Prices

July 27, 2014

Manufacturers Report Distributor Spot Pricing as Mixed

Written by Brett Linton

Balance appears to be the word of the week, well at least for this past week while we were canvassing the flat rolled steel industry during our mid-July survey. Steel Market Update invited slightly more than 600 people representing approximately 590 companies to participate in our survey. Of those responding 44 percent were manufacturing companies (a little lower than normal) and 42 percent were service centers (about normal) with the balance being trading companies (5 percent), steel mills (4 percent), toll processors (3 percent) and suppliers to the industry (2 percent) such as chemical or paint companies.

During the survey process we first canvass the entire group as a whole regarding on a few subjects and then the survey breaks out the respondents by market segment (as noted above).

Those in the manufacturing and service center sections receive questions related to distributor spot pricing into the manufacturing sector. It has been SMU opinion based on past results, that when the service centers are attempting to raise prices the domestic steel mills are also able to collect the increases they have announced.

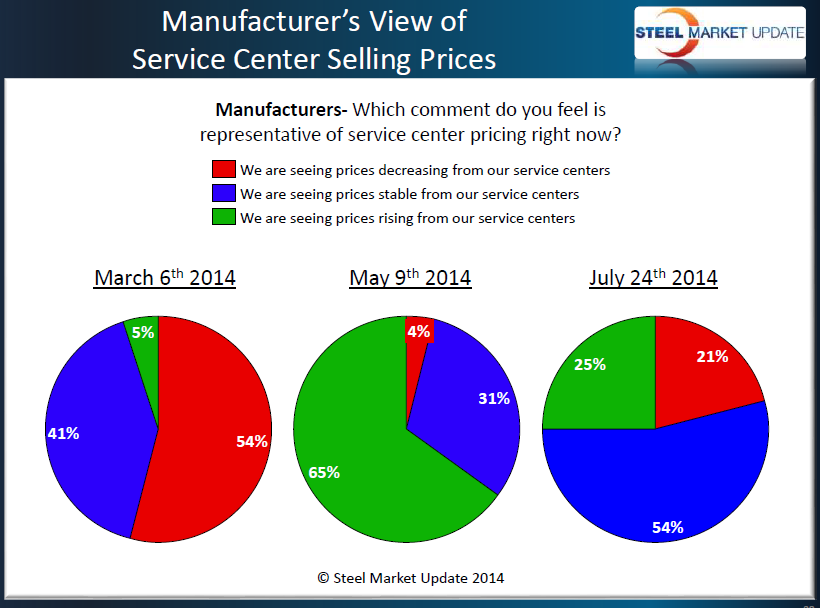

The service center market, according to the manufacturers, is sending mixed messages compared to what we were seeing back in May or even further back to March 2014.

As you can see by the graphics below, manufacturing companies back in March were reporting spot service center pricing as moving lower (54 percent) and only 5 percent reported prices as moving higher. By the time we got into early May the cycle had completely changed and 65 percent of the manufacturing respondents were reporting service center spot prices as increasing with only 4 percent as decreasing.

Fast forward to this past week and we are finding 25 percent of the manufacturing companies are reporting SC spot prices are rising, 21 percent as falling and the balance (54 percent) as being stable.

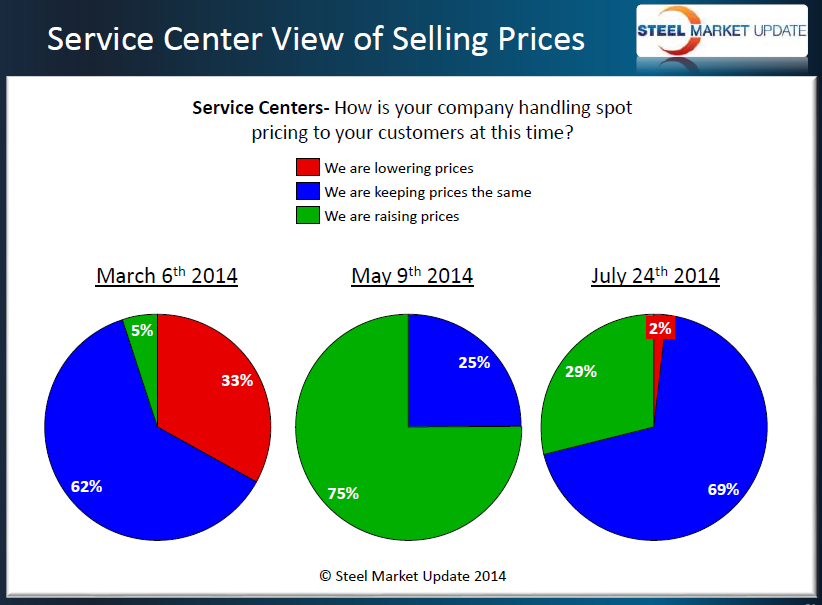

Service centers responded with a slightly more optimistic viewpoint than their manufacturing customers although we believe the net result is the same – the market is relatively balanced at this moment as we wait for a catalyst to move the market in one direction or another with conviction.

We have downloaded our survey power point presentation into our website. Normally, the presentation is available only for those who are Premium Level members but for the remainder of July (through Thursday of this week) we have opened up our Premium content for those who might be interested in seeing what else we have to offer. You can find the survey results under the tab “Analysis” in the top tool bar on our website (login is required).