Market Data

August 15, 2014

Currency Update for Steel Trading Nations August 2014

Written by Peter Wright

Explanation of Data Sources: The broad index is published by the Federal Reserve on both a daily and monthly basis. It is a weighted average of the foreign exchange values of the U.S. dollar against the currencies of a large group of major U.S. trading partners. The index weights, which change over time, are derived from U.S. export shares and from U.S. and foreign import shares. The data are noon buying rates in New York for cable transfers payable in the listed currencies. At SMU we use the historical exchange rates published in the Oanda Forex trading platform to track the currency value of the US $ against that of sixteen steel trading nations. Oanda operates within the guidelines of six major regulatory authorities around the world and provides access to over 70 currency pairs. Approximately $4 trillion US $ are traded every day on foreign exchange markets.

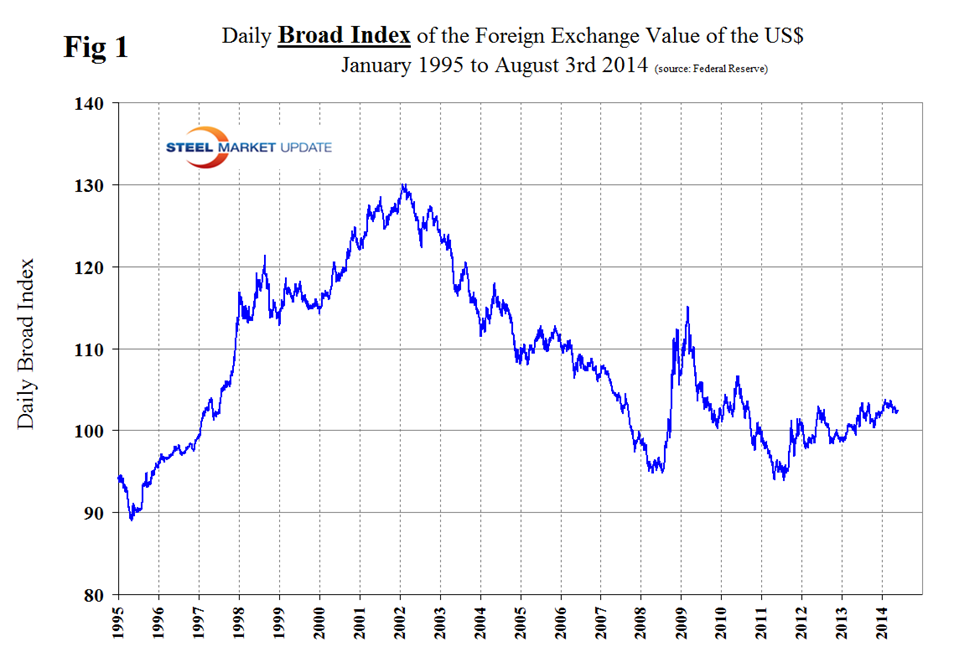

Figure 1 plots the Broad Index (BI) value of the US $ since 1995. This can be described in a number of different ways depending on what message the writer wants to send, all of which are true and some of which are contradictory. The BI is well below its peak in spring 2002. Other than the safe haven effect of late 2008-early 2009 the dollar has been fluctuating within a range since mid-2007. The BI has been strengthening since mid-2011. The BI has been fluctuating within a range since mid-2012. The BI strengthened throughout 2013. The BI has weakened in 2014.

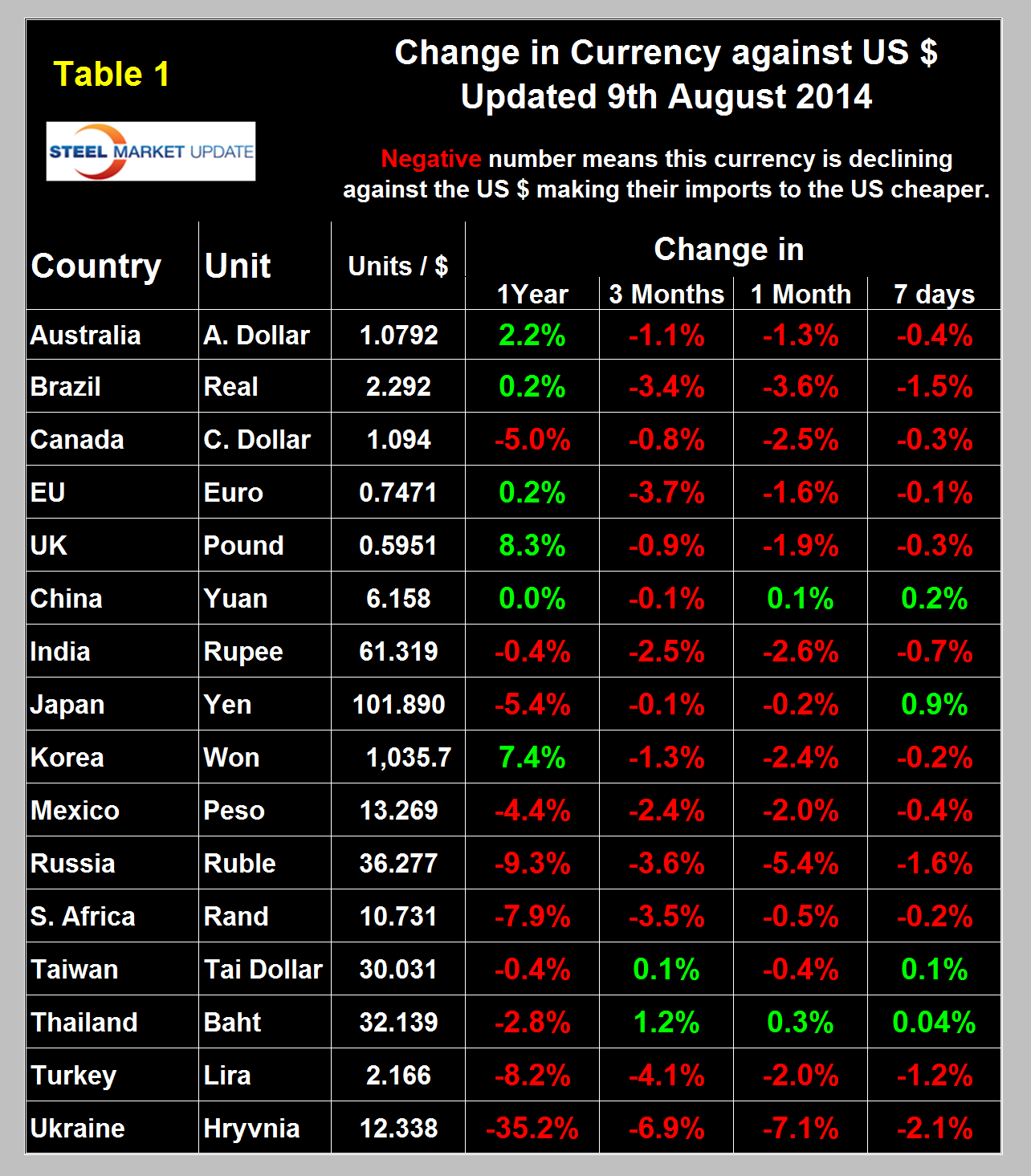

Just to pick a couple of these options, the most significant are probably that the US $ has strengthened by 8.5 percent since mid-2011, this favors imports to the US and depresses exports, and the dollar has weakened by 0.6 percent since February 3rd this year. At SMU we track the currencies of 16 steel trading nations. The currencies of these 16 don’t necessarily follow the broad index and, in fact, at any given time some are always moving in the opposite direction. Table 1 shows the number of currency units that it takes to buy one US $ and the percent change in the last year, three months, one month and seven days. The overall picture for the steel trading nations is that in the last year the US $ has strengthened against ten of the sixteen and weakened against six. In the last three months the dollar has strengthened against fourteen and weakened against two. The situation in the last month is the same as three months, strengthening against fourteen and weakening against two. Table 1 is color coded to indicate weakening of the dollar in green and strengthening in red. We regard strengthening of the US Dollar as negative and weakening as positive because the effect on net imports.

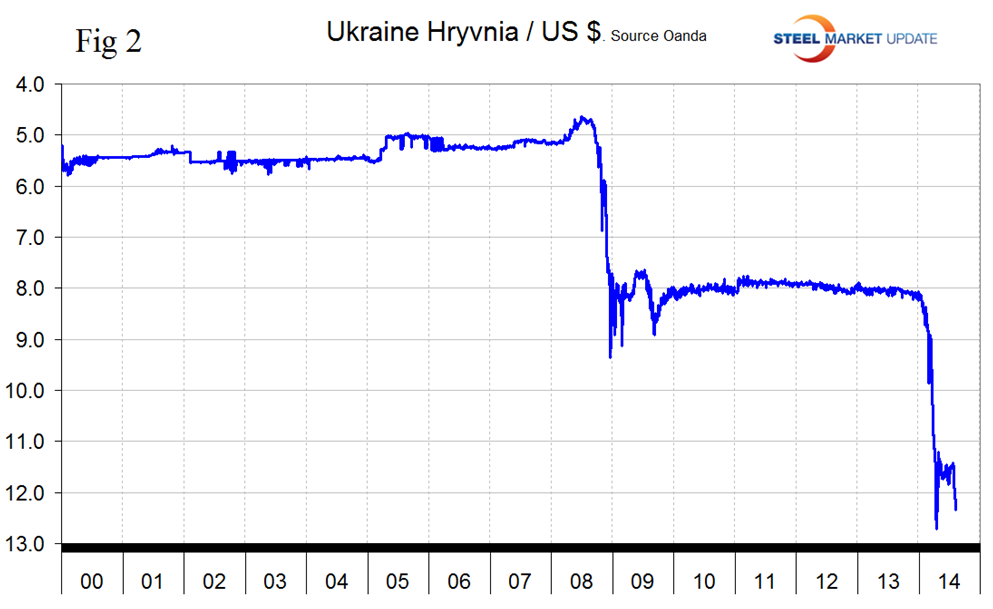

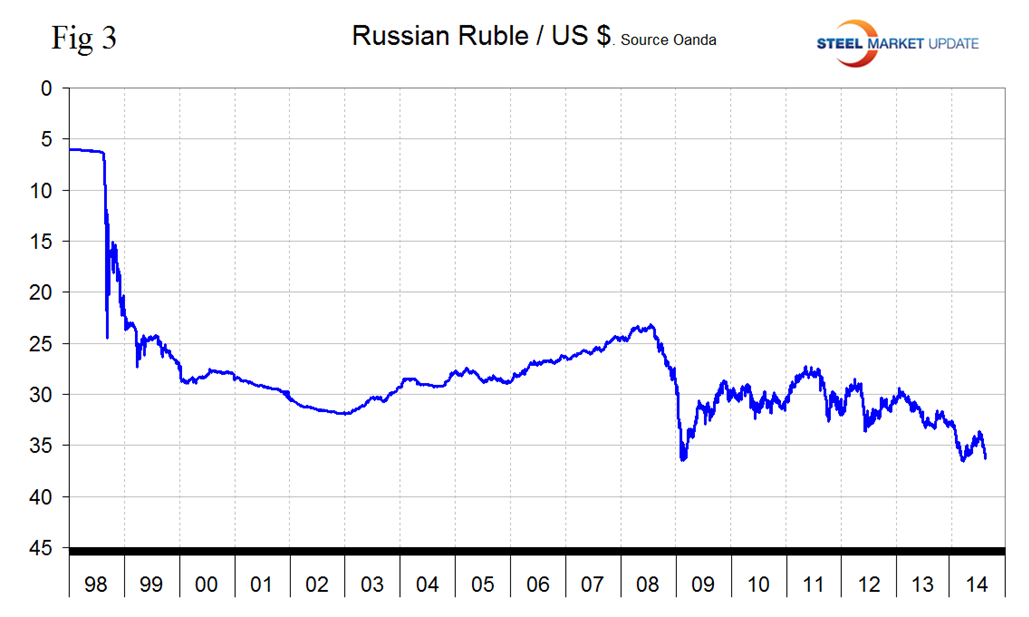

The following major changes have occurred in the last month; the Ukrainian Hryvnia is down by 7.1 percent, (Figure 2) and the Russian Ruble is down by 5.4 percent, (Figure 3). In the last 12 months the Hryvnia is down by 35.2 percent and the Ruble by 9.3 percent.

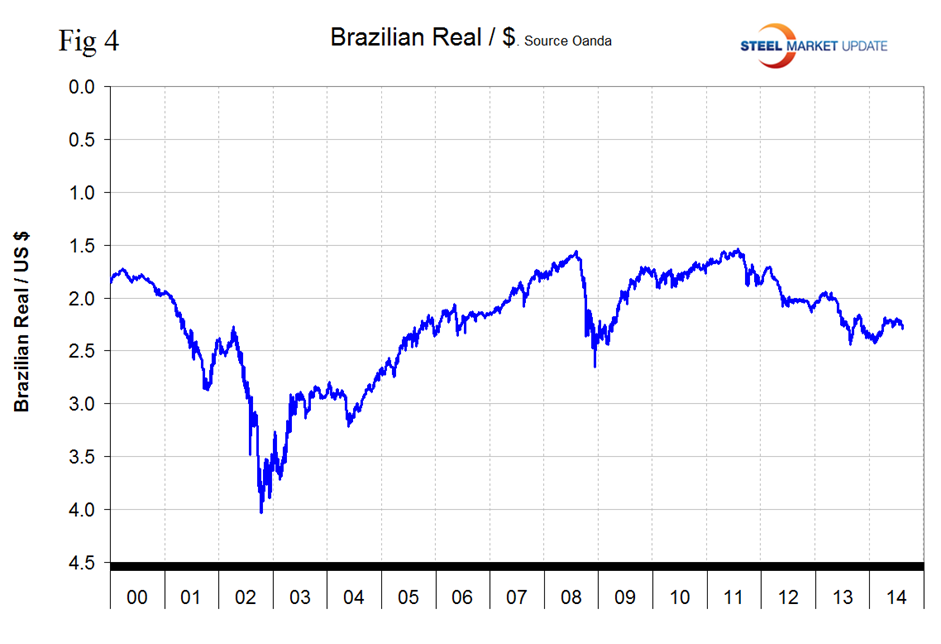

In the last month the Brazilian real is down by 3.6 percent, (Figure 4).

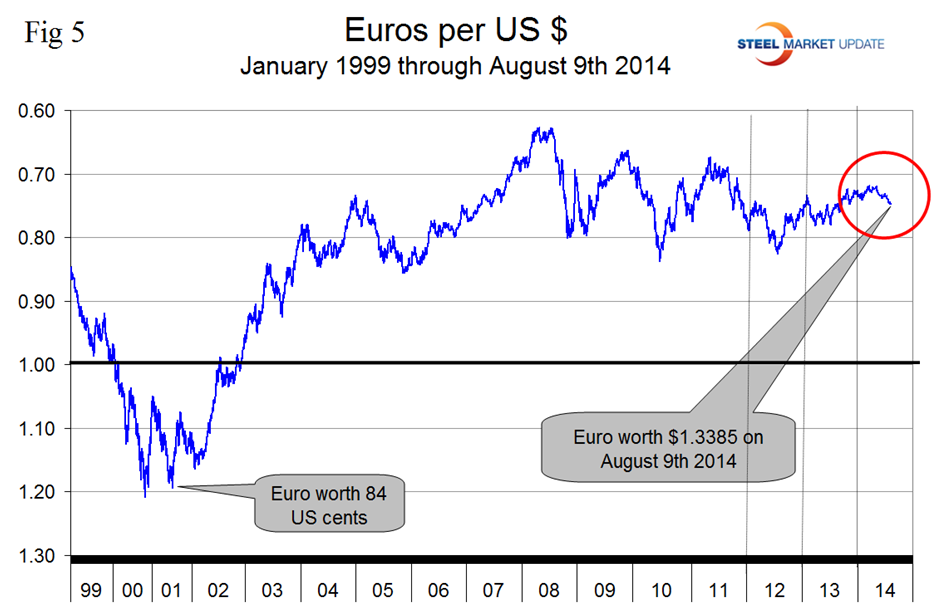

The Euro stood at 1.3385 on August 9th down from 1.3626 in our last report one month ago.The Euro peaked at 1.3924 on May 8th and has since declined by 3.9 percent, (Figure 5). A weakening Euro makes US scrap less attractive to Turkish buyers and tends to promote European exports to the US.

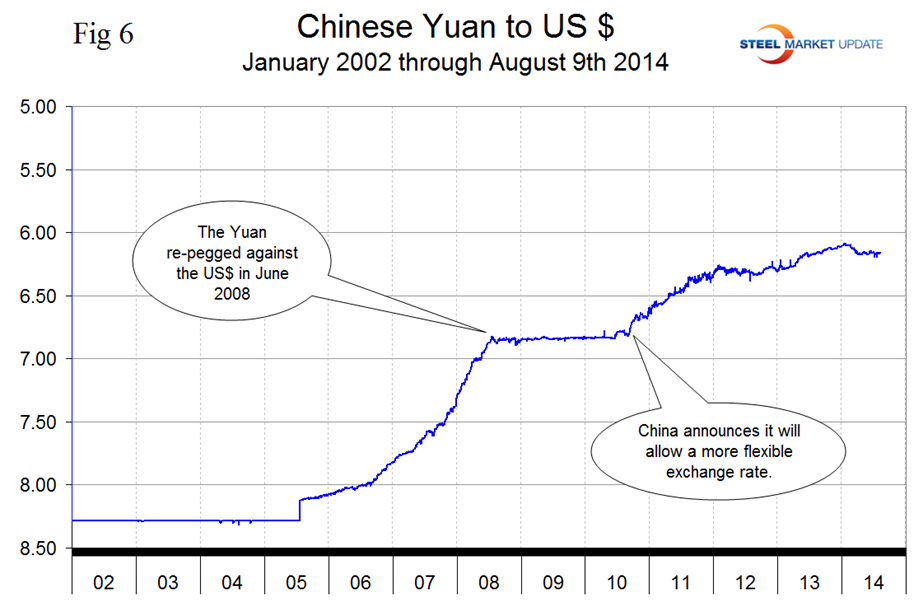

The Chinese Yuan peaked at 6.0987 on February 15th and has since weakened to 6.158, it is now back to exactly where it was a year ago, (Figure 6). We understand that the policy of strengthening the Yuan that existed since Q3 2010 has been abandoned and that the currency will float more freely in future.

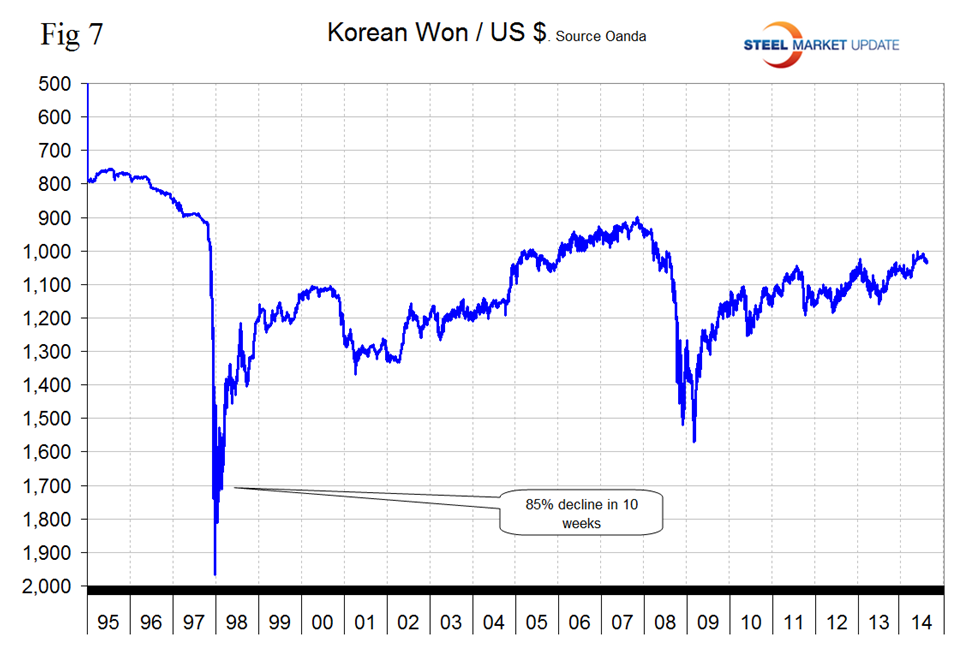

The Korean Won has been strengthening since early 2009, (Figure 7). It is up against the dollar by 7.4 percent in 12 months but lost 2.4 percent in the last month.

In this monthly analysis we show the trends that we think have the most immediate significance, but all 16 steel trading nation graphs are available on request if any reader has a special interest that we haven’t covered.