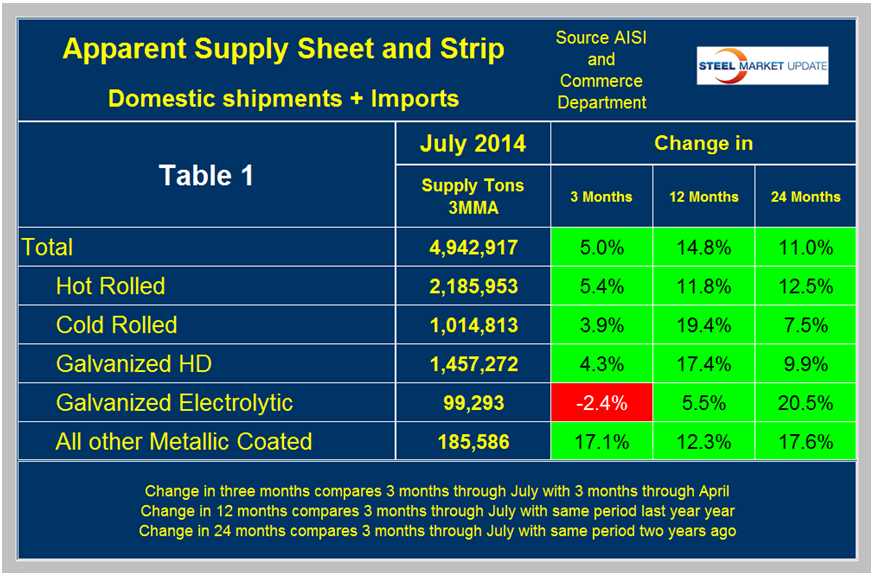

Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Sources are the American Iron and Steel Institute and the Department of Commerce with analysis by SMU. The three month moving average (3MMA) of the total tonnage of sheet and strip supply in the period May through July was 4,942,917 tons, up by 14.8 percent from the same period last year and by 11.0 percent from the same period in 2012.

Table 1 shows the performance by product over three, twelve and twenty four month periods. In three months through July, supply advanced by 5.0 percent compared to three months through April. The only product having negative growth over any of the time periods considered was electro galvanized which contracted by 2.4 percent in three months through July compared to three months through April. Year over year hot band grew by 11.8 percent, cold rolled by 19.4 percent and HGD by 17.4 percent.

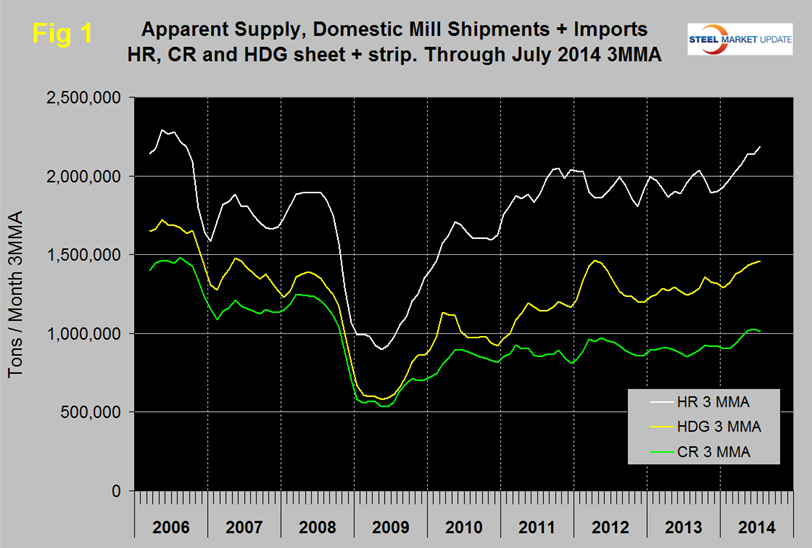

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2006. In July, on a 3MMA basis hot band continued to break away from the range that has prevailed for over 2.5 years. The 3MMA of hot band supply in July was the highest since September 2006 at 2,185.953 tons. Cold rolled supply at 1,014,813 maintained a performance in excess of the one million ton level for the third consecutive month, a level last achieved in October 2008. HDG had a strong bump in H1 2012, declined in H2 2012 and has been steadily improving for 20 months. HDG in three months through July averaged 1,457,272 tons per month.

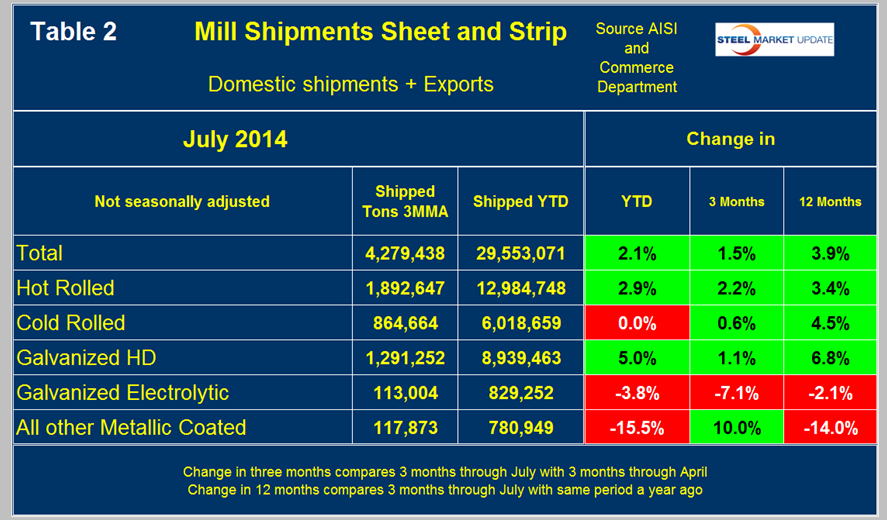

Supply is both domestic shipments plus imports. The total supply of all sheet and strip products was up by 14.8 percent in May through July year over year as mentioned above but imports took the lions share. On the same time basis mill shipments were only up by 3.9 percent, (Table 2).

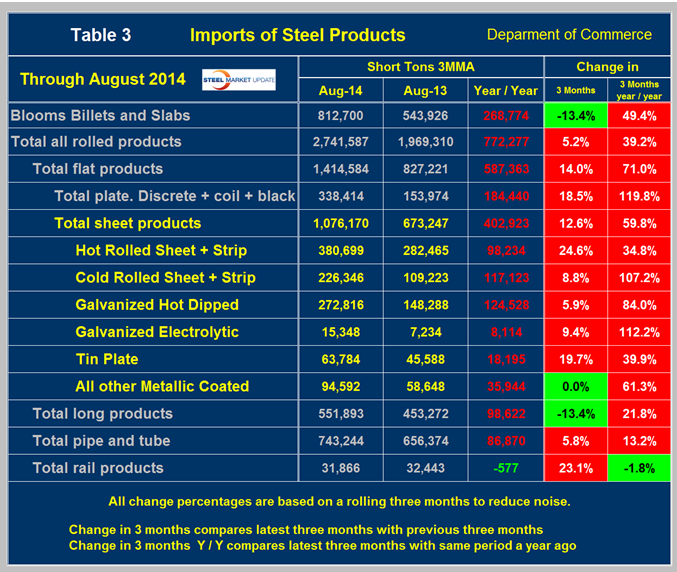

Imports of total sheet products on the other hand were up by 70.8 percent in May through July on a 3MMA basis. License data for August indicates that the monthly average import tonnage slowed very slightly from 1,085,957 tons in there months through July to 1,076,170 tons in three months through August. The year over year growth of total sheet product imports on a 3MMA basis was 59.8 percent as shown in the right hand column of Table 3. Cold rolled imports were up by 107.2 percent year over year.

In summary the supply of sheet products is expanding strongly but the participation of the domestic mills is weak.