Market Data

July 18, 2014

Service Center Apparent Deficit Drops to -351,000 Tons

Written by John Packard

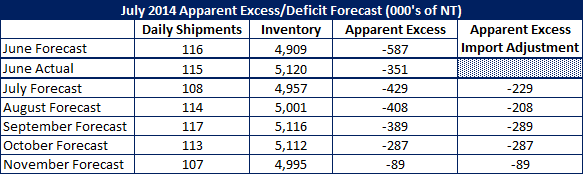

At the end of May 2014 Steel Market Update calculated that the U.S. service center flat rolled steel inventories were short (apparent deficit) by -632,000 tons. At that point in time we projected that the inventory deficit would be reduced by 45,000 tons and that by the end of June the apparent deficit would be -587,000 tons.

When the MSCI released their steel shipment and inventory data earlier this week we used our proprietary formula (basically we calculate where inventories should be in order to be “balanced”) and calculated that the distributors deficit had dropped more than we predicted and at the end of June stood at -351,000 tons.

Based on the formula we are using, SMU forecast total flat rolled shipment shipments would be 2,438,247 tons and they actually came in at 2,414,300 ton. We missed by 24,000 tons.

![]() Our formula also called for receipts to be up 5 percent over 2013 or 109,253 tons per day and the actual receipt rate was 118,125 tons per day. We projected end of month inventories to be 4,909,000 tons and the actual inventories were 5,120,400 tons.

Our formula also called for receipts to be up 5 percent over 2013 or 109,253 tons per day and the actual receipt rate was 118,125 tons per day. We projected end of month inventories to be 4,909,000 tons and the actual inventories were 5,120,400 tons.

The previous month, SMU was putting into our equation 200,000 tons of foreign steel receipts. They did not materialize in May so we dropped them in June. If we had left the 200,000 tons in our inventory numbers we would have been within 1 percent of the final number.

As we work on forecasting July we are going to stay with our daily shipping formula and we are forecasting distributors will ship 2,371,600 tons during the month of July.

Before making any adjustments for foreign imports we believe receipts will be 2,207,800 tons. By itself that would bring flat rolled inventories down 4,956,600 tons. However, if we add an additional 200,000 tons which we are designating as part of the impact of all the foreign steel arriving at the docks that would bring inventories up to 5,156,600 tons.

At 4,956,600 tons the apparent deficit would change to -429,000 tons (deficit would increase).

At 5,156,600 tons the apparent deficit change would be -229,000 tons (deficit would decrease).

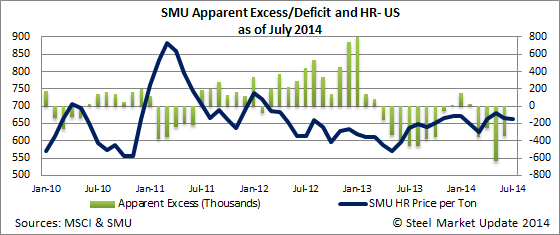

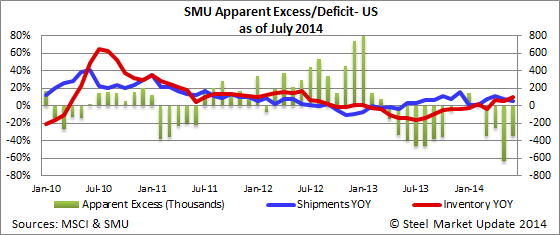

In either case we see service center inventories are remaining tight through the month of July. Here is the correlation between our apparent deficit/excess model and benchmark hot rolled pricing.