Analysis

September 12, 2014

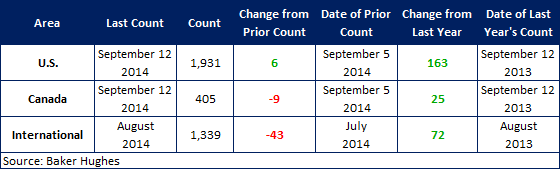

Oil and Gas Rigs Up in US While Canada Drops

Written by Brett Linton

According to Baker Hughes data from September 12th 2014, the U.S rig count for this week is 1,931 rigs exploring for or developing oil or natural gas. This count is an increase of 6 rigs when compared to last week, with oil rigs up 8 to 1,592 rigs, gas rigs down 2 to 338 rigs, and miscellaneous rigs unchanged at 1 rig. Compared to last year the 1,931 count is an increase of 163 rigs, with oil rigs up by 231 gas rigs down by 63, and miscellaneous rigs down by 5.

The Canadian rig count decreased by 9 to 405 rigs this week, with oil rigs down 6 to 222 rigs and gas rigs down 3 to 183 rigs. Compared to last year the 405 count is an increase of 25 rigs, with oil rigs down by 16 and gas rigs up by 41. International rigs decreased by 43 to 1,339 rigs for the month of August, an increase of 72 rigs from the same month one year ago. For a history of both the US and Canadian rig count click here.

About the Rotary Rig Count

A rotary rig is one that rotates the drill pipe from the surface to either drill a new well or sidetracking an existing one. They are drilled to explore for, develop and produce oil or natural gas. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies.

The Baker Hughes North American Rotary Rig Count is a weekly census of the number of drilling rigs actively exploring for or developing oil or natural gas in the United States and Canada. Rigs considered active must be on location and drilling. They are considered active from the time they break ground until the time they reach their target depth.

The Baker Hughes International Rotary Rig Count is a monthly census of active drilling rigs exploring for or developing oil or natural gas outside of the United States and Canada. International rigs considered active must be drilling at least 15 days during the month. The Baker Hughes International Rotary Rig Count does not include rigs drilling in Russia or onshore China.