Market Data

August 14, 2014

US Steel Production, Capacity Utilization and Import Market Share

Written by Peter Wright

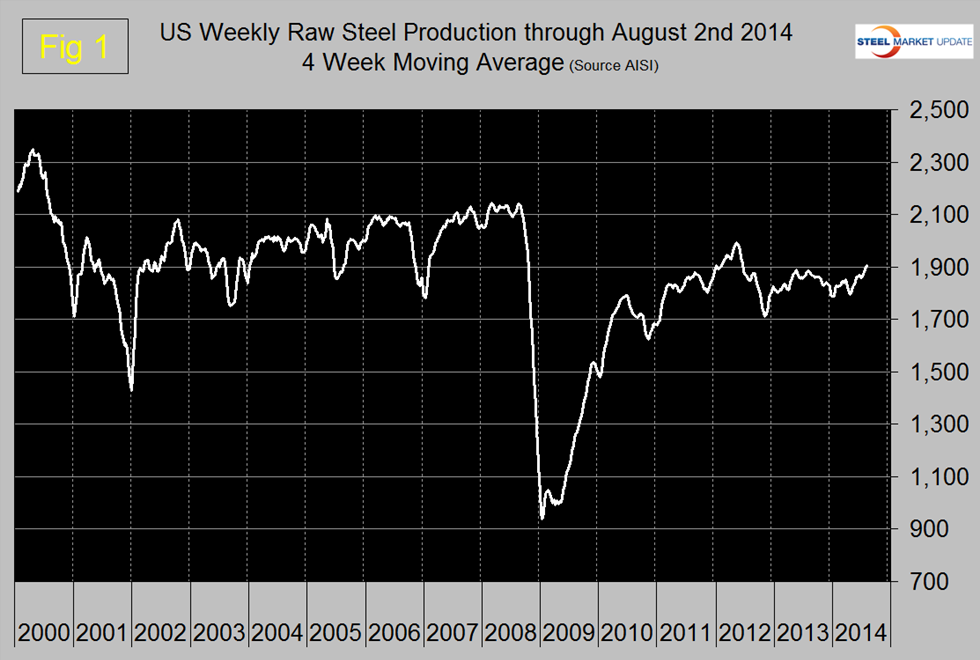

In the week of August 2nd the four week moving average (4WMA) of raw steel production as reported by the AISI exceeded 1,900,000 tons per week, for the first time since June 16th 2012, (Figure 1).

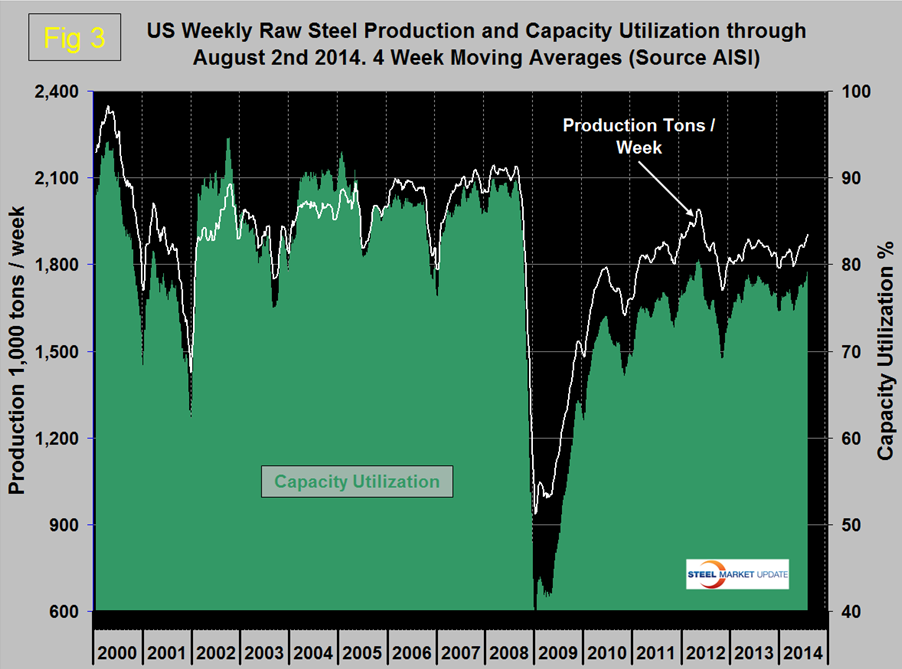

However, capacity utilization at 79.2 percent (4WMA) is still nowhere near where it was before the recession. Capacity is currently just over 125 million tons per year and is higher than in the early 2000’s as integrated mill closures have been more than compensated for by EAF plant startups, (Figure 2).

Since the recession capacity utilization on a 4WMA basis has only exceeded 80 percent once, for a short five week period in mid-2012, (Figure 3). The question has been asked, what has been the effect of imports on capacity utilization?

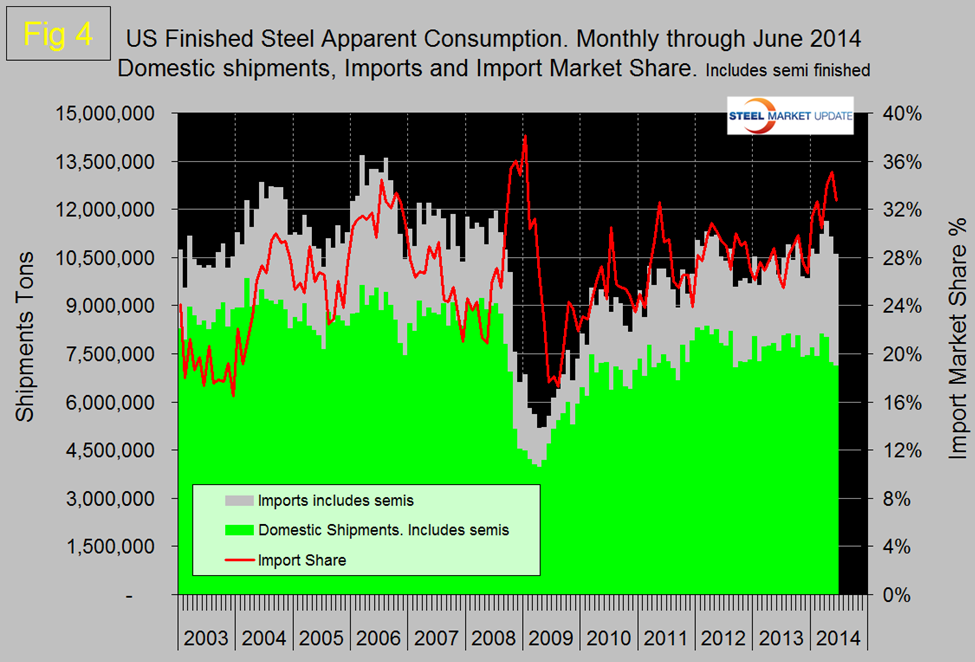

The big picture is that import market share exceeded 35 percent in May for the first time since January 2009. In May, penetration declined to 32.7 percent, still a level achieved only six times in 138 months since January 2003, (Figure 4). These numbers include semi-finished which have surged this year. Through June slab imports were up by 1,574,000 tons or 53 percent.

Drilling down into sheet products, total imports were up by 62 percent in Q2 2014 year over year. This was led by cold rolled up 105 percent and followed by HDG up 90.1 percent and hot rolled up by 40.4 percent. Total supply of sheet and strip products to the market in three months through June was up by 13.6 percent compared to the same period last year, steel mill shipments including exports were down by 0.6 percent in the same time frame. Hot rolled sheet and strip was the only product group of the big three, HR, CR and HDG to have positive shipment growth in Q2 year over year. In this case shipments were up by 4.1 percent as total supply was up by 13.1 percent. Cold rolled shipments were down by 2.3 percent as supply increased by 17.7 percent. HDG shipments were down by 0.9 percent as supply was up by 14.1 percent.

Based on this data the increase in imports has deducted about 200,000 tons per week from the crude steel calculation described in paragraph one above. Crude steel production would be running at 2,100,000 tons per week and capacity utilization would be 87.3 percent, exactly where it was before the recession in the period H2 2007 through H1 2008.