Prices

August 14, 2014

Early August Import License Data Pointing Toward Another Big Month

Written by John Packard

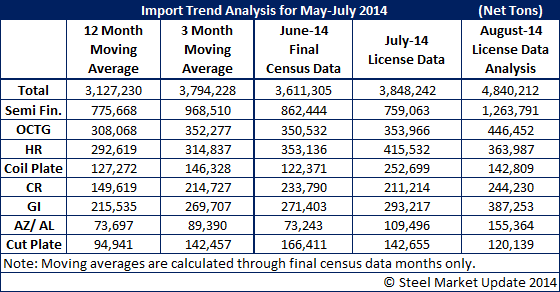

Early indications, based on steel import license data, are suggesting August steel imports will once again exceed 3.5 million net tons and could go as high as 4.0 million tons. The high so far this year was May at 4.033 million net tons. May 2014 was also the highest import level seen since prior to the beginning of the Great Recession.

At the moment the biggest one month surge is pointing to slab imports which are domestic mill driven. Between slab imports, hot rolled coil and some full hard cold rolled coils, the domestic mills account for 25 percent or more of the total steel imports.

Oil country tubular goods (OCTG) are also coming into the United States at high levels with OCTG currently trending toward reaching 400,000 net tons. The 400k level is approximately 100,000 tons above the 12 month moving average. By far the largest exporting country is South Korea which has already requested 82,000 net tons worth of licenses with two and a half weeks still remaining in the month.

The market has been concerned with Chinese cold rolled exports and August appears will be another big month for the Chinese steel mills. The Chinese mills/traders have requested just shy 50 percent of the total licenses requested for CR to date. There is no other country remotely close to the 45,000 net tons requested by China. South Korea is second at 15,000 net tons and Canada is third with 8,800 net tons.

Galvanized imports are another item which has been suggested as a potential target for dumping suits by the domestic steel mills. At the moment galvanized import license data suggests that we could exceed the high for the year which was May at 294,307 net tons. The vast majority of the imports are coming from: China, South Korea, Taiwan and India. There should be no surprise that those are the four countries most often mentioned when the subject of a potential dumping suit is discussed.

Hot rolled import licenses are pointing toward a 300,000-350,000 net ton level which is slightly higher than the 12 month moving average.

Galvalume imports which is another product mentioned when discussions of dumping suits are brought up, license data is suggesting we could see AZ imports exceeding 100,000 net tons which are well above both the 3MMA and 12MMA. Taiwan is the major supplier requesting 36,197 net tons of the 60,140 net tons of licenses requested through SIMA through the 12th of August. The next largest supplier is South Korea with 13,000 net tons requested so far this month. China is third with 5400 tons requested through the 12th.

SMU is using import licensing data from the U.S. Department of Commerce Steel Import Monitoring and Analysis System (SIMA). The most recent update to the data was made on August 12, 2014.

We have mentioned on numerous occasions that import license data can only be used as a barometer as to what the trend looks like. We recommend you read an excellent article on the subject which was produced for Steel Market Update by David Phelps, former president of the American Institute for International Steel (AIIS). The article title is “The Steel Import Monitoring and Analysis System (SIMA)” and was reproduced on our blog on January 12, 2014.

Here is our import trend analysis for August: