Prices

August 5, 2014

Semi's, Flat Rolled & Long Product Steel Imports

Written by Peter Wright

License data for July was updated on August 5th through the Steel Import Monitoring System of the US Commerce Department. The SMU publishes several import reports ranging from this very early look using licensed data to the very detailed analysis of final volumes by district of entry and source nation which is published in our Premium product. The early look, the latest of which you are reading now has been based on three month moving averages (3MMA) using July licensed data, June preliminary data and May final data. We recognize that the license data is subject to significant revisions but believe that by combining it with earlier months data in this way gives a reasonably accurate assessment of volume trends by product as early as possible.

Our previous analyses have shown that the preliminary data is very close to and sometimes identical to the final numbers for a particular product. The main issue with the license data is the month in which the tonnage arrives. We are currently investigating the relationship between licensed tonnage and month of arrival in this newsletter and will publish our summary for the first six months of 2014 in the next few days.

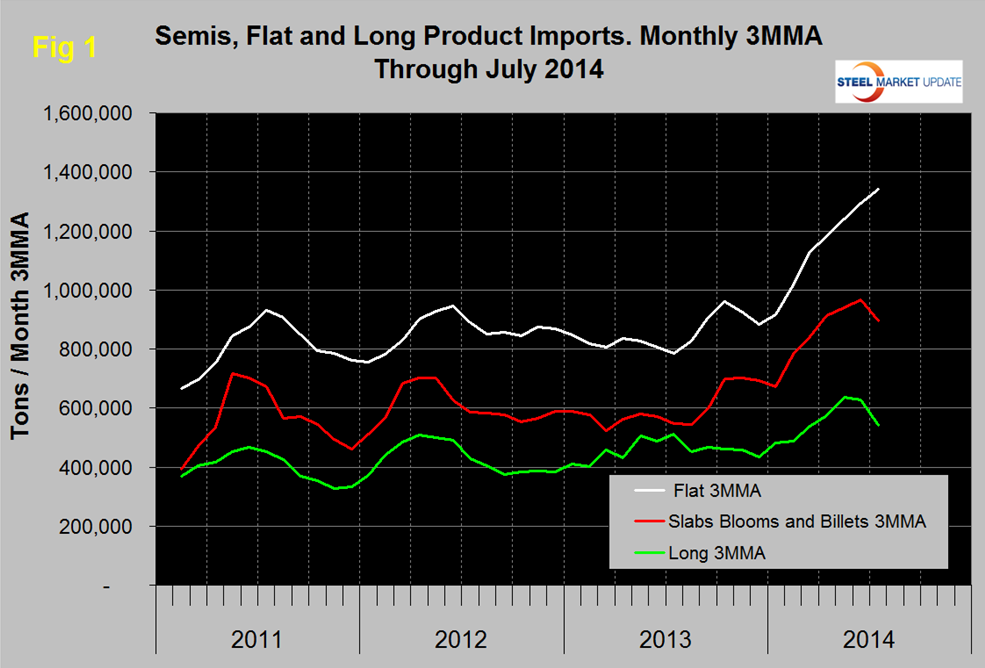

Figure 1 shows the 3MMA through July licenses for semi-finished, flat and long products. Flat includes all hot and cold rolled sheet and strip plus all coated sheet products plus both discrete and coiled plate. The anticipated import surge is now well underway for flat products but has abated somewhat for long products.

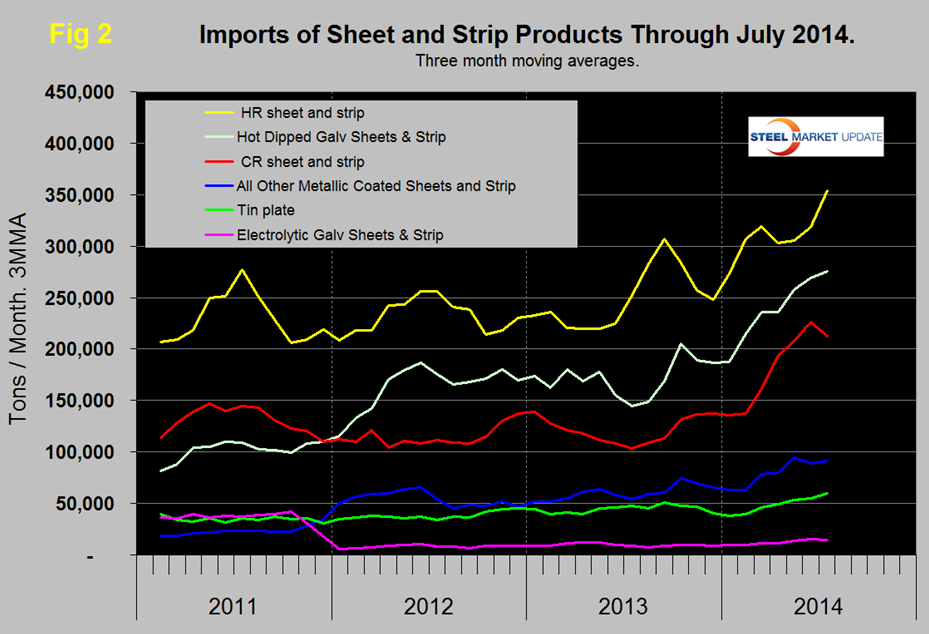

Figure 2 shows the trend of sheet and strip products since January 2011. Cold rolled peaked in June then declined to 213,000 tons / month on a three month moving average basis in July. The import tonnages of hot band and HDG are still surging.

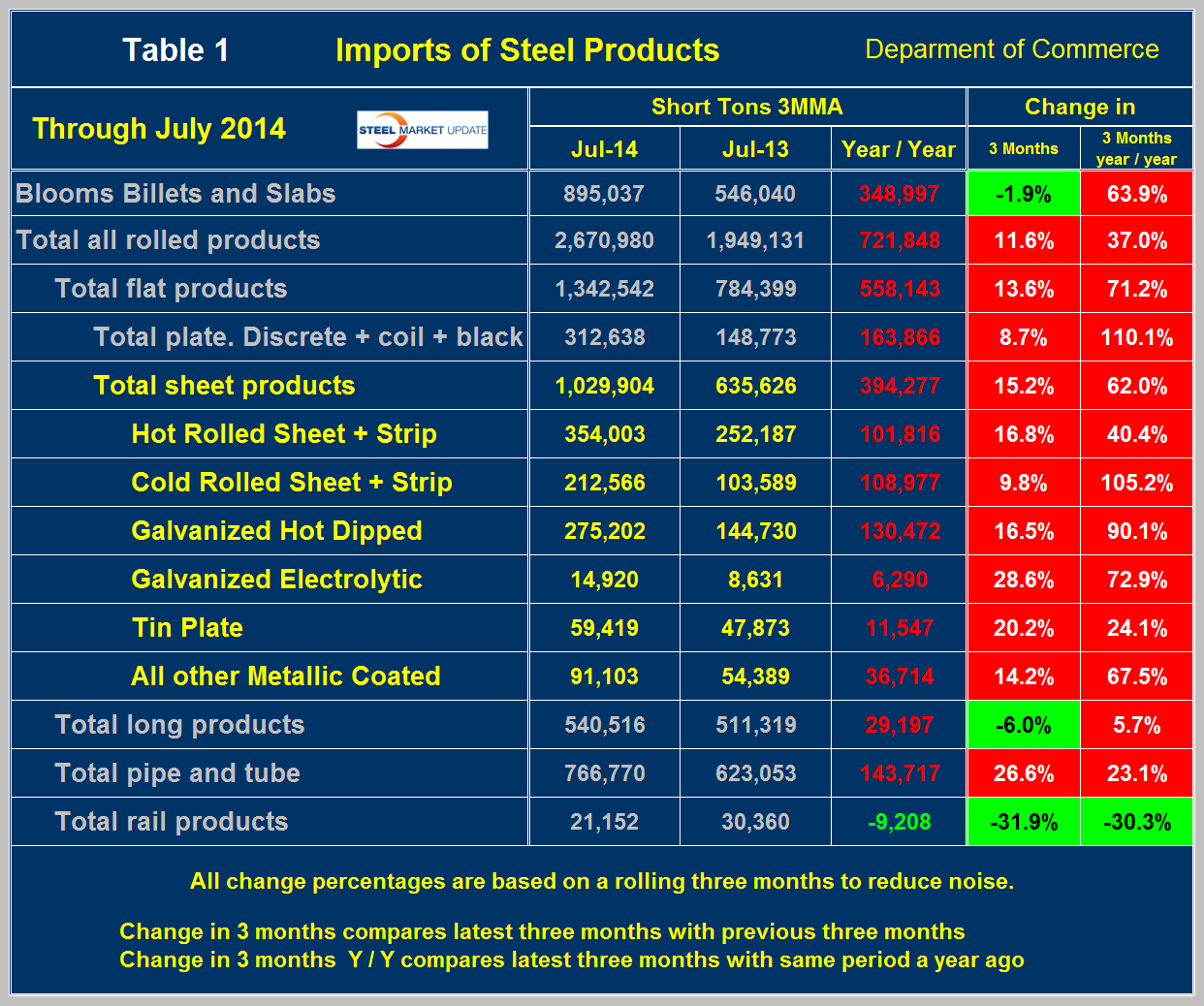

Table 1 provides a detailed import analysis and compares the average monthly tonnage of the three months through July, with both the same period last year and with three months through April. The total tonnage of all hot worked products averaged 2,670,980 tons per month in three months through July, up by 37.0 percent year over year and by 11.6 percent since three months through April. Year over year semi-finished imports were up by 63.9 percent, flat rolled products were up by 71.2 percent, long products fared much better, up by 5.7 percent. Table 1 shows the tonnage and percent change for all the major product groups and for sheet products in detail. The average monthly tonnage of sheet products in three months through July increased by 394,277 tons or 62.0 percent year over year.

Imports of long products were actually down in three months through July compared to three months through April. Imports of pipe and tube had increases in the mid-20s percent and rail products declined in the low 30s percent on both time comparisons.