Prices

September 7, 2014

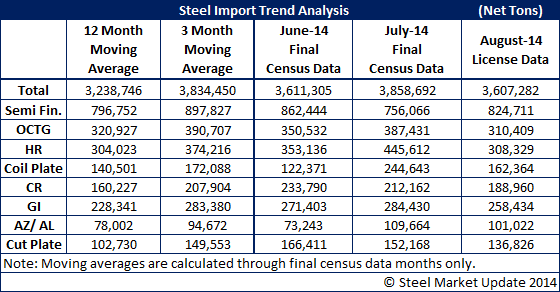

July Final Imports Totaled 3.8 Million Tons

Written by John Packard

The U.S. Department of Commerce released final census data for July steel imports this past week. Total imports were 3,858,692 net tons which was 247,387 tons greater than what we saw during the month of June. License data is pointing toward a slightly lower total volume for total steel imports during the month of August. Based on the most recent license data August should come in very close to the June number at 3.6 million net tons.

The 12 month moving average is 3.2 million tons and the 3 month moving average is 3.8 million tons. May 2014 is the month which has received the greatest number of tons since the beginning of the Great Recession at just over 4.0 million net tons.

One of the major reasons for the decline in tonnage between June and July is due to semi-finished (mostly slabs) being 106,378 net tons lower in July than June. Semi’s are projected to be back to June levels in August.

We saw higher hot rolled imports during the month of July as the final census data reported 445,612 net tons were received in July. This is up 21 percent from the previous month. August license data suggests that HRC imports will be close to the 12 month moving average which is 304,023 net tons.

Cold rolled tons slipped in July, backing down from June’s 233,790 net tons to 212,162 net tons in July. August is currently projected to be down again to 188,960 net tons which would be slightly greater than the 12 month moving average of 160,227 net tons.

Galvanized tonnage was up in July to 284,430 net tons which is slightly higher than the 3MMA and well above the 12MMA.

Galvalume continues to come into the market at levels well above both the 12MMA and 3MMA. July totals of Galvalume were 109,664 net tons in July and expected to exceed 100,000 net tons again in August.

Coiled plate imports grew to 244,643 net tons almost double the 122,371 net tons received during the month of June. August coiled plate imports are expected to be 162,364 net tons which is above the 12MMA but slightly below the 3MMA.

Good news is OCTG imports for August appear will be lower than both the 3MMA and 12MMA. However, for the month of July OCTG imports were up over June and exceeded the 12MMA.

It is expected that with the OCTG final determination having been made imports of the product will shrink in the coming months.