Analysis

July 29, 2014

Traders Preparing for Dumping Suits on Cold Rolled and Coated

Written by John Packard

We have reported previously that the domestic steel industry has been preparing for possible dumping suits on flat rolled products. The countries named most often are all located in Asia with China, India, Taiwan and South Korea as being those countries named most often and likely to be affected by any new dumping suits.

A number of trading companies have suspended quoting foreign imports out of China for fear they will become entangled in any new trade cases.

This morning a large service center told us on a conference call that traders are warning potential buyers of foreign steel that they may be liable for any duties should trade cases be filed and critical circumstances come into play. In normal circumstances duties are paid by the importer of record (normally the trading company or original producing mill).

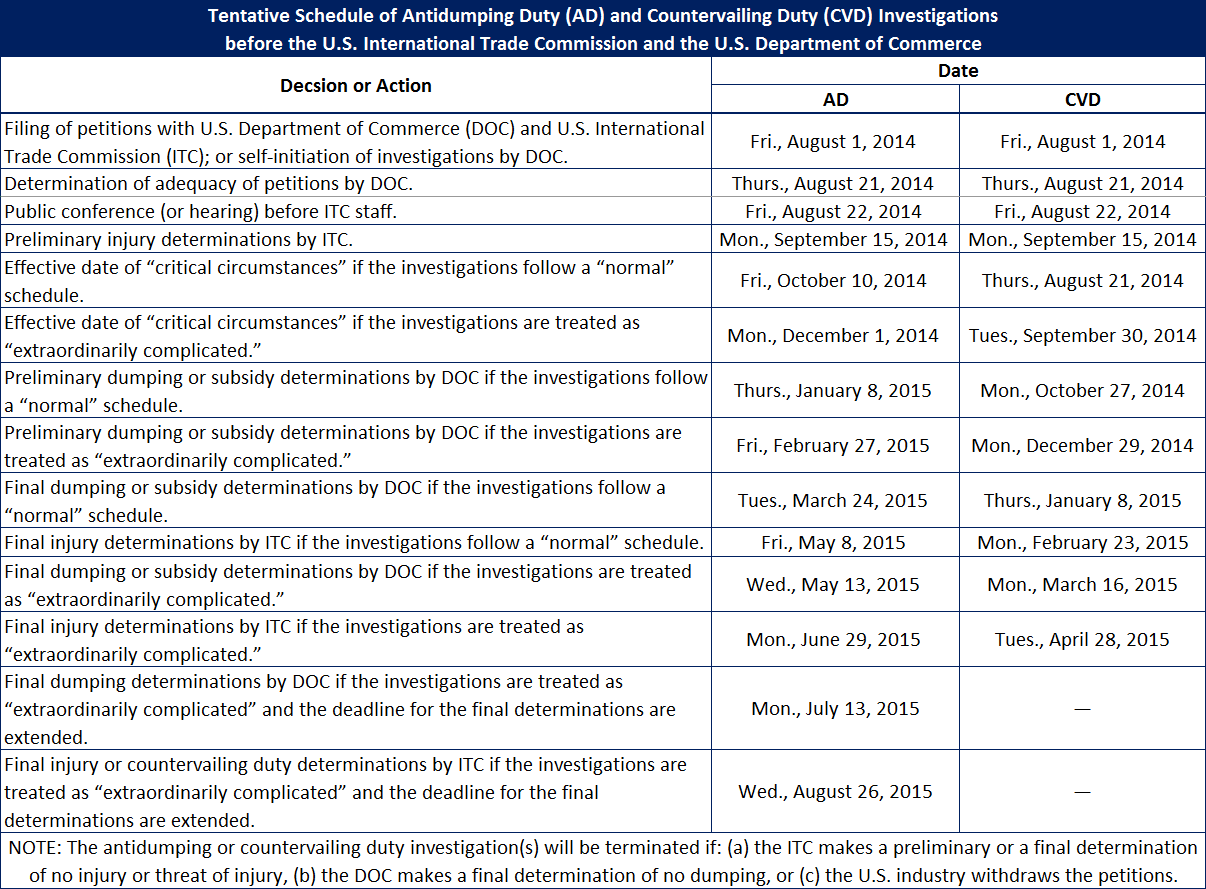

We have seen new documents which suggest that the trading companies have enlisted the help of their attorneys in order to be proactive and to anticipate what may happen should a dumping suit be filed. In one scenario seen by Steel Market Update the attorneys have prepared a timeline should new suits be filed on August 1st (hypothetical date) and what would transpire after that date.

One of the key concerns for trading companies is if the US Department of Commerce instructs the CBP to collect any estimated anti-dumping (AD) or countervailing (CVD) duties on imports made during the 90-day period covered by critical circumstances. Coming up with the funds to cover such cash deposits can be a tremendous burden on importers even though the deposits are likely to be eventually refunded should the ITC ultimately rule in favor of the foreign imports.

One trader told us today that there are some Chinese offers available for September shipment. However, any shipments after that point in time would fall within the “danger zone.”

The following table is a mock-up of what one group believes the timeline could be if there were dumping suits filed on August 1, 2014. This is an example and not reality as there have been no suits filed on cold rolled or coated steels at this point in time.