Prices

July 17, 2014

July Steel License Data Suggests Import Trend Not Slowing

Written by John Packard

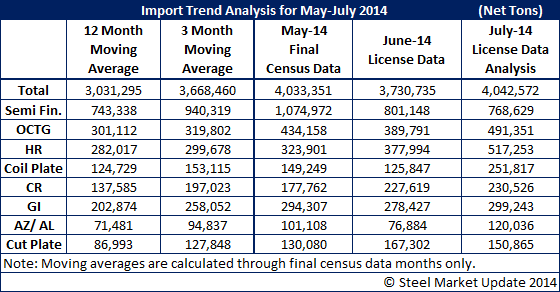

Based on a quick analysis of the just released July steel import license data (through the 15th of July) we see the foreign steel imports continuing at very high rates. The import data suggests we will see July imports at levels similar to that of May and June. May had the highest level of imports since 2008 at 4,033,351 net tons. Import license data suggests June will be approximately 3.7 million net tons. We expect when the final numbers are counted that July foreign steel imports will come in around 3.5-4.0 million net tons.

![]() The steel mills themselves continue to be the largest importing segment as Semi-Finished steels (mostly slabs) continue to be a large percentage of the total imports. Our analysis is suggesting that approximately 19 percent of all imports in July will be semi-finished products. This is actually a little lower than the 26.7 percent we saw in May when slightly more than 1 million net tons of semi-finished steels were imported out of the 4,033,251 net tons which arrived at U.S. ports during the month.

The steel mills themselves continue to be the largest importing segment as Semi-Finished steels (mostly slabs) continue to be a large percentage of the total imports. Our analysis is suggesting that approximately 19 percent of all imports in July will be semi-finished products. This is actually a little lower than the 26.7 percent we saw in May when slightly more than 1 million net tons of semi-finished steels were imported out of the 4,033,251 net tons which arrived at U.S. ports during the month.

Oil country tubular goods (OCTG) appear that imports will continue to surge in July as our analysis anticipates OCTG imports to come close to the 400,000 net ton mark. South Korea represents 62 percent of the license requests so far for July. The next closest country is Mexico with 5.5 percent of the license requests.

Hot rolled numbers are also growing with South Korea leading the way. The South Koreans have already requested licenses for July on as many tons as they shipped during the entire month of May (68,349 net tons).

There has been discussions about the domestic mills asking that the Suspension Agreement on hot rolled with Russia be vacated. The Russians have requested 33,254 net tons of HRC and another 32,055 net tons of coiled plate through the 15th of July. Both suggest that Russia will grow their participation in the U.S. market in July.

It has been suggested that China is dumping cold rolled into the U.S. market over the past few months. The license data for June has the Chinese exporting 82,581 net tons during that month. From May 2013 to March 2014 the Chinese mills averaged 23,494 net tons per month of CR exports to the USA. July license data suggests that the Chinese are on pace to match the June number.

Another product of concern to the domestic steel mills is galvanized which has been growing over the past months and now our 3-month-moving average is 258,052 net tons per month. That average is expected to grow once the final June and July tonnages are calculated into the number (our 12 month and 3 month moving averages are based on Final Census Data).

The largest month for Galvalume (zinc aluminum) imports was May 2014 at 101,108 net tons. The July license data for the first 15 days of the month are already at 58,081 net tons and suggests we could come close to the 100,000 net ton level again this month. To put this into perspective, during 2012 the average monthly imports on the product were 59,995 net tons.