Prices

September 7, 2014

Iron Ore Drops to Lowest Levels Since 2009

Written by John Packard

Iron ore spot pricing CFR Tianjin port, China was reported by The Steel Index on Friday morning to be $83.6/dmt for 62% Fe fines. During the past week, iron ore pricing has dropped $4.30/dmt or about 5 percent. Over the past 4 weeks, spot pricing has dropped $12.1/dmt or, 12.6 percent. To put this into perspective the high for the past twelve months was $139.7/dmt with the current number being the 52-week low.

The industry is seeing the lowest iron spot price levels in almost five years according to a press release from TSI: “Spot market prices for high quality iron ore fines fell to their lowest level in nearly five years yesterday as deteriorating conditions in China’s steel market were manifested in weaker demand for the steelmaking ingredient. TSI’s 62% Fe iron ore fines benchmark price fell a dollar to US$85.70/dry metric tonne, CFR Tianjin port, China on September 3, taking it to its lowest level since October 8, 2009, when the price stood at US$84.60/dmt.”

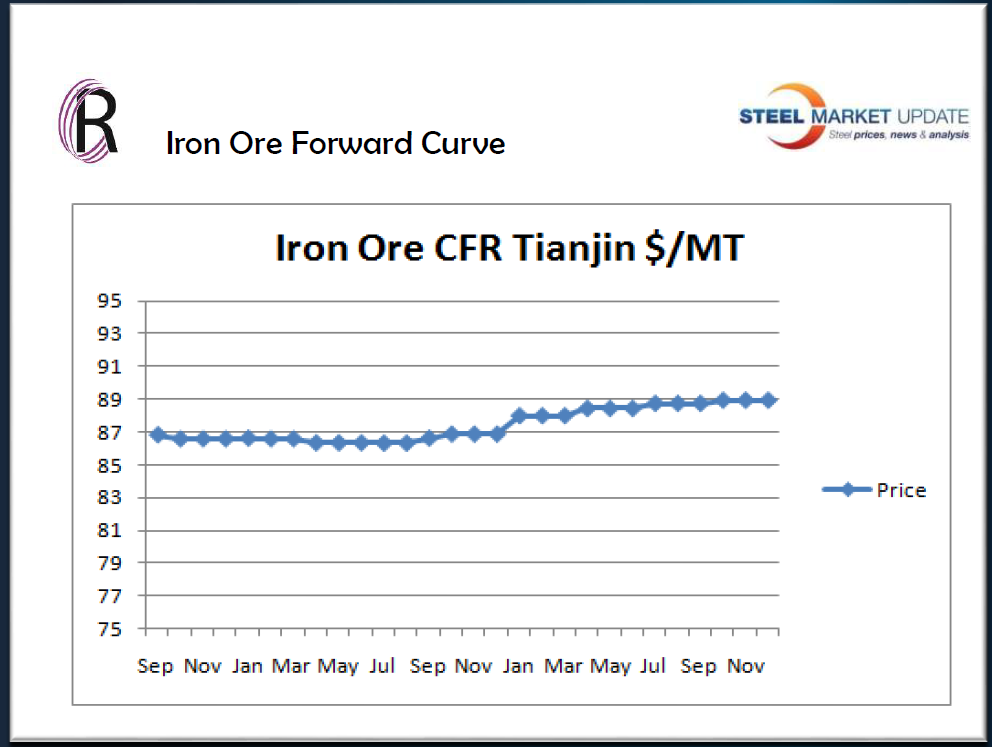

During the SMU Steel Summit Conference held in Atlanta earlier this week, Andre Marshall of Crunch Risk advised those in attendance that the flat forward curve on the Chinese iron ore futures markets were a concern and, in his opinion, pointed to a possibility iron ore prices could fall further. He pointed out that in a normal market as prices reach the bottom of their cycle, the futures forward curve should be in contango (higher pricing than current physical market).